HousingWire

The 120-day delinquency rate for July was 1.4 percent — the highest rate in more than 21 years and double the Great Recession peak.

The delinquency spike that many warned about at the start of the pandemic is coming — and, in many states, it is already here.

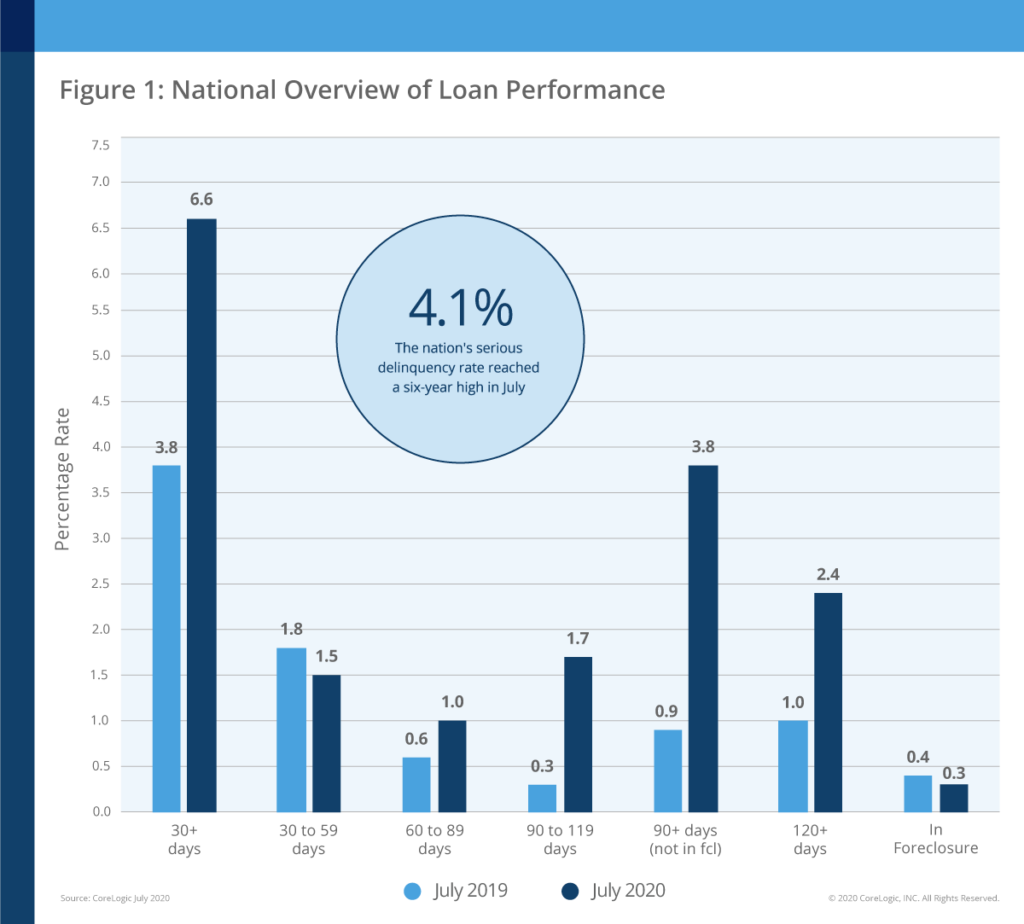

According to the latest data from CoreLogic released on Tuesday, 6.6 percent of mortgages were in a state of delinquency in July, a jump of 2.8 percentage points from the same time last year.

While early stage delinquencies are still down 0.3 percent compared to last year, mortgage payments that were late by 60 to 89 days are up 0.4 percent from 2019. The biggest jump — 4.1 percent compared to 1.3 percent last year — occurred in serious delinquencies, or payments that are late by more than 90 days.

“Four months into the pandemic, the 120-day delinquency rate for July spiked to 1.4 percent,” Dr. Frank Nothaft, chief economist at CoreLogic, said in a prepared statement. “This was the highest rate in more than 21 years and double the December 2009 Great Recession peak. The spike in delinquency was all the more stunning given the generational low of 0.1 percent in March.”

CoreLogic

At 0.3 percent, foreclosures are still down from the 0.4 percent seen last year. But what’s happening with serious delinquencies could be a sign of more bad news to come. As the coronavirus pandemic shows no signs of abating and shutdown-related unemployment persists, many people are buying a home only to find that they later struggle to make the payments.

“Many Americans, particularly millennials, are taking advantage of low rates to either purchase their first home or upgrade their living situations,” Frank Martell, president and CEO of CoreLogic, said in a prepared statement. “However, given the unsteadiness of the job market, many homeowners are beginning to feel the compounding pressures of unstable income and debt on personal savings buffers, creating heightened risk of falling behind on their mortgages.”

CoreLogic

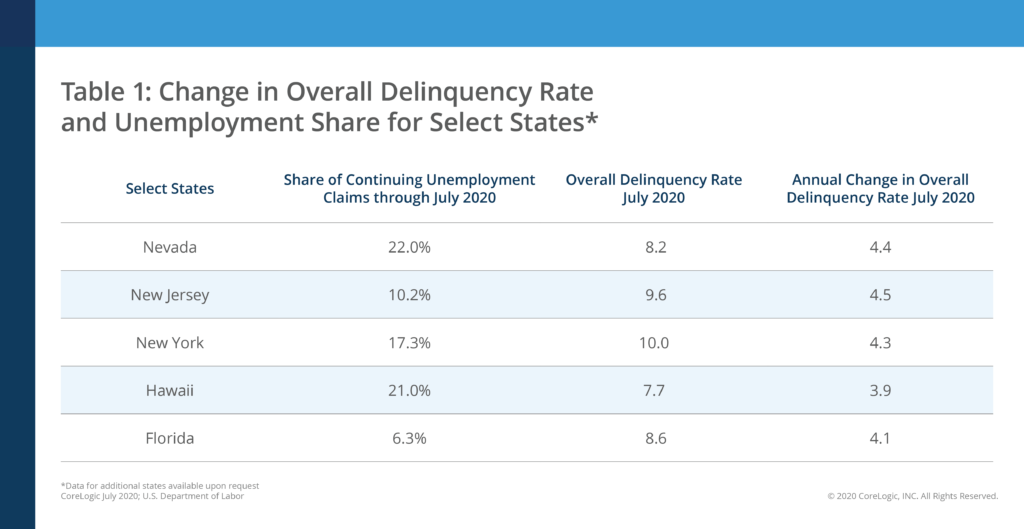

Delinquencies are on the rise in different hotspots across the country; places whose economies depend heavily on entertainment and tourism saw some of the biggest rises. Nevada, New Jersey and Hawaii saw the biggest increases at 5.2, 4.8 and 4.7 percentage points, respectively.