Inman News

Only 0.4% of Americans experienced foreclosure in December.

The number of homeowners failing to make mortgage payments has dipped to levels unseen since before the 2008 housing crisis.

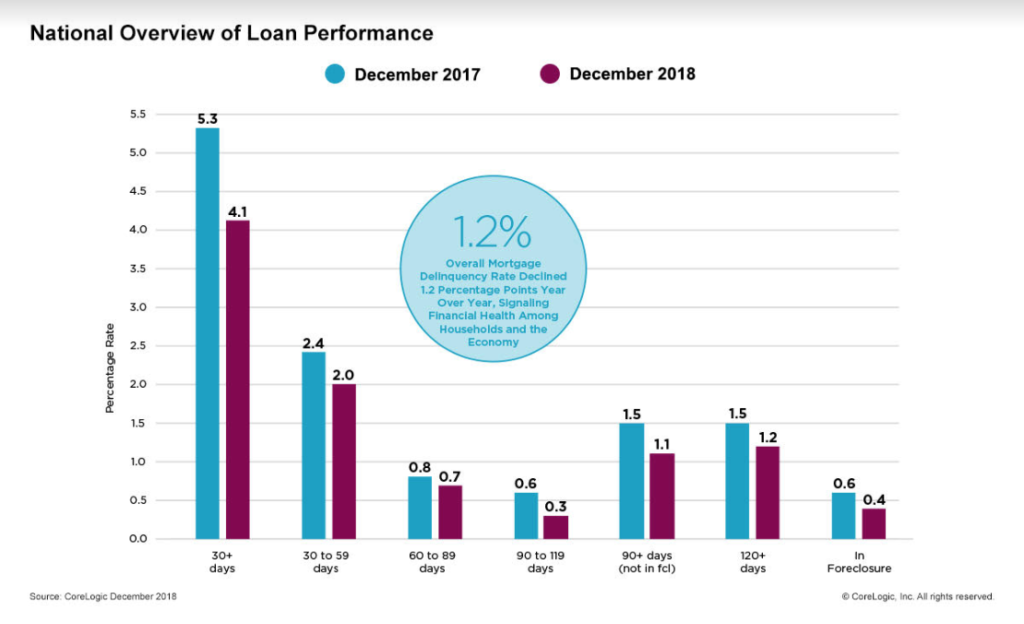

Nationwide, only 4.1 percent of homeowners were delinquent on their mortgage in December, according to CoreLogic’s latest Loan Performance Insights report released Tuesday. Down from 5.3 percent in December 2017, the latest rate is the lowest since January 2000.

Yearlong delinquency rates, which have been falling steadily since the start of 2018, have not been this low since early 2006 – just before the housing and financial crisis of 2008-2009.

Foreclosures, in which property is seized due to an owner’s inability to pay, fell to 0.4 percent from 0.6 percent the year before.

CoreLogic.

“Our latest home equity report found that the average homeowner saw a $9,700 increase in their equity during 2018,” said Dr. Frank Nothaft, chief economist for CoreLogic, in a prepared statement. “With additional ‘skin in the game,’ rising equity reduces the chances of a foreclosure, helping to push the foreclosure rate down to its lowest level since at least 2000.”

All stages of the delinquency process have been seeing drops over the past 12 months — but serious delinquencies, in which mortgage payments are overdue by more than 90 days, saw the biggest drop, from 2.1 percent in December 2017 to 1.5 percent this year.

CoreLogic.

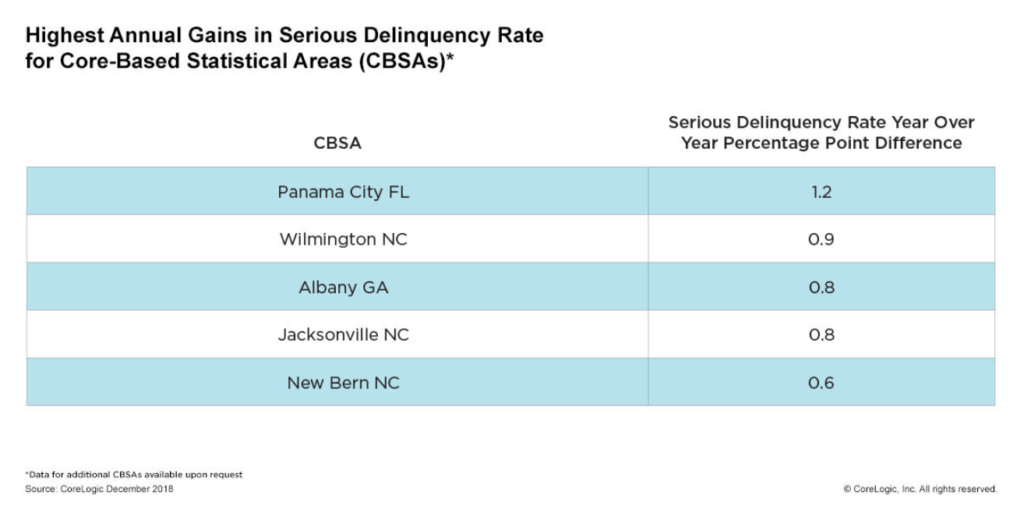

A strong job market and low unemployment rates continue to spell good news for homeowners for what will likely be months to come – even as the frequent rate of natural disasters puts homeowners in some parts of the country at risk of falling behind on payments, said Frank Martell, president and chief executive of CoreLogic.

“On a national basis, income and home-price growth continue to support strong loan performance,” said Martell. “Although things look good across most of the nation, areas that were impacted by hurricanes and other natural hazards are experiencing a sharp increase in the numbers of mortgages moving into 60-day delinquency or worse.”