HousingWire and Inman News

Loans in forbearance decreased by 27 basis points to 2.62%; Ginnie Mae portfolio, finally, is below 3%, shows MBA. Total delinquency rates dropped 4.2 percent in July, 2.3 percentage points lower than the 6.5 percent observed in July 2020, according to new data released Tuesday by CoreLogic.

Servicers’ forbearance portfolio volume declined at the fastest rate in a year, as mortgage holders exit COVID-19 plans, according to the Mortgage Bankers Association (MBA). Exits are expected to pick up the pace in the weeks ahead due to economic improvement.

The total number of loans in forbearance decreased by 27 basis points to 2.62% as of Oct. 3. In the previous week, the rate dropped seven basis points to 2.89%

Last week, all categories showed declines. The most notable case was in the Ginnie Mae portfolio, dipping by 41 bps to 2.94% – for the first time, since the beginning of the pandemic, at a level below 3%. Meanwhile, Fannie Mae and Freddie Mac loans dropped by 17 basis points to 1.21%.

The loans and private-label securities (PLS) category showed a decline of 35 bps, to 6.42%. For depository servicers, the percentage declined 24 bps to 2.69%. The share of independent mortgage bank loans in forbearance fell 37 basis points to 2.82%.

Per the MBA’s estimate, 1.3 million homeowners are still in active forbearance plans. The survey included data on 36.5 million loans serviced as of Oct. 3, 73% of the first-mortgage servicing market.

Mike Fratantoni, senior vice president and chief economist at the MBA, said in a statement that many borrowers reached the expiration of their forbearance term, and “the pace of exits climbed to the fastest pace in over a year.”

Despite a job growth weaker than expected in September, as a result of the Delta variant and supply chain challenges, Fratantoni expects that the drop in the unemployment rate, rising wages, and abundant job openings will continue to help borrowers exit forbearance successfully in the weeks ahead.

“Payment performance has remained steady for those who have exited forbearance and into a workout since 2020, with more than 85% of those borrowers current as of October,” he said.

During the last 15 months, MBA’s data revealed that 28.8% of exits resulted in a loan deferral or partial claim. Also, 21.3% represented borrowers who continued to pay during the forbearance period. However, 16.5% were borrowers who did not make their monthly payments and did not have a loss mitigation plan.

The survey shows that 13.3% of total loans in forbearance were in the initial stage last week, and 77.5% were in a forbearance extension. The remaining 9.2% were re-entries.

Total requests were at 0.05% of servicing portfolio volume, while exits represented 0.33% of the total – in the previous week, the share was 0,12%, the report said. Servicer call volume increased to 7.8% of the servicing portfolio volume last week, up from 5.9% the week prior.

~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~

Mortgage delinquency rates are steadily decreasing nationwide and are now approaching pre-pandemic levels, according to data released Tuesday by property analytics provider CoreLogic.

