Inman News

A slowing global economy and a shortage of available stateside homes appear to have contributed to a slowdown in purchases from foreign buyers, according to a new NAR report.

International real estate buyers still have an appetite for American property, though over the last fiscal year the amount they’ve spent on U.S. real estate has fallen precipitously compared to earlier periods.

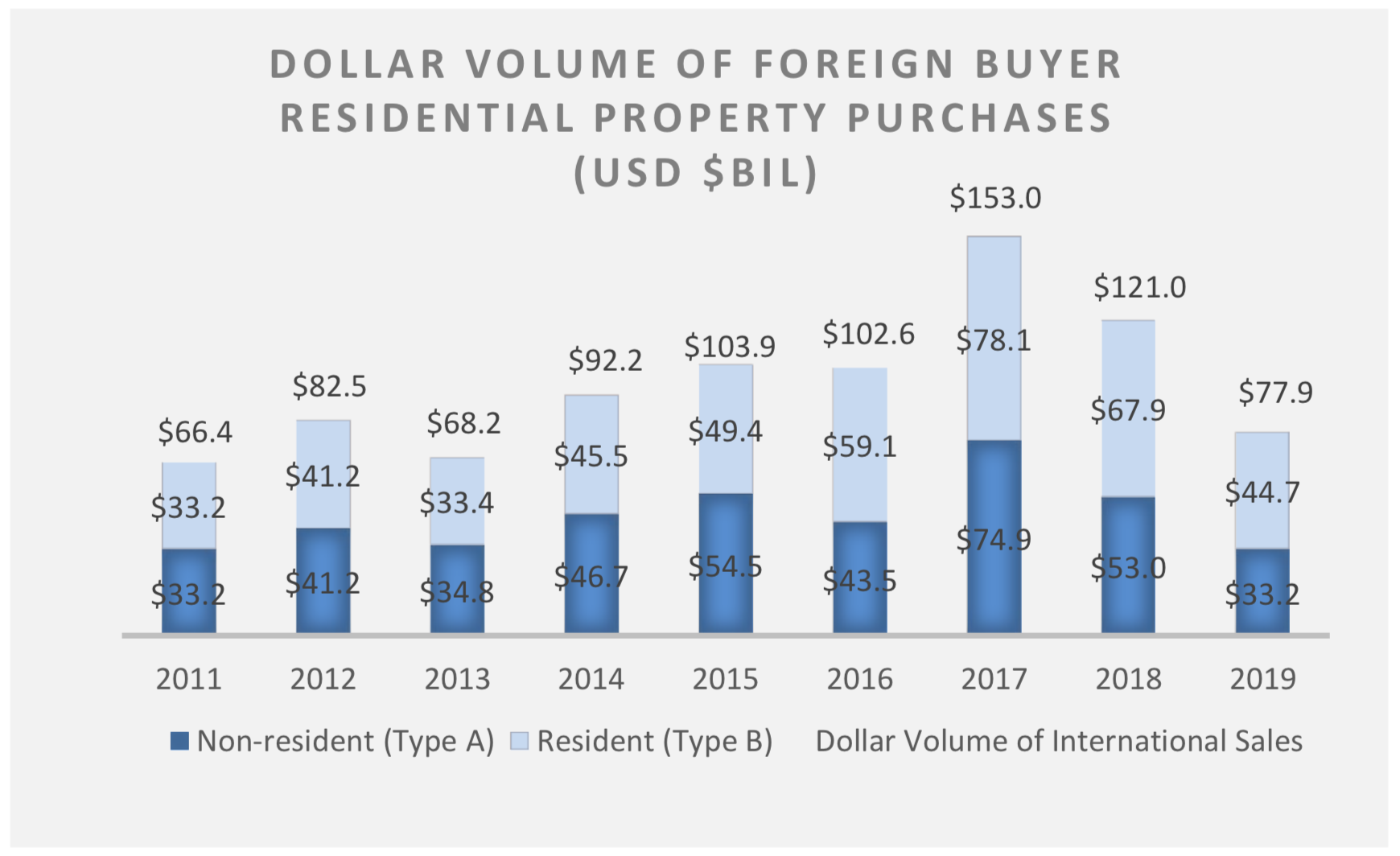

A new report from the National Association of Realtors (NAR), released today, shows that between April of 2018 and March of 2019 183,100 international buyers purchased existing homes in the U.S. Those buyers also generated $77.9 billion in volume during that same period, according to the NAR report.

