KCM

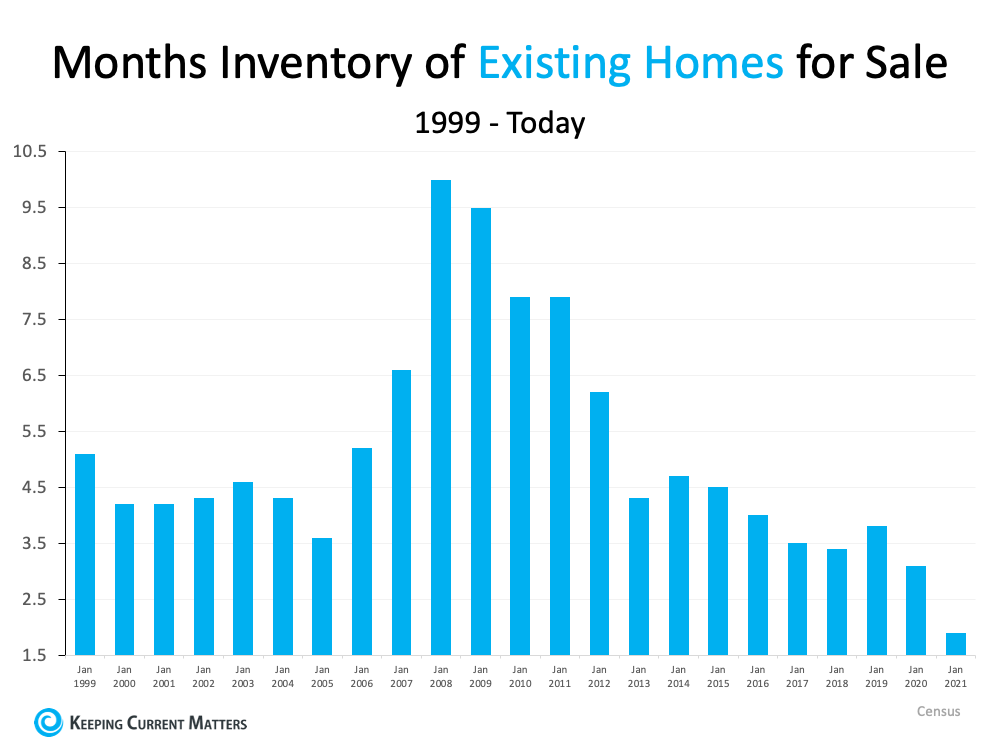

The major challenge in today’s housing market is that there are more buyers looking to purchase than there are homes available to buy. Simply put, supply can’t keep up with demand. A normal market has a 6-month supply of homes for sale. Anything over that indicates it’s a buyers’ market, but an inventory level below that threshold means we’re in a sellers’ market. Today’s inventory level sits far below the norm.

According to the Existing Home Sales Report from the National Association of Realtors (NAR):

“Total housing inventory at the end of April amounted to 1.16 million units, up 10.5% from March’s inventory and down 20.5% from one year ago (1.46 million). Unsold inventory sits at a 2.4-month supply at the current sales pace, slightly up from March’s 2.1-month supply and down from the 4.0-month supply recorded in April 2020. These numbers continue to represent near-record lows.”

