Inman News

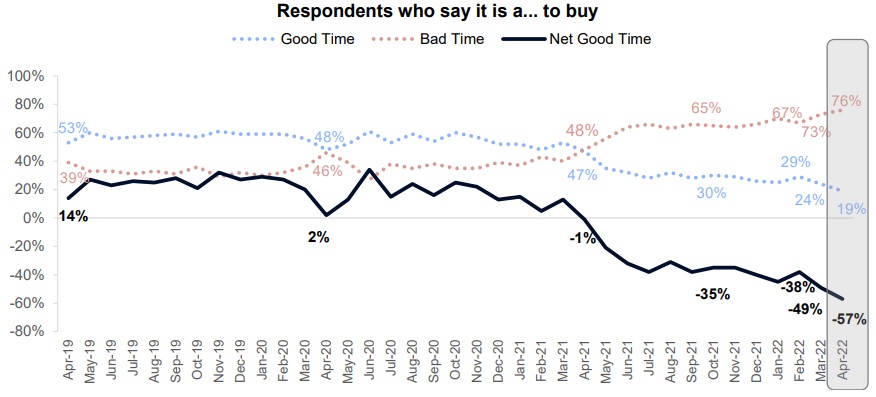

A record low 19 percent of Americans say it’s a good time to buy a home, according to a monthly survey Fannie Mae’s been conducting since 2010.

The percentage of Americans who think it’s a good time to buy a home dropped to a new record low in April, as listings shortages in many markets, rising prices and mortgage rates continued to create challenging conditions for would-be homebuyers.

Fannie Mae’s monthly latest National Housing Survey, released Monday, found that the percentage of Americans who think it’s a good time to buy a home fell to 19 percent in April, breaking the previous record low of 24 percent seen in March. The mortgage giant has been conducting the monthly telephone surveys of 1,000 consumers since 2010.

“The current lack of entry-level supply and the rapid uptick in mortgage rates appear to be adversely impacting potential first-time homebuyers in particular,” said Fannie Mae Chief Economist Doug Duncan, in a statement. A larger share of 18- to 34-year-olds said it was a bad time to buy a home, he noted.

“Additionally, consumer perception regarding the ease of getting a mortgage also decreased across nearly all surveyed segments this month, suggesting to us that the benefit of the recent past’s historically low mortgage rate environment appears to have diminished, and affordability is poised to become an even greater constraint going forward,” Duncan said. “This sentiment is consistent with our forecast of decelerating home sales through the rest of 2022 and into 2023.”

In an April 19 forecast, Fannie Mae economists said they expect home sales to decline by 7.4 percent this year and by 9.7 percent in 2023, and that there’s a chance of a “modest recession” in the second half of next year in the face of continued Fed tightening.

Despite an 11.3 percent drop from March to April, demand for purchase loans was essentially at the same level as a year ago, demonstrating “consistent and resilient demand from homebuyers,” mortgage data aggregator Black Knight said in another report out Monday.

Although the Fed is expected to continue raising short-term rates this year, some observers believe mortgage rates could plateau now that the Fed has unveiled details of its plans to unwind nearly $9 trillion in long-term government debt and mortgages.

But nearly three in four consumers surveyed in April (73 percent) said they think mortgage rates are headed still higher over the next 12 months.

A similar share of consumers — 71 percent — said they thought the economy was on the wrong track in April, down 2 percentage points from March’s record high of 73 percent.

Fannie Mae’s overall Home Purchase Sentiment Index (HPSI), which is based on six survey questions, decreased by 4.7 points in April, to 68.5 — its lowest level since May 2020, at the outset of the pandemic.

Home Purchase Sentiment Index components

Source: Fannie Mae National Housing Survey, April 2022.