CALCLATEDRISK

Early Reports Suggest New Cycle Low for NAR reported Sales in July

By Bill McBride

NOTE: The tables for active listings, new listings and closed sales all include a comparison to July 2019 for each local market (some 2019 data is not available).

This is the first look at several early reporting local markets in July. I’m tracking over 40 local housing markets in the US. Some of the 40 markets are states, and some are metropolitan areas. I’ll update these tables throughout the month as additional data is released.

Closed sales in July were mostly for contracts signed in May and June when 30-year mortgage rates averaged 7.06% and 6.92%, respectively (Freddie Mac PMMS).

Active Inventory in July

Here is a summary of active listings for these early reporting housing markets.

Inventory was up 40.1% year-over-year. Last month inventory in these markets was up 36.4% YoY. A key will be how much inventory builds over the next couple of months.

Inventory is down in most of these areas compared to 2019. Inventory in Denver and Nashville are now up compared to July 2019.

Notes for all tables:

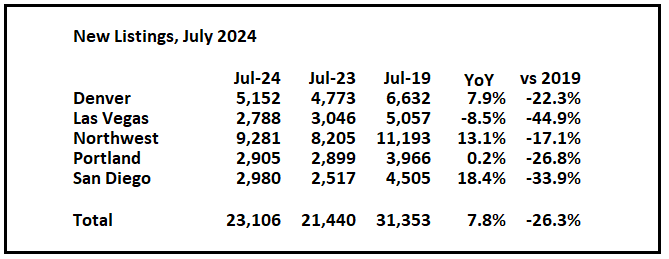

New Listings in July

And here is a table for new listings in June (some areas don’t report new listings). For these areas, new listings were up 7.8% year-over-year.

Last month, new listings in these markets were up 3.8% year-over-year.

New listings are now up year-over-year, but still at historically low levels. New listings in all of these areas are down compared to July 2019 activity.

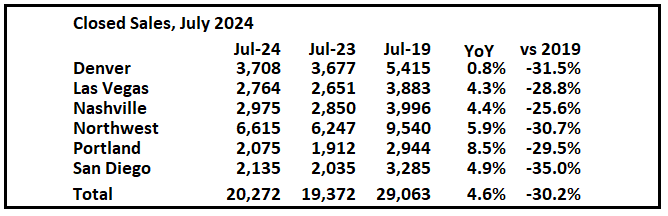

Closed Sales in July

And a table of July sales.

In July, sales in these markets were up 4.6% YoY. Last month, in June, these same markets were down 6.7% year-over-year Not Seasonally Adjusted (NSA).

Important: There were two more working days in July 2024 compared to July 2023 (22 vs 20), so seasonally adjusted sales will be much lower than the NSA data suggests.

Sales in all of these markets are down significantly compared to July 2019.

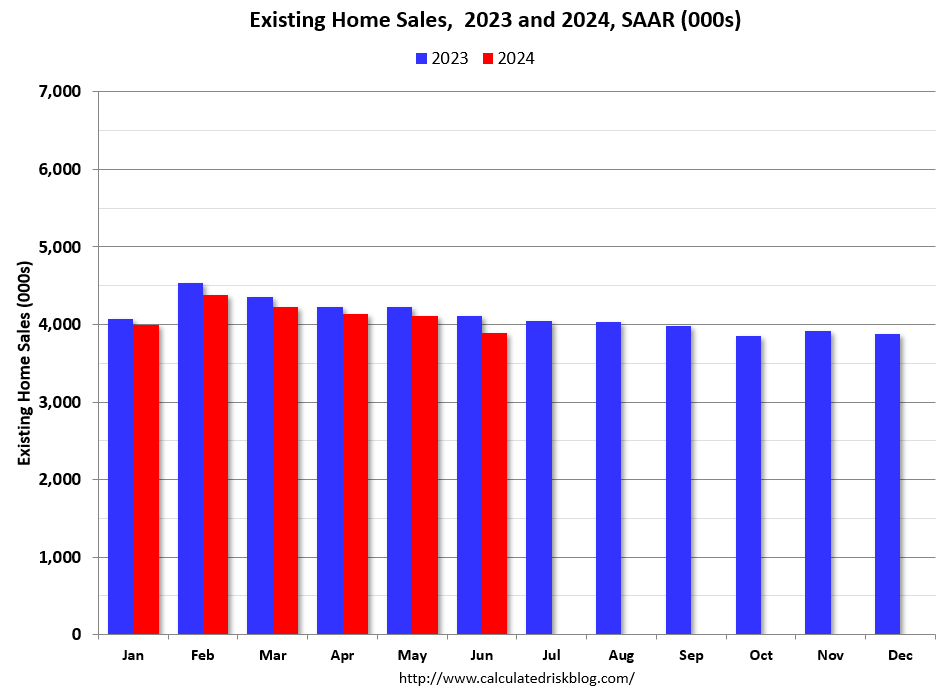

This graph shows existing home sales by month for 2023 and 2024, on a Seasonally Adjusted Annual Rate (SAAR) basis. The NAR reported sales in July 2023 were 4.05 million SAAR.

This early data suggests that the July existing home sales report will likely show a seasonally adjusted decline from June 2024, and a year-over-year decline from July 2023. The cycle low was 3.85 million SAAR in October 2023, and sales in July might set a new cycle low.

This was just a several early reporting markets. Many more markets to come!