HousingWire / Inman News

Driven by low inventory, median U.S. home price reaches record high in July.

The national average median home price reached a new high in July due to low inventory and pent-up demand.

According to realtor.com‘s Housing Recovery Index, the new median price is $349,000, with listing price growth increasing $27,000 or 8.5% year over year.

“The coronavirus has impacted every corner of the U.S., but it hasn’t hit every area equally or at the same time,” said realtor.com Chief Economist Danielle Hale. “The U.S. housing market performance is closely mirroring COVID’s path, which is providing clues into what we can expect for various housing markets in the months to come.

“After being particularly hard hit in March and April, new coronavirus cases remain stable in the Northeast and we’re seeing buyers return to the market in force,” Hale said. “If this same trend follows in the South and Midwest – where outbreaks continue to rise, we could see a flurry of activity well into the fall, especially as schools delay their openings.”

Out of the 50 largest metros, 48 had year-over-year median listing price gains in July, up from 46 metros in June.

The two metros that actually saw declines in median listing prices were Miami-Fort Lauderdale-West Palm Beach, Florida, at -1.5%, and Orlando-Kissimmee-Sanford, Florida, -0.9%. Notably, Florida has been severely impacted by the spread of COVID-19.

The number of new listings was down 13.4% year over year in July, but that represents a significant recovery from the 44.1% drop in April. Only the Northeast saw a slight decline in listings at a drop of just 1.2%, while new listings were down 10% in the West, 16.1% in the South and 20.8% in the Midwest.

Nationwide, inventory sank 34.8% year over year in July, worsening from June’s decline at 26.5%. None of the metros realtor.com tracks had an increase in inventory. The Riverside-San Bernardino-Ontario, California metro saw the largest drop in inventory at -50.4% over last year, while Baltimore-Columbia-Towson, Md. (-48.7 percent); and Providence-Warwick, R.I.-Mass. (-47.4 percent) weren’t far behind.

Inman News

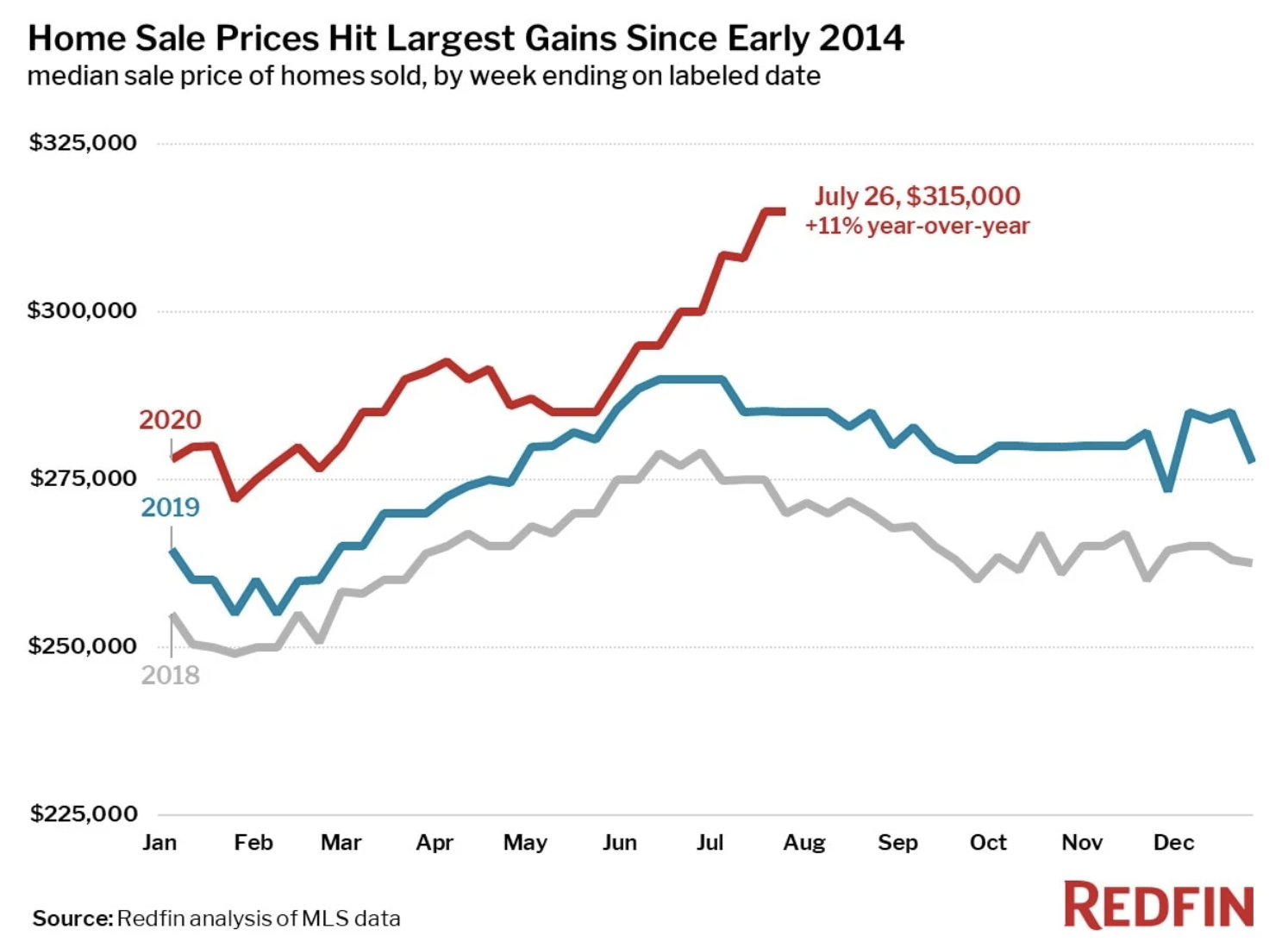

The median home sale price soared 11% year over year during the week ending July 26, bringing that figure up to a record-high of $315K, according to a market report by Redfin.

