Inman News

After 6 months of easing, credit availability tightened by 8.5% in June.

Mortgage lenders tightened underwriting standards in June, undoing much of the easing seen over the last six months as initial fears about the long-term impacts of the pandemic began to wane.

That’s according to an index gauging mortgage credibility compiled by the Mortgage Bankers Association (MBA), which showed credit availability dropping to its lowest level since September 2020.

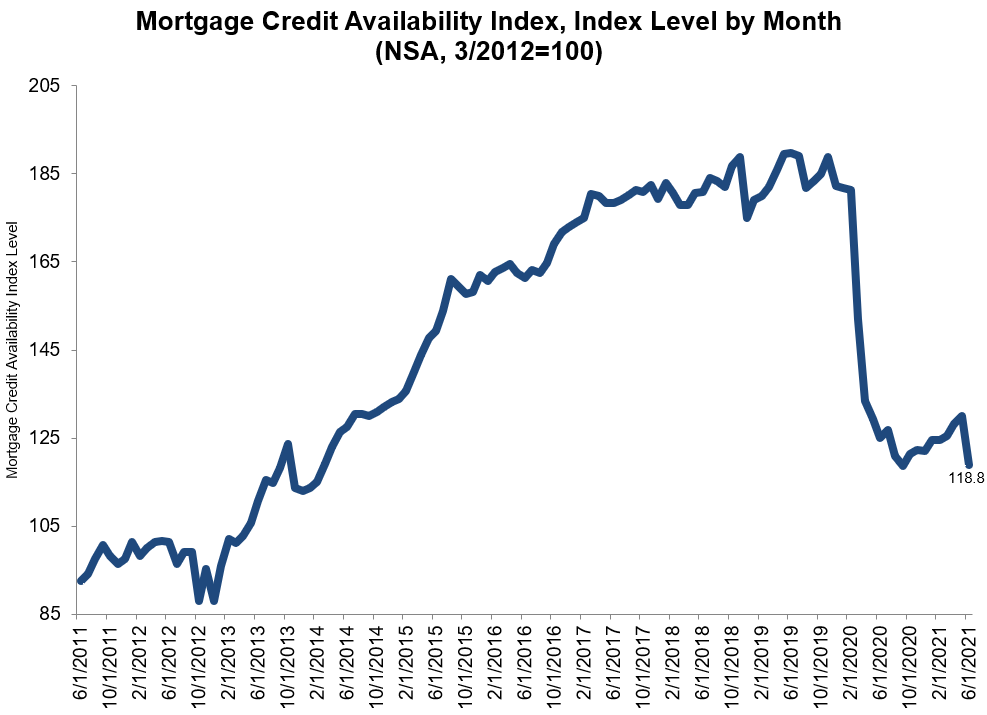

The Mortgage Bankers Associations’ Mortgage Credit Availability Index (MCAI) fell by 8.5 percent to 118.8 in June. Source: Mortgage Bankers Association.

The tightening was largely attributable to restrictions on refinancing mortgages with high loan-to-value ratios put in place by Fannie Mae and Freddie Mac in consultation with their federal regulator, the Federal Housing Finance Agency (FHFA), in order to comply with the Consumer Financial Protection Bureau’s revised qualified mortgage rule, said the MBA’s Joel Kan.

Credit availability for all types of mortgages fell by 8.5 percent in June, while availability for conventional, conforming mortgages eligible for purchase by Fannie and Freddie fell by 23.5 percent.

“We did see the addition of refinance programs designed to reduce costs for lower income borrowers, but the full impact of those new loan programs remains to be seen,” Kan said in a statement. “In addition to the tightening in supply from the policy change, there was also a pullback in jumbo ARM offerings, which contributed to the lowest supply of jumbo credit since February 2021.”

In the months ahead, homeowners may have a greater incentive to refinance their mortgages. The FHFA announced on July 16 that beginning Aug. 1, Fannie and Freddie will no longer have to charge lenders a 50-basis point refinancing fee.

The fee, equal to $500 on every $100,000 refinanced, was intended to help the mortgage giants cover at least $6 billion in anticipated losses due to the pandemic. The FHFA has determined the fee is no longer needed, since most borrowers who stopped making payments on their loans during the pandemic are no longer in forbearance.

On the other hand, new limits federal regulators have placed on Fannie and Freddie’s purchases of loans secured by second homes and investment properties are thought to be a contributing factor in the recent decline in demand for those homes.