Inman News

By Mike DelPrete

With the recovery of new listings coming to market slowing and buyer demand remaining strong, the supply and demand imbalance doesn’t appear to be changing soon.

There’s a reason I’ve been talking about new listing volumes as the best lead indicator of the health of the real estate market. That reason is now clearly manifesting: a precipitous decline in available inventory across the U.S. Fewer new listings leads to less inventory, which is causing a supply and demand imbalance.

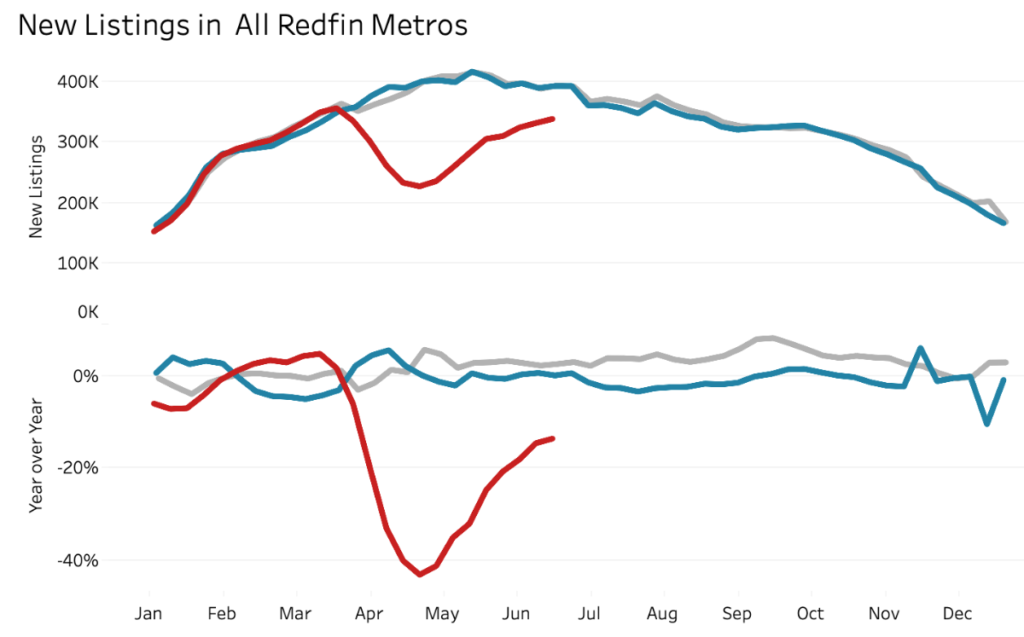

National new listings and active inventory

Nationally, new listings dropped significantly — down more than 40 percent — and are slowly recovering. The velocity of that recovery has slowed in recent weeks; new listings are coming to market slower and are still down 18 percent compared to last year.

The significance is that when new listings stop coming to market, overall supply — inventory — drops. There are fewer available homes for prospective buyers to purchase.

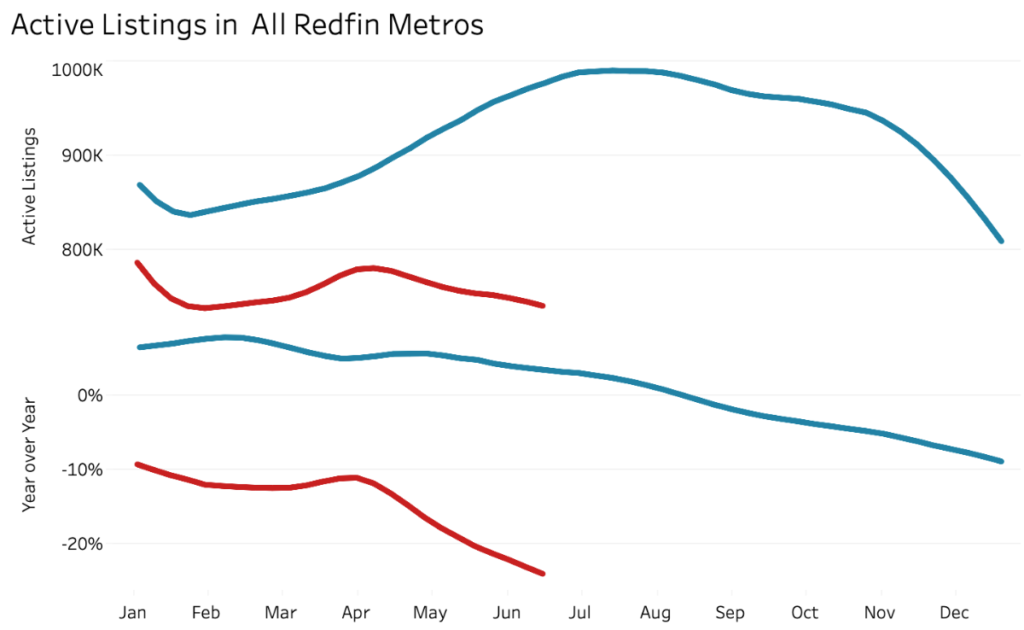

Nationally, the number of active listings is down 25 percent as of June 21. And the slope of the line is heading down, both absolutely and compared to last year.

