Inman News

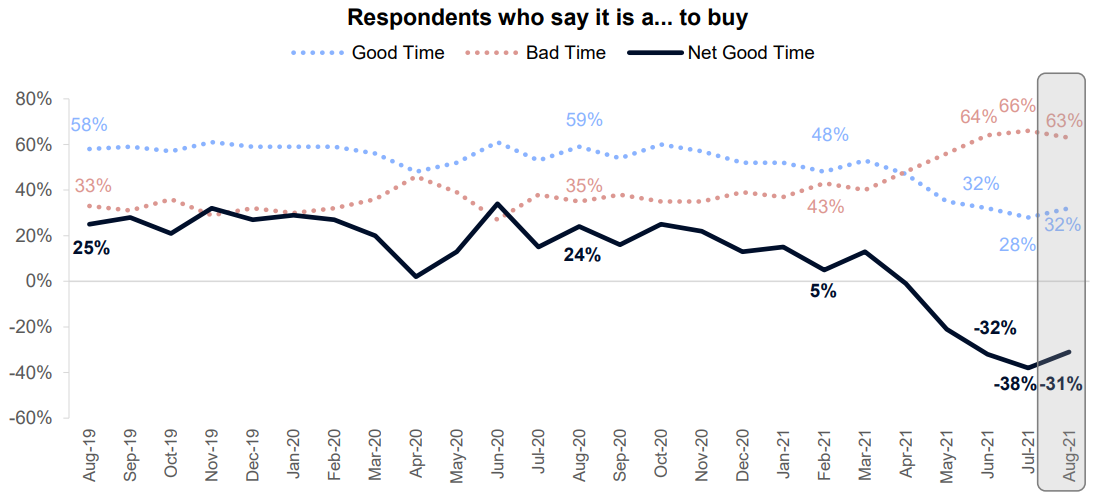

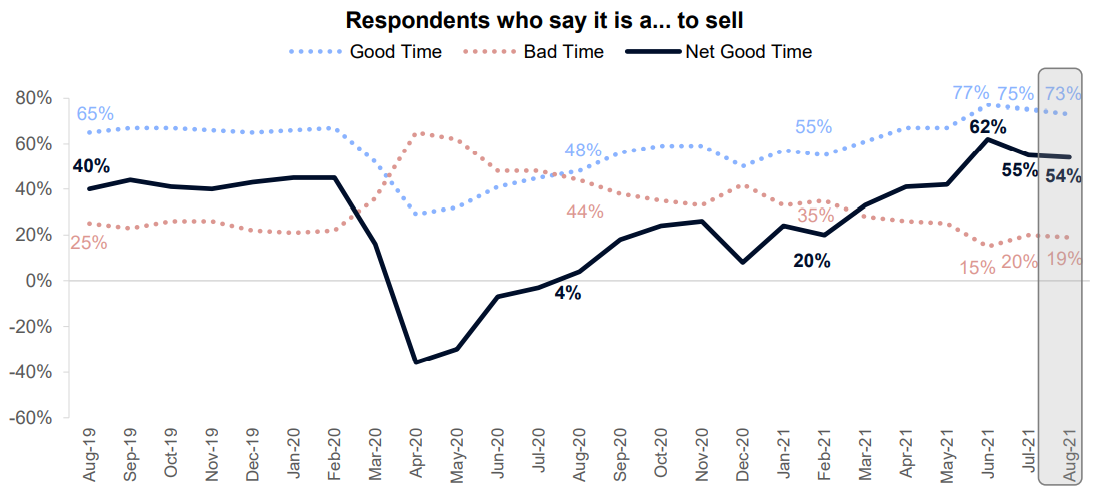

Most consumers continue to report that it’s a good time to sell a home — but a bad time to buy — and they frequently cite high prices and a lack of supply as their primary rationale.

The net share of Americans who think it’s a good time to buy a home ticked up in August for the first time since March, even as worries that the Delta variant and inflation could derail the economy have dinged other consumer confidence indexes.

Fannie Mae’s National Housing Survey, a monthly telephone survey of homeowners and renters, also found that a growing number of consumers have their doubts that home prices will keep going up — but most remain convinced that mortgage rates probably will.

The net share of Americans who think it’s a good time to buy a home increased by 7 percentage points in August, to negative 31 percent. That’s the first increase in four months, but still left buyer sentiment near last month’s historic low of negative 38 percent.

The “Net Good Time” to buy share is the difference between the percentage of those who said it’s a good time to buy (32 percent) minus those who said it’s a bad time to buy (63 percent).

