Inman News

Despite declines in 3 key housing market indicators, most real estate economists say nay to the bubble — but one argues an ‘apartment bubble’ is gaining momentum.

It’s a question that resurfaces every economic cycle, creeping into the psyche of the real estate industry like English Ivy along the edges of a home. One financial analyst believes it’s happening, but real estate economists disagree.

Are we in a housing bubble?

Dave Kranzler, a co-manager of a precious metals and mining stock investment fund in Denver, wrote on his website Investment Research Dynamics earlier this week that he believes an even bigger housing bubble than 2008 is set to burst.

“Housing is dropping and it’s demand-driven, not supply-driven – all three housing market reports released two weeks ago showed industry deterioration,” Kranzler wrote in the July 2 post, citing declines in home builder sentiment, new construction permits and existing home sales.

In fact, the home builder sentiment index suffered its fourth decline in May since hitting its peak in December while falling 10 points below Wall Street analysts’ predictions. Permits for new construction, meanwhile, fell 4.6 percent, according to the most recent housing starts data released Tuesday by the U.S. Bureau of Labor Statistics.

And existing home sales fell for the second straight month while the seasonally adjusted annualized rate fell below Wall Street analysts’ estimates, according to Kranzler. In short, he isn’t buying spin that the decline is due to low inventory.

“The month’s supply for May increased from April and, at 4.1 months, is above the average month’s supply for the trailing 12 months,” he said. “It’s also above the average months supply number for all of 2017. If low inventory is holding back pent-up demand, then May sales should have soared, especially given that May is historically one of the best months seasonally for home sales.”

A number of economists, however, disagreed when asked if a housing bubble is afoot.

Lawrence Yun at an NAR media briefing.

Lawrence Yun, the chief economist at the National Association of Realtors, doesn’t believe a housing bubble exists, but he does worry some market issues persist.

“Home prices are clearly rising too fast, they have outpaced people’s income growth for the past five years,” he said. “Is it a bubble in terms of potential to go down? The answer is no, because the fundamental supporting factors of today’s housing market versus what happened 10 years ago are drastically different.”

The distinction between today’s market and the pre-crash housing market, he said, are the tighter underwriting standards created in the aftermath of the 2008 housing crises and the current dearth of new residential construction.

“There is a massive housing shortage,” Yun said. “It’s fundamentally different in terms of both demand and supply.”

Yun acknowledged that current homebuilder sentiment – which surveys builders and their perceptions of the housing market over time – is similar to a decade ago, prior to the housing crises. Indeed, both now and 10 years ago, homebuilders overwhelmingly believed that when new homes are built, buyers would respond. They also insisted that supply would increase in the future — yet in terms of construction, today’s inventory falls short of 2008.

Windermere Real Estate Chief Economist Matthew Gardner echoed Yun’s sentiment, adding that, while he doesn’t believe a single-family housing bubble is rising, other property classes may not be so fortunate.

number of factors are leading to supply issues, Gardner said, including an overall lack of construction employment and rising land and material costs, not to mention regulatory expenses and added levies through the Trump administration’s beefed-up tariff policies.

“Builders are being far more cautious than they were prior to the recession,” he said, adding housing starts and permits have dwindled to less than half of what they were prior to 2008.

“The last time we were at this level of permit activity was 1992,” he said. “We’ve had an awful lot of people come into the country in between those two times.”

It’s important to separate the multi-family and single-family housing markets when talking about bubbles, Gardner added. He does believe we are currently in an apartment bubble.

“When you look at multi-family, you really have to go back to 2010 – that was essentially the time the credit markets started to thaw and the builders could start borrowing money again,” he said. “However what was the only asset class they would lend money on… apartments.”

“We went from a big supply and demand imbalance to oversupply,” he added. “And that’s where we’re at right now in many major markets.”

Zillow Senior Economist Aaron Terrazas believes fears of a widespread downturn are premature as long as the U.S. labor market remains on steady footing.

“There’s no doubt that home-buying demand will face stronger headwinds over the next year – with interest rates rising and the cyclical rebound in young adult homeownership moving toward its final act,” he told Inman. “But slowing sales (over the past year and a half) and slowing permits over the past four months are primarily a supply-side problem: home builders have been struggling with rising costs – including land, labor and materials – and as a result have been unable to move downstream from a relatively high price point where the numbers make sense.”

When reached by phone Thursday, Kranzler insisted the housing bubble is price-driven, not inventory fueled. He said a combination of rising home prices and increasingly lax lending standards from government entities are the factors that will lead to the next housing bubble burst and he compared mortgages from government agencies and government-sponsored entities to mid-2000s subprime loans with their increasingly lower downpayment and credit requirements.

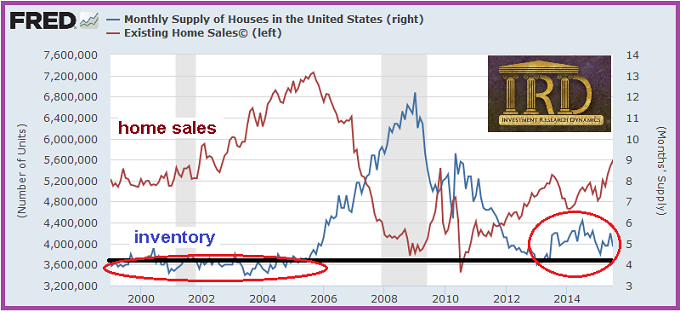

Kranzler also took issue with the notion that low inventory leads to higher prices, citing data that the Federal Reserve Bank of St. Louis published up until 2015.

“This chart shows just the opposite – that low inventory and home prices are inversely correlated,” he said, saying when inventory gets low, people rush out to buy.

Chart from the Federal Reserve Bank of St. Louis shows monthly supply of homes and existing home sales from 1998-2015. Emphasis marks by Dave Kranzler.