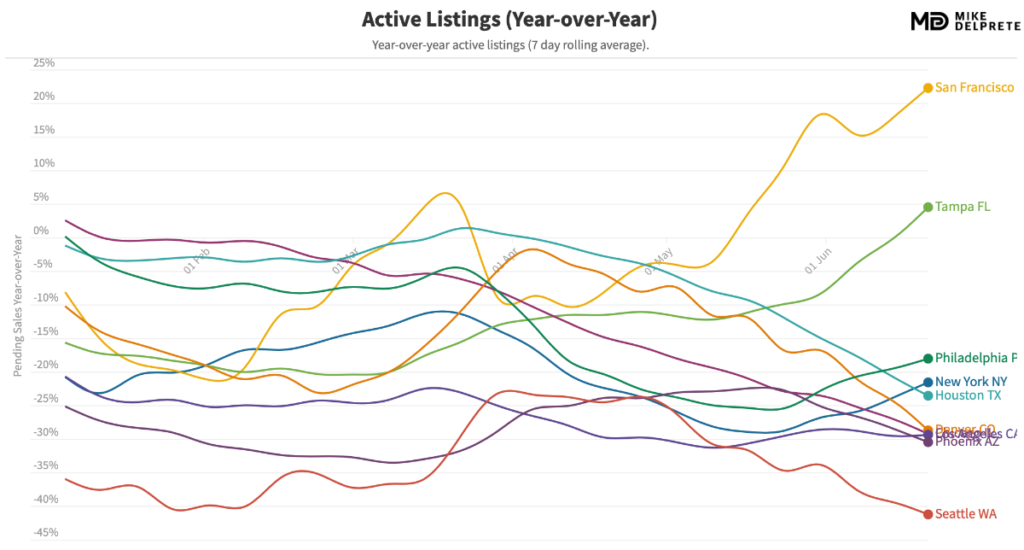

Active listing tracker

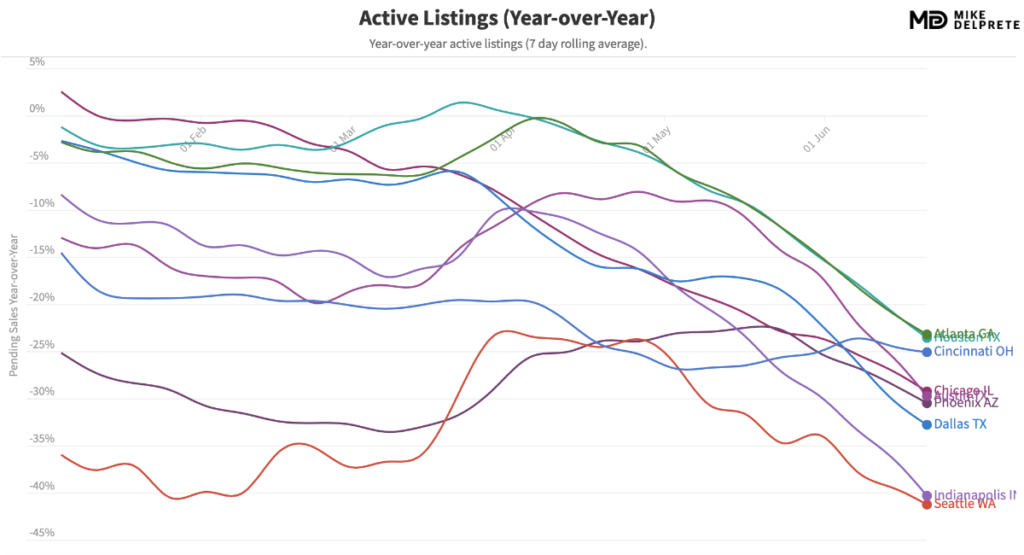

An overview of some of the biggest markets in the U.S. shows, with few exceptions, that the number of active listings in most markets is down 20-40 percent compared to last year. Demand is strong, and buyers are gobbling up the available inventory.

Markets such as Atlanta, Dallas, Seattle, Chicago, Phoenix and others show a strikingly common downward trend. Compared to last year, the number of active listings is plummeting downward.

The significance of inventory

A drop in active listings isn’t necessarily a problem, but it’s a significant disruption to the market dynamics of supply and demand. If the amount of active buyers remains constant and the available inventory drops, home prices will rise.

In many markets — and nationally — the available inventory continues to drop, and it doesn’t appear to have stabilized yet. The supply and demand imbalance, especially in certain markets, is acute. And with the recovery of new listings coming to market slowing and buyer demand remaining strong, it does not appear to be changing anytime soon.

Mike DelPrete is a strategic adviser and global expert in real estate tech, including Zavvie, an iBuyer offer aggregator.