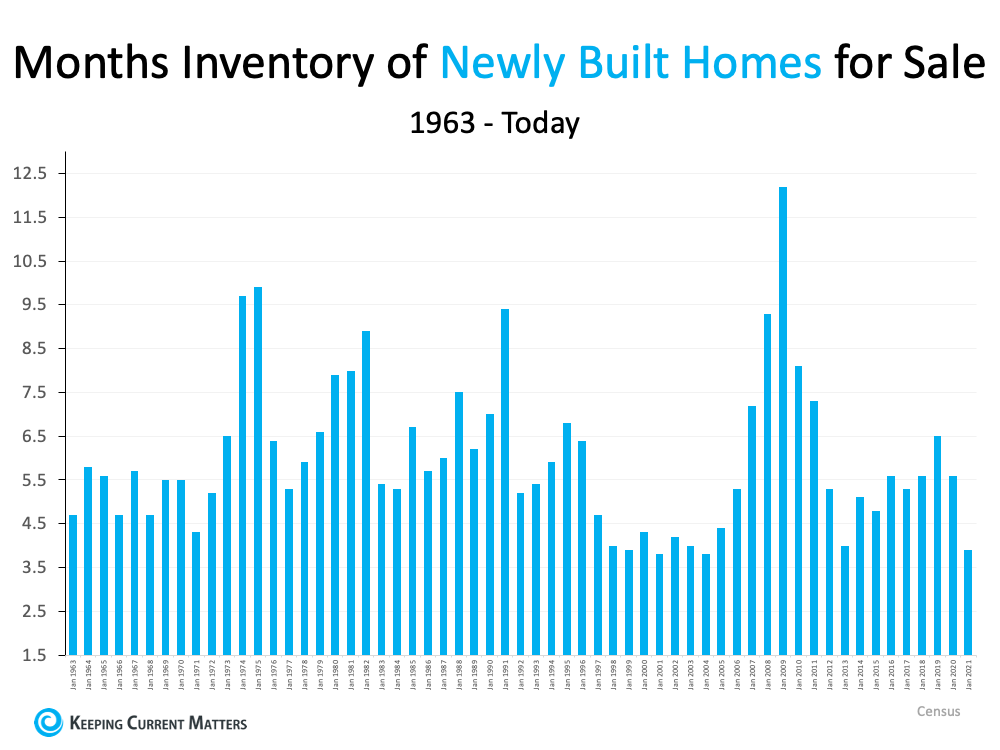

Basically, while we are seeing some improvement, we’re still at near-record lows for housing inventory (as shown in the graph below). Here’s why. Since the pandemic began, sellers have been cautious when it comes to putting their homes on the market. At the same time that fewer people are listing their homes, more and more people are trying to buy them thanks to today’s low mortgage rates. The influx of buyers aiming to capitalize on those rates are purchasing this limited supply of homes as quickly as they’re coming to market.This inventory shortage doesn’t just apply to existing homes that are already built. When it comes to new construction, builders are trying to do their part to bring more newly built homes into the market. However, due to challenges with things like lumber supply, they’re also not able to keep up with demand. In their Monthly New Residential Sales report, the United States Census Bureau states:

“The seasonally‐adjusted estimate of new houses for sale at the end of April was 316,000. This represents a supply of 4.4 months at the current sales rate.”

Sam Khater, Chief Economist at Freddie Mac, elaborates:

“In the span of five decades, entry level construction fell from 418,000 units per year in the late 1970s to 65,000 in 2020.

While in 2020 only 65,000 entry-level homes were completed, there were 2.38 million first-time homebuyers that purchased homes. Not all renters looking to purchase their first home were in the market for entry-level homes, however, the large disparity illustrates the significant and rapidly widening gap between entry-level supply and demand.”

Despite today’s low inventory, there is hope on the horizon.

Regarding existing home sales, Sabrina Speianu, Senior Economic Research Analyst at realtor.com, explains:

“In May, newly listed homes grew by 5.4% on a year-over-year basis compared to the earlier days of the COVID-19 pandemic last year…

In May, the share of newly listed homes compared to active daily inventory hit a historical high of 44.4%, 17.3 percentage points higher than last year and 15.1 percentage points above typical levels seen in 2017 to 2019. This is a reflection of quickly selling homes and, for buyers, it means that while they can expect fresh new listings every week, they will have to be prepared to move quickly on desirable homes.”

As for newly built homes, builders are also confident about what’s ahead for housing inventory. Robert Dietz, Chief Economist at the National Association of Home Builders (NAHB), shares:

“Builder confidence in the market remains strong due to a lack of resale inventory, low mortgage interest rates, and a growing demographic of prospective home buyers.”

Things are starting to look up for residential real estate inventory. As the country continues to reopen, more houses are likely to be listed for sale. However, as long as buyer demand remains high, it will take time for the balance between supply and demand to truly neutralize.

Bottom Line

Although it may be challenging to find a house to buy in today’s market, there is hope on the horizon.