Inman News

More sellers dropped their asking prices in June almost everywhere in the US. In some places, more than half of homes for sale saw a cut.

More than half of sellers lowered their asking prices last month in three major U.S. cities as some of America’s once-hottest housing markets were hit especially hard by the ongoing slowdown in real estate.

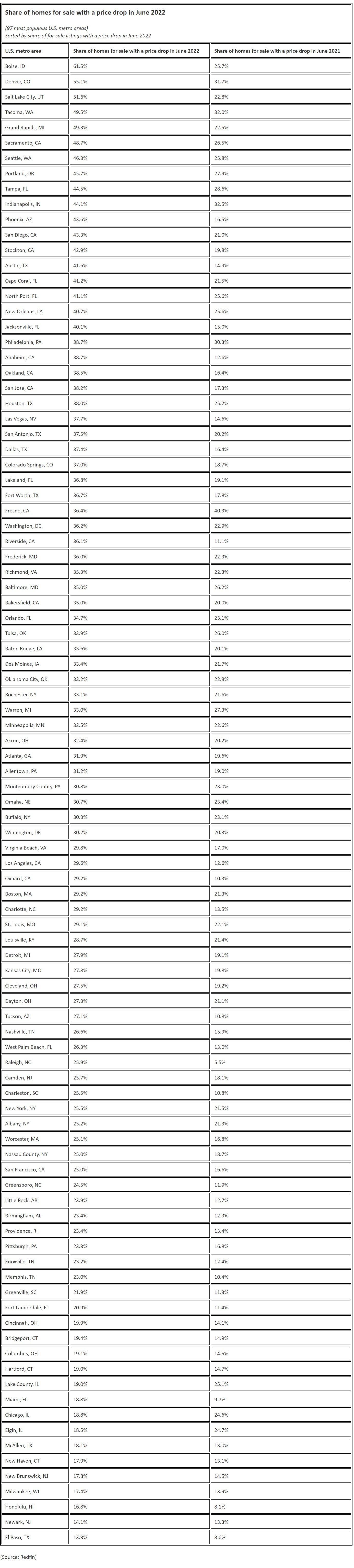

Nearly 62 percent of houses for sale in Boise, Idaho, had a price drop in June, the most dramatic figure recorded in any major U.S. metro, Redfin disclosed Thursday in a new report.

Price drops hit 55 percent of homes in Denver and 52 percent of homes in Salt Lake City, the report reveals.

This time last year, a mere 26 percent of homes for sale in Boise had to resort to a price cut. Since then, the share of listings with price drops rose faster there than in any other big- or mid-sized metro area in the nation.

The downward pressure on sale prices in this pandemic migration hotspot was driven by a market slowdown far deeper than any other major metro area. For every 10 homes in Boise that went pending in May of last year, a mere six went pending in May of this year, according to a separate Redfin report last week.

The next-closest drop in pending homes that month occurred in San Jose, where eight homes went pending in May for every 10 that sold the same time last year.

The latest numbers reveal how the ongoing cooldown of the housing market has affected sellers, many of whom have found in recent weeks that their initial asking price overshot the actual amount for which their home could quickly sell.

For many buyers, today’s higher mortgage rates make these all-time high sale prices a tough pill to swallow — especially amid this uncertain economic environment, Redfin Senior Economist Sheharyar Bokhari said in the report.

“Home sellers are contending with a rapidly changing market, especially in places where they’re used to their neighbor’s homes getting multiple offers and selling for more than asking price,” Bokhari said. “Sellers are adjusting their expectations in real time as they realize they may not get the price their neighbor got two months ago.”

The downward pressure on home prices affected broad swaths of sellers in other once-hot markets as well.

Sacramento, Seattle, Portland and Tampa each saw nearly half of homes for sale undergo a price cut in June. The same was true for Indianapolis and Grand Rapids, Michigan.

The vast majority of markets in Redfin’s analysis — roughly 3 in 4 — had at least 25 percent of homes undergo a price drop last month.

Even in El Paso, Texas — the market with the fewest price cuts in the nation — 13 percent of sellers had to step back from their initial asking price.

