Inman News

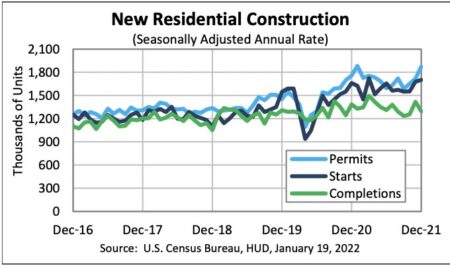

Overall housing starts increased 1.4% month over month in December to a seasonally adjusted rate of 1.70 million units, according to the the Department of Housing and Urban Development.

New housing starts reached a high in December not seen since March, according to the latest monthly report from the Department of Housing and Urban Development.

Overall housing starts, which represent the number of housing units on which construction was started, increased 1.4 percent month over month in December to a seasonally adjusted rate of 1.70 million units, the report states.

Starts on construction of single-family homes dropped 2.3 percent between November and December to 1.12 million, while construction of multifamily units, which includes apartment buildings and condos, posted a sizable increase of 10.6 percent month over month at 530,000.

Despite the December decrease, single-family starts increased by double digits overall in 2021 despite increasingly difficult supply chain challenges for builders.

An estimated 1,595,100 housing units started construction in 2021, a 15.6 percent increase from 2020 and the second-least volatile year for housing since 2005.

Housing starts took an enormous loss in 2020 as the pandemic wrecked havoc on the housing market, and supply chain effects rippled across the industry. Operations eventually ramped back up just as quickly as they fell off, but supply chain effects continue to be felt.

Experts have attributed the steady rise in starts to a stabilization of the labor market, steady demand for housing, low mortgage rates, and extremely low inventory of existing housing.

The steady increase paints a picture of an industry that may be slowly persevering in the face of supply chain chaos, though experts predict a flat rebound as material costs increase and higher mortgage rates price out homebuyers.

“The double-digit gain for single-family starts in 2021 was a continuation of the rebound and expansion of home building that took place in the wake of the pandemic,” National Association of Homebuilders Chief Economist Robert Dietz said. “However, as mortgage interest rates are rising and construction costs increase, affordability headwinds are steepening. NAHB’s outlook for 2022 calls for relatively flat conditions for single-family construction, with additional gains for multifamily and remodeling.”

These concerns caused builder sentiment to dip for the first time in months this week, despite the steady gains in housing starts.

Regionally, home construction starts were 0.7 percent higher in the Northeast, 9.3 percent higher in the South, 17.1 percent higher in the Midwest, and 18.1 percent higher in the West, according to HUD.