Inman News

In face of historic inventory shortage, privately-owned housing starts jumped 9.2% month-over-month and 9.4% year-over-year.

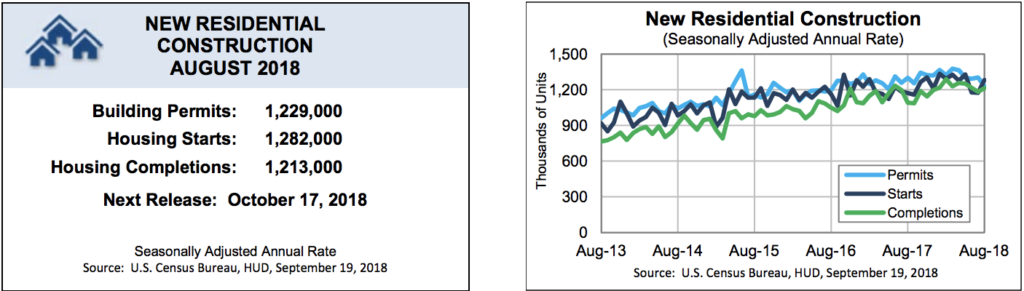

Privately-owned housing starts jumped 9.2 percent in August and 9.4 percent year-over-year to a seasonally adjusted annual rate of 1,282,000, but privately-owned housing units authorized by building permits fell to a 15-month low, according to the latest data from the U.S. Department of Housing and Urban Development (HUD) and the U.S. Census Bureau, released Wednesday.

Courtesy HUD and U.S. Census Bureau.

“The robust demand we are seeing in the overall housing market and the shortage of supply of existing homes leads us to believe that new home construction should generally trend upward over the next year,” said Ruben Gonzalez, chief economist, Keller Williams.

Despite the rise in starts, privately-owned housing units authorized by building permits fell 5.7 percent month-over-month and 5.5 percent year-over-year. Single-family authorizations, in particular, fell 6.1 percent, month-over-month.

“Material and labor costs have likely eaten into builder margins this year and higher mortgage rates may put some pressure on builders’ ability to raise prices,” Gonzalez added. “This all may result in builders moving more cautiously in the second half of year. We still believe demand favors more construction of new homes.”

Despite the headline numbers being strong, Scott Volling, principal at PricewaterhouseCoopers, said breaking down the numbers further shows the entire year-over-year gain in housing starts can be attributed to multi-family, whereas single-family actually decreased year-over-year.

“This continues an overall disappointing three-month trend in starts,” said Volling. “Permits in June and July provided a bit of a promising silver lining, but in August permits came in at the lowest levels since May 2017.”

“With mortgage rates at a 7 year high, homebuilder sentiment trending lower, and an increased threat of tariffs further pressuring existing affordability challenges, the ho-hum results of August could very well be the norm for the foreseeable future,” Volling added.