Inman News

Fannie Mae’s latest quarterly survey on lender sentiment reports a bleak outlook for mortgage lending in Q4 and likely for the future.

In one of the latest signs that the housing market is shifting into a lower gear, demand for purchase mortgages has continued to slide recently, hitting its lowest level for the fourth quarter since at least 2014, according to Fannie Mae‘s latest Mortgage Lender Sentiment Survey.

“Stressful conditions continue to hang over the mortgage industry,” said Doug Duncan, senior vice president and chief economist at Fannie Mae. “Lenders are reporting the lowest purchase mortgage demand expectations across all loans types and the worst refinance demand expectations for GSE-eligible loans [mortgages eligible for purchase by Freddie Mac and Fannie Mae] in the survey’s five-year history.”

He blames rising mortgage rates, tight housing inventory and “solid home price appreciation” for the softened demand.

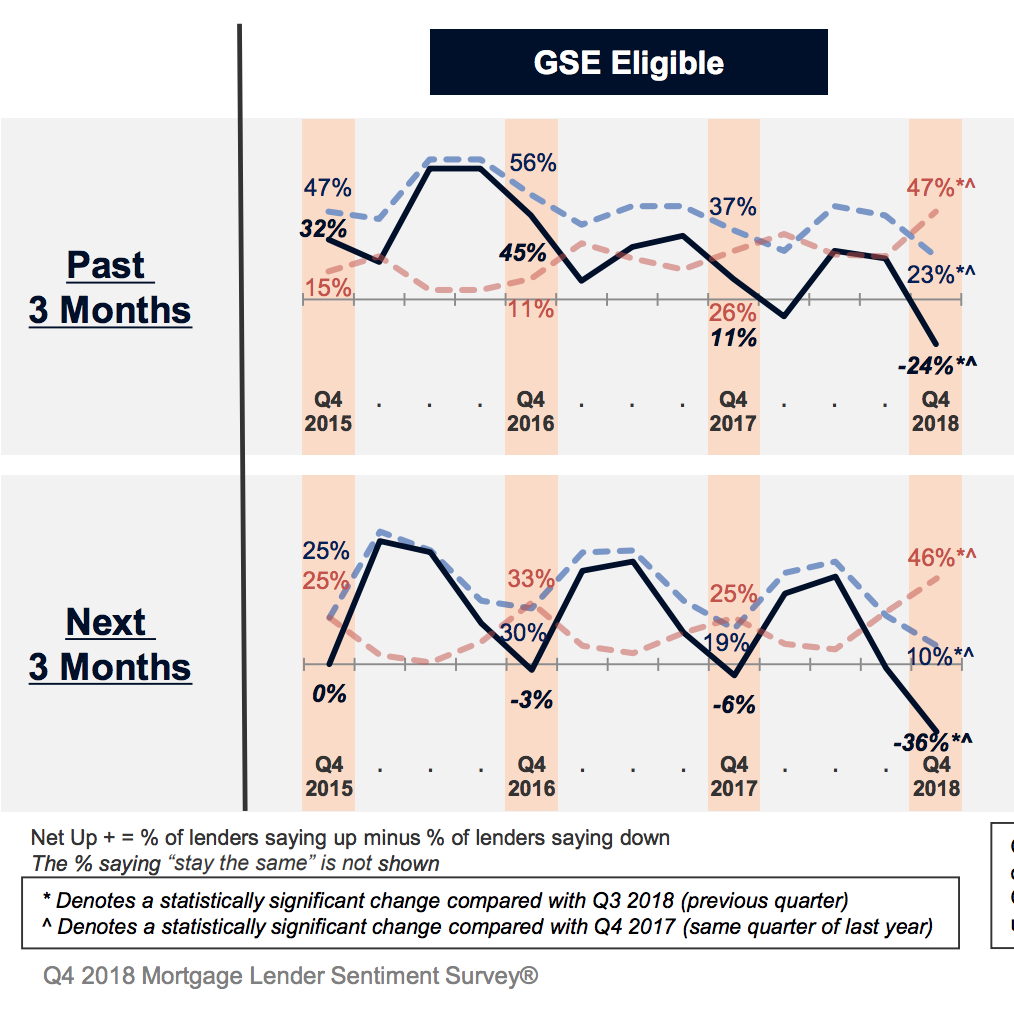

For purchase mortgages, across all loan types, the net share of lenders reporting demand growth over the previous three months clocked the lowest reading for any fourth quarter since the survey’s inception in 2014. Meanwhile, the net share indicating growth expectations over the next three months also fell to an all-time low across all loan types.

The survey results are consistent with other data that portend a cooling housing market, such as NAR’s recent finding that home sales contract signings fell on annual basis for the tenth straight month in October.

Demand for purchase mortgages that are eligible for purchase by Freddie Mac and Fannie Mae.

Demand for refinance mortgages is also in the doldrums, with the net share of lenders reporting demand growth over the prior three months declining to the second lowest level in the survey history for loans eligible for purchase by Fannie Mae and Freddie Mac.

Demand for refinance loans that aren’t eligible for purchase by the GSEs also dropped to its lowest level in survey history.

Part of why homebuyers and owners are less keen on taking out new mortgages is the steady rise in mortgage interest rates. The average rate for a 30-year fixed-rate mortgage for the week ending December 6 was 4.75 percent, up from less than 4 percent the year before, according to Freddie Mac.

Given the slackening mortgage appetite, it should come as little surprise that the lenders’ profit expectations slid for the ninth straight quarter, dipping to a new a survey low. Competition from other lenders was cited as the top reason for their negative outlook, while consumer demand was cited as the second most important reason.

The declining mortgage demand comes even as lenders continue to loosen lending standards, albeit at a slower pace than in the fourth quarter of 2014.

Despite the discouraging survey results, “continued strength in demographics and the labor market offers hope that conditions should stabilize and may even improve next year,” Duncan said.

The quarterly survey gauges lender sentiment by polling executives on a quarterly basis. The latest version was conducted between October 31 and November 12 by PSB in coordination with Fannie Mae.