Inman News

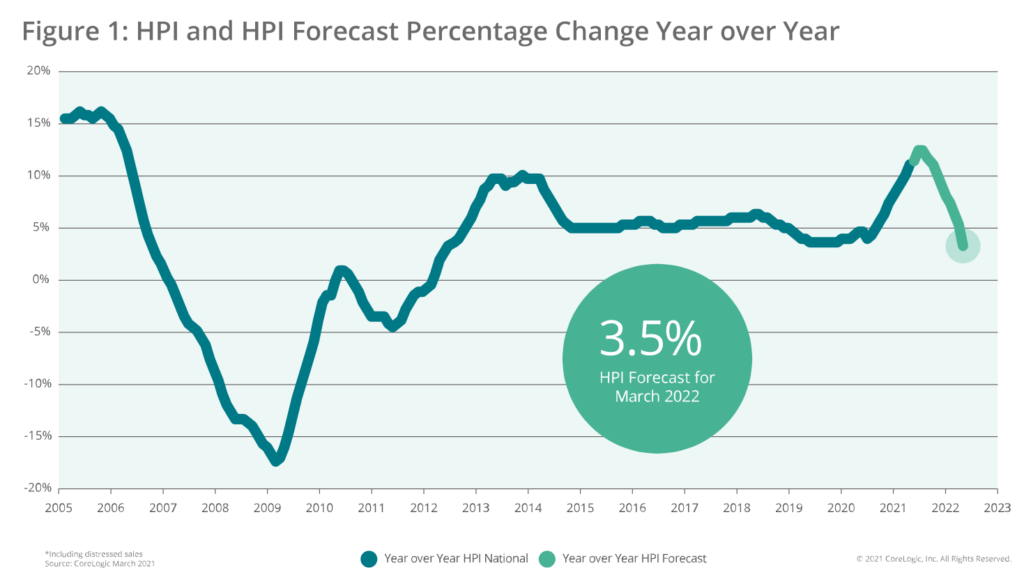

CoreLogic expects national home price appreciation to cool to 3.5% by next year, identifies some markets at risk of price declines.

National home prices posted annual gains of 11.3 percent in March, the biggest jump in 15 years, with millennials seeking their first home or to trade up helping fuel demand.

That’s according to the latest CoreLogic Home Price Index, which showed prices surging even more drastically in many local markets, led by Boise, Idaho, where home prices were up 27.7 percent from a year ago.

The Mountain-West and Sun Belt regions saw the strongest price appreciation, led by Idaho (25 percent), Montana (18.8 percent), and Arizona (18 percent).

CoreLogic projects that for the nation as a whole, annual home price appreciation will cool to 3.5 percent by March, 2022, as construction picks up and more homes are listed for sale.

Source: CoreLogic Home Price Index.

For now, first-time homebuyers will find conditions challenging in many markets.

“Lower-priced homes are in big demand and short supply, driving up prices faster compared to their more expensive counterparts,” said CoreLogic Chief Economist Frank Nothaft in a statement. “First-time buyers seeking a starter home priced 25 percent or more below the local-area median saw prices jump 15.1 percent during the past year, compared with the overall 11.3 percent gain in our national index.”

Rising home prices don’t necessarily motivate existing homeowners to sell, particularly if mortgage rates are rising, said Mark Fleming, chief economist at title insurer First American Financial Corp.

“There is a financial ‘lock-in’ effect that increases as mortgage rates rise and as the size of a mortgage increases,” Fleming concluded in a recent analysis. “Instead of a tailwind, rising mortgage rates increase the monthly cost of borrowing the same amount that a homeowner owes on their existing mortgage. Why move out if you have to move ‘down’ or pay more to move up?”

Economists at CoreLogic see some local markets at a low to moderate risk of price declines in the next year, including:

- Brownsville-Harlingen, Texas

- Beaumont-Port Arthur Texas

- New Haven-Milford Connecticut

- Gulfport-Biloxi-Pascagoula, Mississippi

- Detroit-Dearborn-Livonia, Michigan

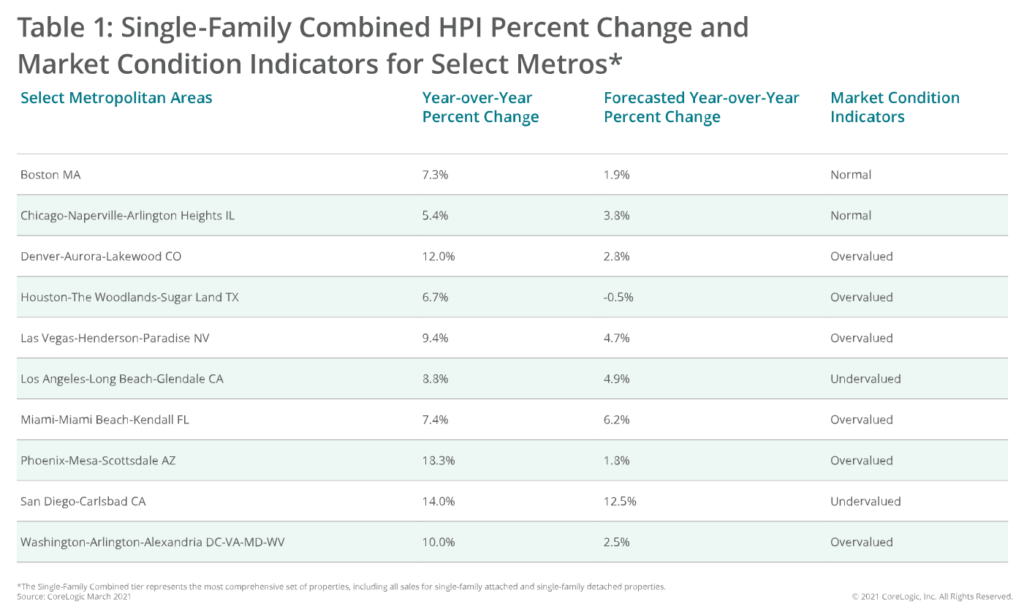

But CoreLogic still considers markets like Los Angeles and San Diego undervalued, and predicts they’ll continue to post price increases.

Source: CoreLogic Home Price Index