Inman News

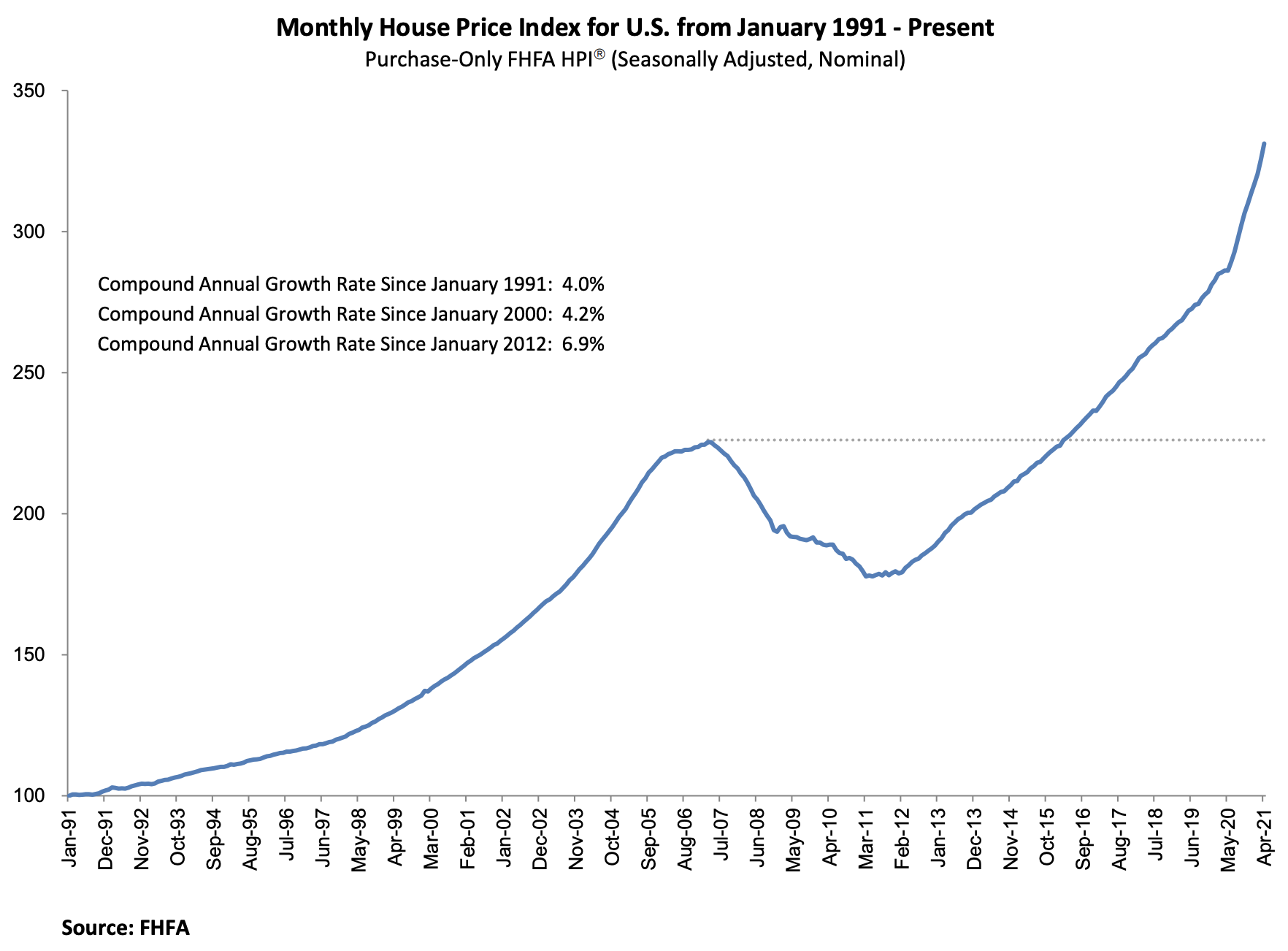

Home prices rose 1.8% in April from the previous month and 15.7% year over year, according to the Federal Housing Finance Agency. Both figures represent record growth for the HPI.

Home prices continue to climb amid low inventory and strong buyer demand, according to the Federal Housing Finance Agency’s monthly House Price Index (FHFA HPI) released on Tuesday.

Home prices rose 1.8 percent in April from the previous month, and they rose 15.7 percent from April 2020. Both figures represent record growth for the HPI.

Across the nine census divisions, seasonally adjusted monthly house price changes spanned between +1.2 percent in the West North Central division to +2.6 percent in the Mountain and Middle Atlantic divisions.

Annually, changes were between +13.0 percent in the West North Central division to +20.6 percent in the Mountain division.

“House prices recorded another monthly and annual record in April,” Dr. Lynn Fisher, FHFA’s Deputy Director of the Division of Research and Statistics, said in a statement. “This unprecedented price growth persists due to strong demand, bolstered by still-low mortgage rates, and too few homes for sale.”

The FHFA HPI measures changes in single-family home values based on home sales data across over 400 U.S. cities in all 50 states. The HPI is based on “a weighted, repeat-sales statistical technique to analyze house price transaction data.”

The Federal Housing Finance Agency index is in line with the latest S&P/Case-Shiller U.S. National Home Price Index, also released on Tuesday.

According to Case-Shiller, home prices across the U.S. rose by 14.6 percent year over year, the highest gains since 2005. April’s gains mark the 11th consecutive month of price increases. Home prices rose by 12 percent in February and 13.2 percent in March. Compared to last month, prices rose by 2.1 percent, according to Case-Shiller.