The price jump also marks the largest annual increase in median sale price since 2014.

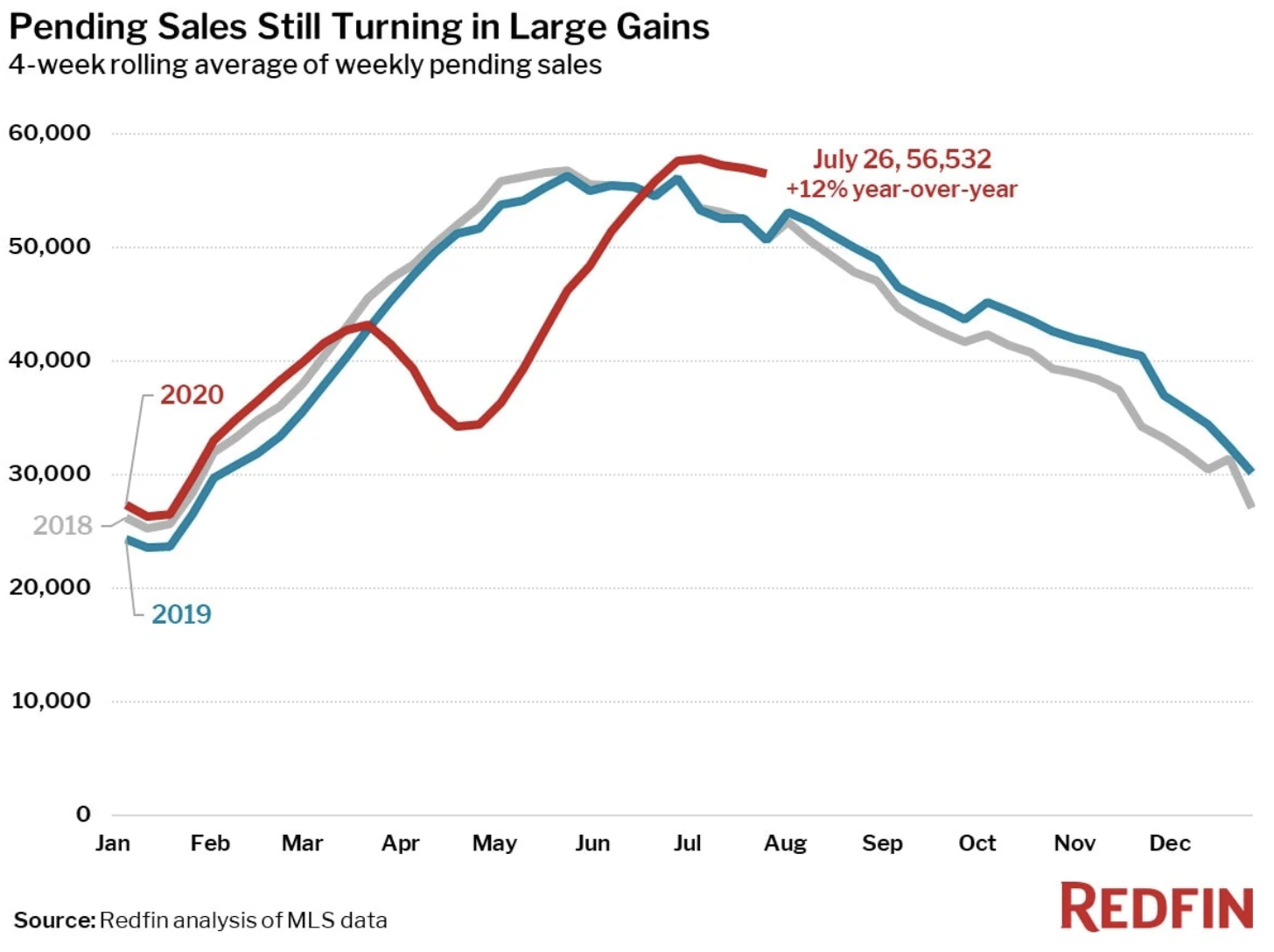

The significant price growth can be attributed to strong homebuyer demand, which is up 27 percent from pre-pandemic levels in January and February, according to Redfin’s seasonally adjusted homebuyer demand index. Prices have seen a rise as homebuyers compete for limited inventory, with new listings down 0.7 percent year over year and active inventory down 30 percent as of the four weeks ending July 26.

Buyer competition has also been reflected in the median sale-to-list price ratio, which rose to 99 percent — its highest point in at least six years.

“One of the first things I have to do with many of my buyers here in Houston is educate them on the reality that most houses are selling for more than asking,” Houston Redfin agent Melanie Miller said in Redfin’s report. “You can’t wait around for a price drop. Rather, homes that are priced right are receiving offers at or above full price within three days of being listed, so serious buyers need to be ready to act quickly.”

Sellers’ hesitancy seems to have left more cautious homebuyers wondering if they should wait for a more plentiful market with less competition, but it’s unclear when that time may arrive.