Those are big numbers and clearly indicate that foreign buyers are still interested in the U.S.

But more startlingly, the numbers also represent a drop of 31 percent in the number of foreign buyers year-over-year. And volume fell 36 percent year-over-year.

Ultimately, the last fiscal year saw dollar volume from international residential purchases fall to its lowest levels since 2013.

Credit: NAR

The NAR report highlights a number of reasons that could be contributing to these declines.

“A confluence of many factors — slower economic growth abroad, tighter capital controls in China, a stronger U.S. dollar and a low inventory of homes for sale — contributed to the pullback of foreign buyers,” NAR chief economist Lawrence Yun said in a statement about the report. “However, the magnitude of the decline is quite striking, implying less confidence in owning a property in the U.S.”

Conditions in China play a huge role in the amount of foreign real estate investment taking place in the U.S. Over the last year, China buyers accounted for $13.4 billion in U.S. real estate volume — far and away the most of any foreign country. Canada came in second at $8 billion, followed by India at $6.9 billion, the U.K. at $3.8 billion and Mexico at $2.3 billion.

However, that $13.4 billion in volume from Chinese buyers represents a decline of 56 percent year-over-year. NAR’s data shows that purchases from buyers in every other top-five country also fell over the last year, though not as dramatically as was the case with China.

Other factors that could have contributed to these shifts include a stronger dollar, which weakens foreigners’ purchasing power, as well as China’s now-tighter controls on outward flowing capital.

In addition to breaking down the countries from which foreign real estate buyers hail, NAR’s report also paints a picture of what types of properties they tend to focus on. Over the last fiscal year, for instance, Florida attracted 20 percent of all foreign buyers, making it the most popular state for the sector. California came in second, with 12 percent of international purchases.

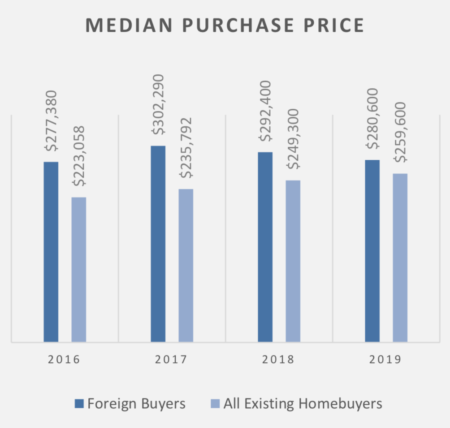

Credit: NAR

The report further reveals that the median home price for foreign buyers was $280,600 — just slightly higher than the overall U.S. median of $259,600 — and that 47 percent bought a home to serve as their primary residence. Also, 44 percent of foreign buyers purchased a property in a suburban community, and 76 percent bought either a single-family home or townhouse.

In total, 41 percent of foreign buyers also paid cash for their property. Canadian buyers were the most likely to pay cash, while most buyers from India took out U.S. mortgages, the report states.