And over the last year, nearly every major city in the nation has seen the share of homes with price drops expand.

The main pocket of exceptions to this rule resides in Illinois, where price drops declined year-over-year as a share of homes for sale in the Chicago, Elgin and Lake County markets. This share also declined year-over-year in Fresno, California.

But in the rest of the country’s major cities, Bokhari said many sellers are behind the ball in recognizing the ongoing change in buyer appetites.

“If demand plateaus in the coming months, price cuts are likely to be less common as sellers realize the market has shifted and price realistically from the start,” Bokhari said in the report. “But if demand falls further, sellers will continue to play catch-up and cut prices to attract buyers.”

~~~~~~~~~~~~~

1 in 4 U.S. Home Sellers Nationwide Now Lowering Asking Prices in June

The World Property Journal

Fast rising mortgage rates, economic uncertainty negatively impact home sales and prices mid 2022.

According to national property broker Redfin, nearly two-thirds (61.5%) of homes for sale in Boise, ID had a price drop in June 2022.That’s the highest share of the 97 U.S. metros in Redfin’s analysis. Price drops have become a common feature of the cooling housing market, particularly in places that were popular with homebuyers earlier in the pandemic.

Next came Denver (55.1%) and Salt Lake City (51.6%), each metros where more than half of for-sale homes had a price drop. They were followed by Tacoma, WA (49.5%), Grand Rapids, MI (49.3%) and Sacramento (48.7%). Seattle (46.3%), Portland, OR (45.7%), Tampa, FL (44.5%) and Indianapolis (44.1%)-all of which saw price cuts for nearly half the for-sale homes-round out the top 10.

Boise also had the biggest increase in the share of listings with price drops from a year earlier, when 25.7% of sellers cut their price. Denver, Salt Lake City and Grand Rapids were also among the 10 metros with the biggest upticks from a year earlier.

Boise, Salt Lake City, Sacramento and Tampa were popular during the pandemic with homebuyers moving in from pricey coastal job centers, taking advantage of low mortgage rates and remote work. Their popularity led to heated competition for a limited supply of homes for sale, pushing up prices and making them unaffordable for many buyers. In Boise, for instance, the typical home sold for $550,000 in May, up more than 60% from two years earlier. Home prices increased 44% to $610,000 in Sacramento. Mortgage rates nearly doubled to almost 6% in the first half of 2022 priced even more buyers out.

“Home sellers are contending with a rapidly changing market, especially in places where they’re used to their neighbor’s homes getting multiple offers and selling for more than asking price,” said Redfin Senior Economist Sheharyar Bokhari. “Higher mortgage rates and a potential recession are causing prospective buyers in popular migration destinations to press the pause button, and they’re also having a big impact on workers in big job centers who rely on their stock portfolio for down payments. In places like Denver, Seattle and Portland, some buyers feel less confident about their finances in the face of a shaky economy and faltering stock market. Sellers are adjusting their expectations in real time as they realize they may not get the price their neighbor got two months ago.”

“If demand plateaus in the coming months, price cuts are likely to be less common as sellers realize the market has shifted and price realistically from the start,” Bokhari continued. “But if demand falls further, sellers will continue to play catch-up and cut prices to attract buyers.”

Over 25% of home sellers dropped their price in over three-quarters of U.S. metros in June

More than three-quarters of the metros in Redfin’s analysis saw over 25% of home sellers drop their asking price in June. More than 10% of home sellers dropped their price in all of the metros.

In El Paso, TX, 13.3% of home sellers dropped their asking price, a smaller share than any other metro. Newark, NJ (14.1%), Honolulu (16.8%), Milwaukee (17.4%) and New Brunswick, NJ (17.8%) come next. New Haven, CT (17.9%), McAllen, TX (18.1%), Elgin, IL (18.5%), Chicago (18.8%) and Miami (18.8%) round out the top 10. The relatively small share of price drops is likely largely because homes in most of those metros are affordable: In six of the 10, the typical home costs less than the national median.

The share of homes with a price drop rose from a year earlier in all but four metros, three of which are in Illinois. The share declined in Elgin, IL, Lake County, IL, Chicago and Fresno, CA.