Inman News

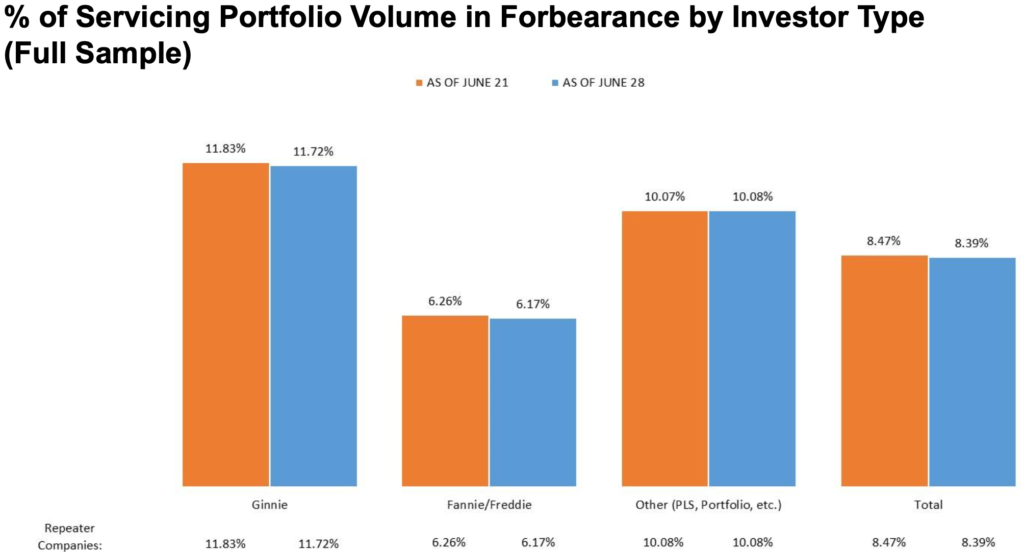

During the week ending June 28, the total number of mortgage loans in forbearance dropped to 8.39 percent of servicers’ portfolio volume from 8.47% the week prior.

The total number of mortgage loans in forbearance dropped for the third consecutive week during the week ending June 28, to 8.39 percent of servicers’ portfolio volume from 8.47 percent the week prior, according to estimates from the Mortgage Bankers Association’s (MBA) latest forbearance and call volume survey.

About 4.2 million homeowners are now in forbearance plans, according to the report, released Tuesday.

Fannie Mae and Freddie Mac loans in forbearance declined for the fourth week in a row to 6.17 percent from 6.26 percent the week before. Ginnie Mae loans in forbearance likewise dropped to 11.72 percent from 11.83 percent the previous week, and loans in forbearance for depository servicers declined to 9.03 percent from 9.09 percent the week before. Loans in forbearance for independent mortgage banker (IMB) servicers dropped as well, to 8.33 percent from 8.42 percent the week prior.

Courtesy of Mortgage Bankers Association

“We learned last week that the job market improved more than expected in June,” Mike Fratantoni, senior vice president and chief economist of MBA, said in a statement. “With that as background, it is not surprising that the forbearance numbers continue to improve as more people go back to their jobs. The improvement in the forbearance data was broad-based, with declines for both GSE and Ginnie Mae loans. The decrease in new forbearance requests indicates that further declines are likely in the weeks ahead.”

Across all investor types, forbearance requests as a percent of servicing portfolio volume declined to 0.12 percent from 0.14 percent the previous week.

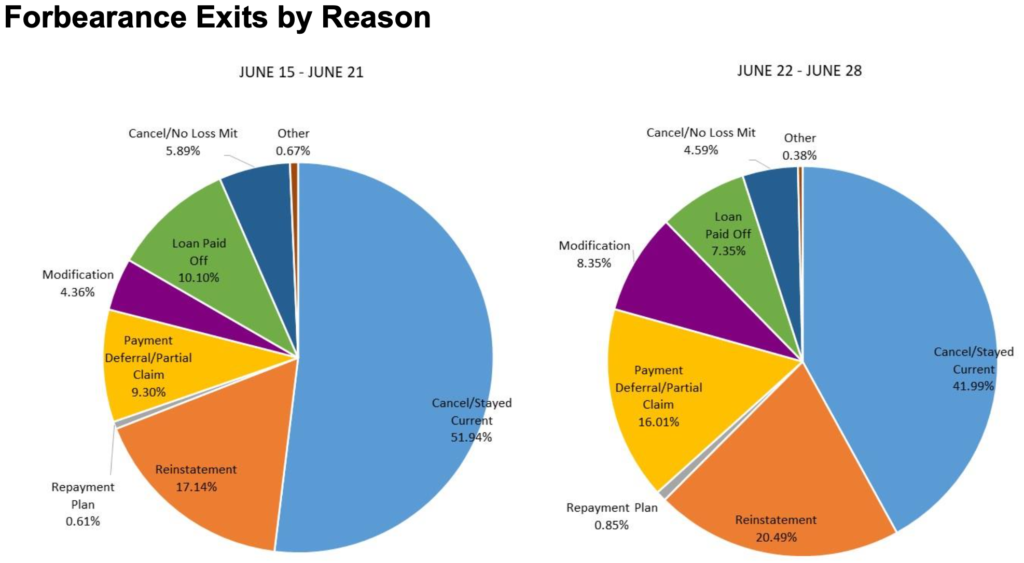

The percentage of borrowers who exited forbearance through modification of their forbearance plan increased to 8.35 percent from 4.36 percent the week before. The number of borrowers who exited through payment deferral or a partial claim likewise increased week-over-week to 16.01 percent from 9.30 percent the week prior.

Courtesy of Mortgage Bankers Association

Fratantoni noted that fewer borrowers weren’t merely opting out of a forbearance plan, but exploring other options.

“Looking at the mix of loans that are exiting forbearance, we are seeing a higher share exiting into deferral options and modifications, and somewhat fewer simply opting out of a forbearance plan,” Fratantoni said in a statement.