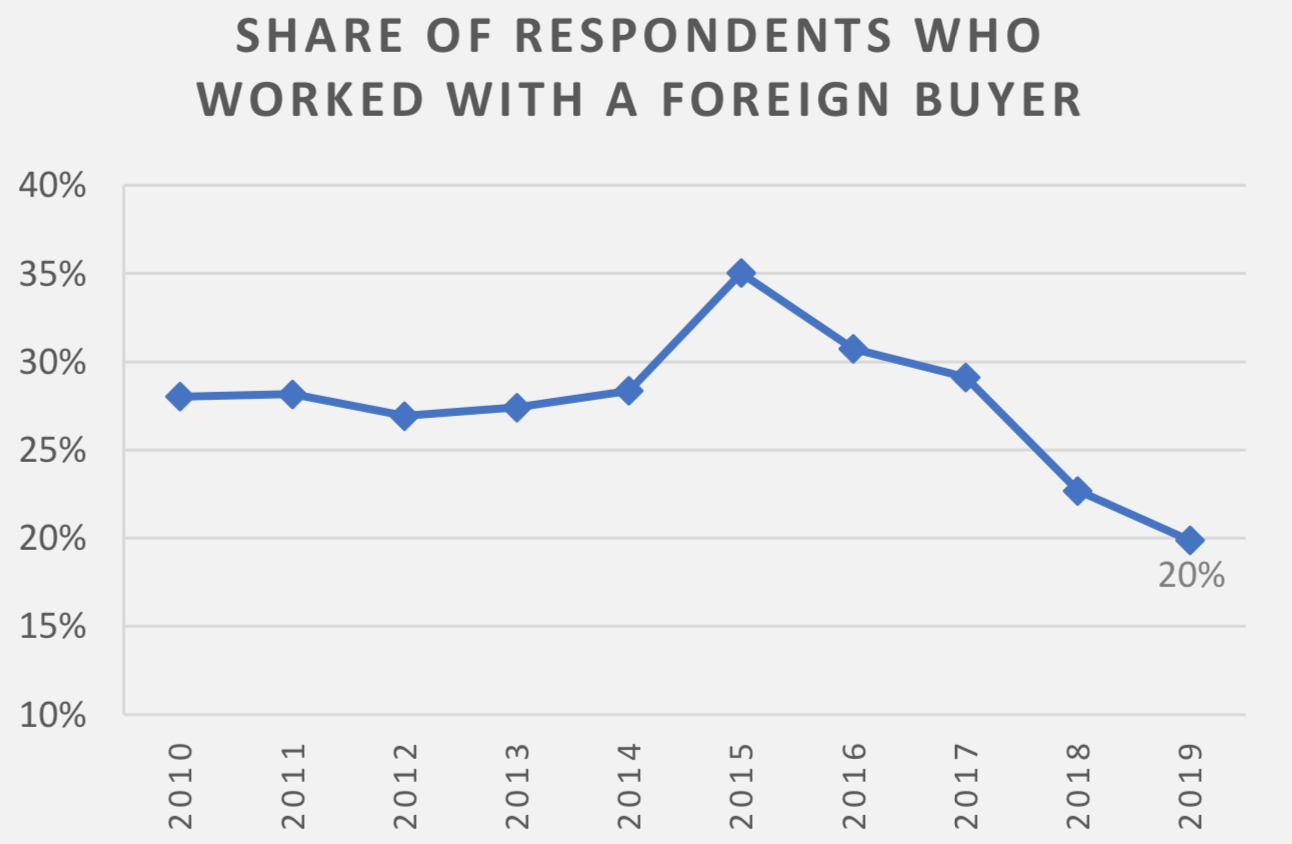

Finally, the report notes that the share of real estate agents who have worked with foreign buyers has been declining for several years now and most recently hit just 20 percent.

Credit: NAR

To compile the report, NAR collected responses from 11,812 real estate agents in the U.S. who were asked about their work with international buyers. This is the tenth year that the trade group has conducted such a survey.

While the NAR report overall paints a picture of declining investment in U.S. real estate from international buyers, the trade organization still believes there is some room for optimism.

“Even though numbers were lower this year than during the previous 12 months, international investors and buyers still spent and invested a great deal of money in U.S. real estate,” NAR President John Smaby said in a statement. “Home buyers from across the globe know that the U.S. market is still a safe, secure and promising place to invest.”