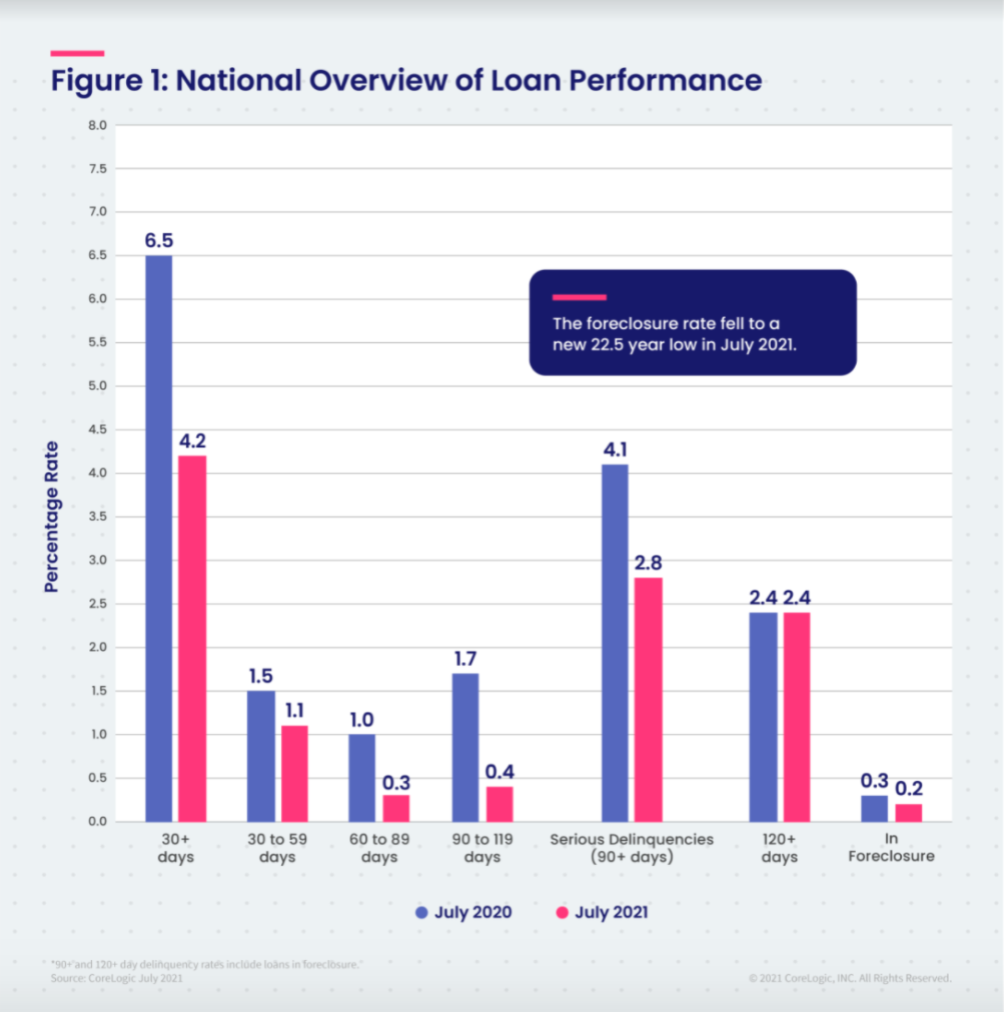

Total delinquency rates dropped 4.2 percent in July, 2.3 percentage points lower than the 6.5 percent observed in July 2020 and significantly closer to the 3.2 percent rate seen in March 2020, according to the new data. In the previous month, the same number stood at 4.4 percent.

“Declining delinquency levels are an encouraging sign of economic improvement and the durability of the housing market,” CoreLogic CEO Frank Martell said in a statement. “Looking ahead to the end of many forbearance and other assistance programs, many borrowers receiving support must consider their financial options, including a potential loan modification, to ensure they stay current and keep foreclosures at bay.”

CoreLogic

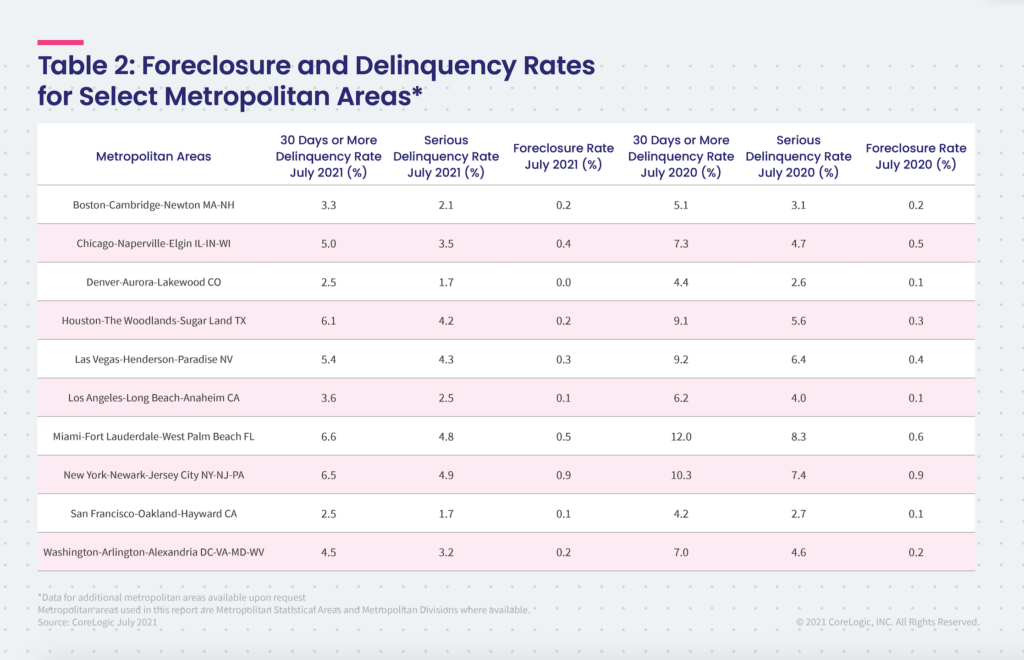

Delinquency rates fell in every U.S. state while New Jersey (3.9 percentage-point drop), Florida (3.5 percentage-point drop) and Nevada (3.3 percentage-point drop) experienced the biggest declines.

Miami, Laredo, Texas and Kingston, New York saw the most significant declines among urban areas, dropping 5.4 percent, 5.1 percent and 5 percent, respectively.

Adverse Delinquency (60 to 89 days past due date) are down to 0.3 percent from 1 percent while serious delinquencies (late by more than 90 days) are down to 2.8 percent from 4.1 percent. Early delinquencies (30 to 59 days past due) are down to 1.1 percent from 1.5 percent while foreclosures, or having one’s home seized entirely due to missed payments, are down to 0.2 percent from 0.3 percent.

Overall, the numbers are encouraging, with the number of homes lost due to unemployment or missed mortgage payments less significant than originally predicted near the beginning of the pandemic. A range of government forbearance programs have kept many afloat following job loss while rapidly rising home prices have helped transform homes into financial buffers.

CoreLogic

“Even if loan modification or income recovery is unable to help delinquent homeowners become and remain current on their payments, the double-digit rise in home prices may help them avoid a distressed sale,” Dr. Frank Nothaft, chief economist at CoreLogic, said in a statement. “Homeowners with substantial home equity are far less likely to experience a foreclosure sale, and fortunately, the CoreLogic Home Equity Report found the average owner gained $51,500 in equity in the past year — a five-fold annual increase.”

According to Black Knight’s latest Mortgage Monitor report, there were nearly 1.6 million homeowners in pandemic-related forbearance plans in September, and many of those borrowers will be reaching their 18-month program limits this year. Black Knight estimates that high-equity borrowers are more than 40 percent less likely to lose their home through a foreclosure, deed-in-lieu, or short sale than those with weaker equity positions.

Loan servicers are required to reach out to borrowers who are 120 days behind on their payments and give them a chance to apply for assistance, such as a loan modification, before initiating foreclosure proceedings.