“Most consumers continue to report that it’s a good time to sell a home – but a bad time to buy – and they most frequently cite high home prices and a lack of supply as their primary rationale,” said Fannie Mae Deputy Chief Economist Mark Palim, in a statement. “However, the ‘good time to buy’ component, while still near a survey low, did tick up for the first time since March, perhaps owing in part to the favorable mortgage rate environment and growing expectations that home price growth will begin to moderate over the next twelve months.”

Mortgage rates were remarkably stable in August, with rates for 30-year fixed-rate loans staying below 3 percent despite continuing discussion amongst Fed policymakers on when to taper mortgage purchases that have helped keep rates low during the pandemic.

March was the last time that the majority of those surveyed by Fannie Mae thought it was a good time to buy. At that time, 53 percent of Americans thought it was a good time to buy, and only 40 percent thought it was a bad time.

A scarcity of listings that’s sparked bidding wars and sent prices soaring in many markets has been hurting buyer sentiment, Fannie Mae Chief Economist Doug Duncan said when July’s survey results were released.

Curiously, the net share of those who thought it was a good time to sell also slipped by 7 percentage points in July’s survey, a trend that continued in August.

Source: Fannie Mae National Housing Survey.

But the 1 percentage point decline in seller sentiment seen in August was not as drastic as July’s drop. Although the percentage of those who said it’s a good time to sell dropped by two percentage points, to 73 percent, that’s still not far off June’s high of 77 percent. And the percentage who said it was a bad time to sell also fell by 1 percentage point, to 19 percent.

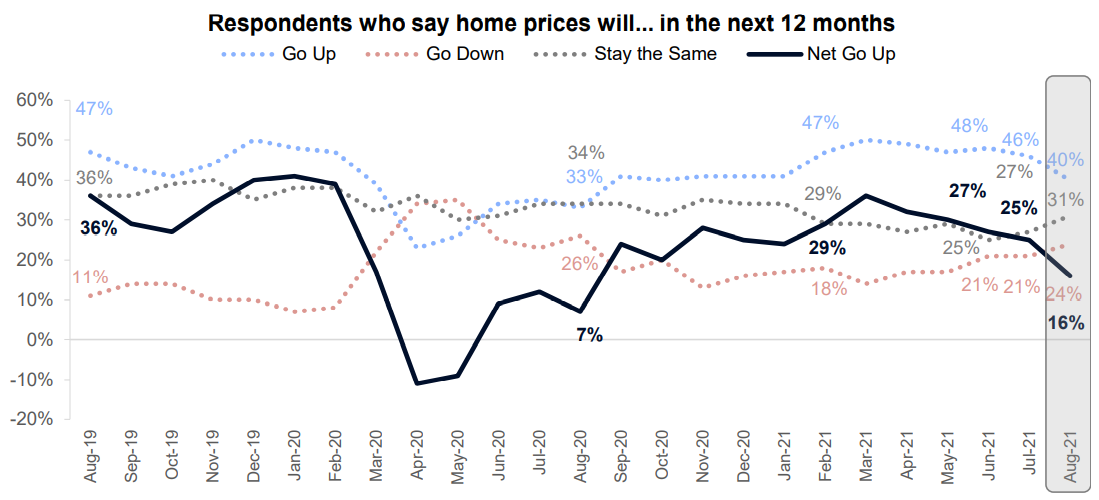

Would-be buyers and sellers are increasingly skeptical that home prices will keep going up. The net share of consumers who said home prices will go up in the next 12 months dropped by 9 percentage points in August, to 16 percent, continuing a trend seen over the last several months.

Source: Fannie Mae National Housing Survey.

Only 40 percent of renters and homeowners surveyed by Fannie Mae expect home prices to go up in the next 12 months, down from 46 percent in July. While only 24 percent expect prices to fall, a growing number of consumers — 31 percent — think prices have stabilized, and will stay the same over the next 12 months.

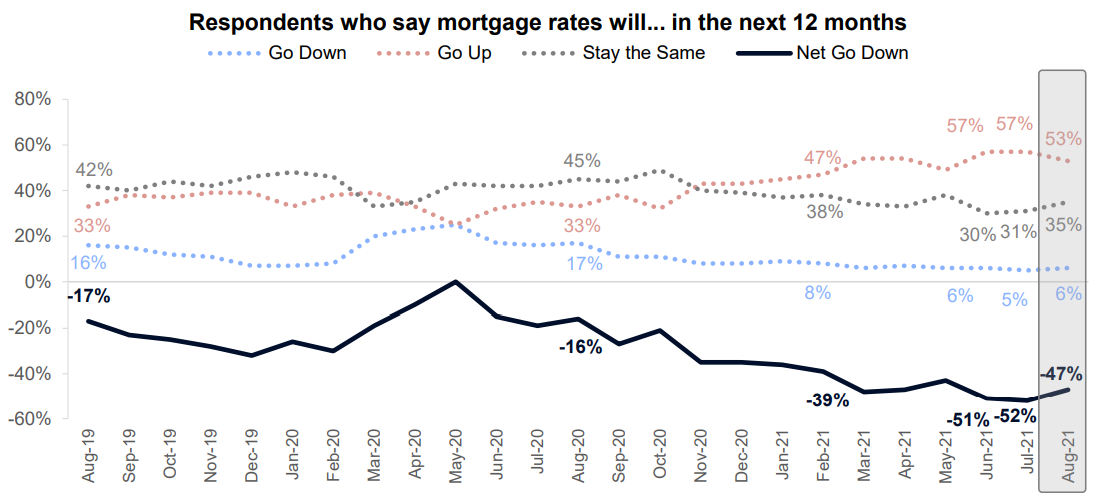

Despite talk of Fed tapering, the net share of Americans who think mortgage rates will go down over the next 12 months increased by 5 percentage points in August, to -47%.

Only 6 percent of those surveyed think rates will actually fall in the next 12 months. But a growing number of respondents (35 percent) think rates will stay right where they are, and the percentage of Americans who think rates will go up fell to 53 percent, down from 57 percent in July.

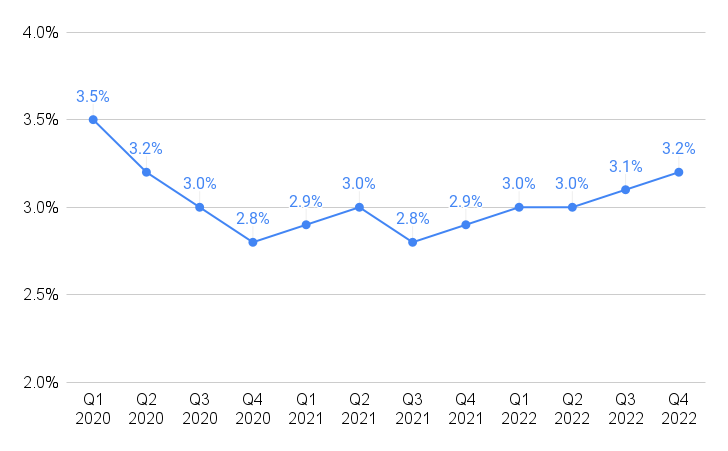

In a forecast released last month, Fannie Mae economists projected that rates for 30-year fixed-rate loans will rise to 3.2 percent by the end of next year.

Fannie Mae mortgage rate forecast

Average rates for 30-year fixed-rate loans by quarter. Rates after the second quarter of 2021 are projected. Source: Fannie Mae Economic and Housing Outlook, August 2021

Fannie Mae’s National Housing Survey also provides insights into consumer sentiment around their household income and job security and household income.

The net share of those who said their household income was significantly higher in August than it was 12 months ago increased by 1 percentage point, to 14 percent. About one in four (26 percent) said their income was significantly higher, but 12 percent said it was significantly lower. Most (59 percent) said their household income was about the same as a year ago.

Source: Fannie Mae National Housing Survey.

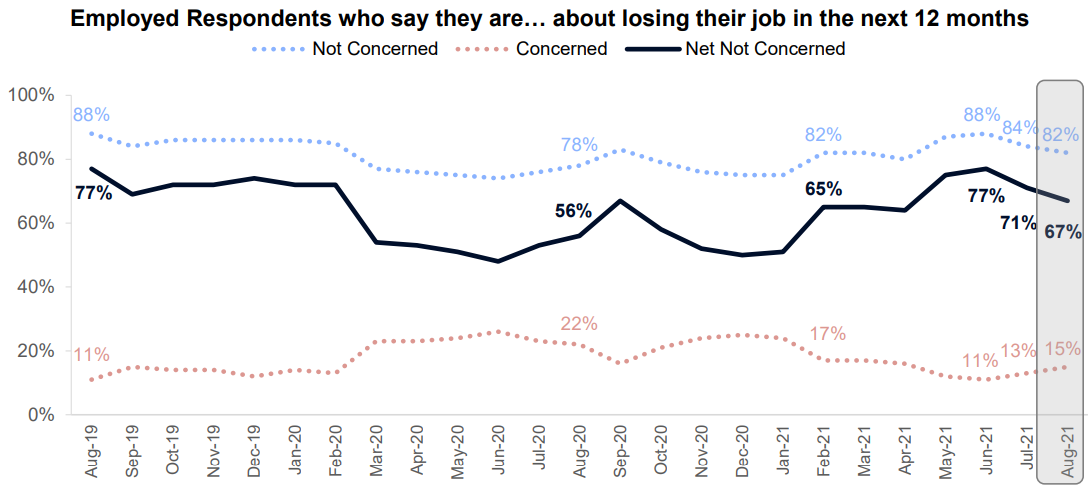

The survey found growing unease among people who are employed that they’ll lose their job in the next 12 months. Although only 15 percent of those surveyed said they’re concerned about losing their job, that’s up from 11 percent in June. In June, 88 percent of employed Americans said they weren’t concerned about losing their jobs. But that fell to 84 percent in July and 82 percent in August. Those changes brought the net share of employed Americans who are not concerned about losing their jobs to 67 percent, down from 77 percent in June.

Fannie Mae distills results from the National Housing Survey into a single number, the Home Purchase Sentiment Index (HPSI). The HPSI fell 0.1 points in August, to 75.7.

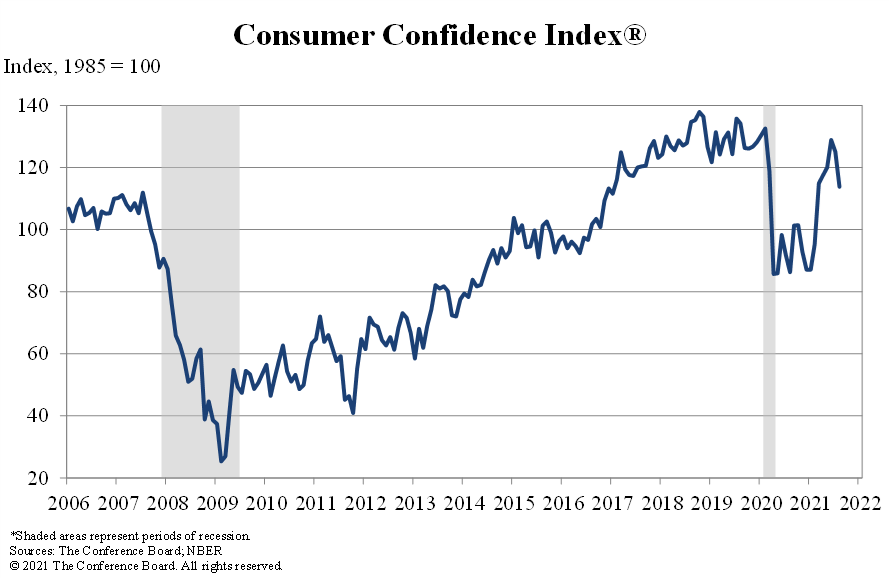

The Conference Board’s monthly Consumer Confidence Index also fell in August, to the lowest level since February.

“Concerns about the Delta variant — and, to a lesser degree, rising gas and food prices — resulted in a less favorable view of current economic conditions and short-term growth prospects,” with spending intentions for homes, autos, and major appliances all cooling somewhat, said Lynn Franco, senior director of economic indicators at The Conference Board, in a statement.

Both surveys were taken before Friday’s release of a disappointing jobs report from the Bureau of Labor Statistics, which showed employers adding only 235,000 jobs in August. That compares to an average of 586,000 new jobs added each month so far this year, and economists’ expectations that 720,000 new jobs would be created in August.

But with revisions boosting the number of jobs added in June and July by 134,000, the unemployment rate still declined by 0.2 percentage points in August, to 5.2 percent. That left 8.4 million people out of work, compared to 5.7 million before the pandemic.

Lawrence Yun, chief economist at the National Association of Realtors, said the key question raised by the jobs report is, “What will the Federal Reserve do?”

With the inflation rate picking up and “help wanted” signs “at a record high,” Yun expects the Fed’s first act will be to taper its $120 billion in monthly purchases of Treasurys and mortgage-backed securities, perhaps before year end.

“That means consumer mortgages that are sold to Fannie and Freddie will need to find other buyers, like Wall Street, [the] Chinese government, and German mutual funds,” Yun said. “That will lead to an uptick in mortgage rates. Moreover, the Fed will raise its short-term interest rates from 2022, which will further raise mortgage rates next year.”