CALCULATERISK

Price-to-rent index is 8.1% below 2022 peak

By Bill McBride

It has been over 18 years since the bubble peak. In the August Case-Shiller house price index released last Tuesday, the seasonally adjusted National Index (SA), was reported as being 75% above the bubble peak in 2006. However, in real terms, the National index (SA) is about 11% above the bubble peak (and historically there has been an upward slope to real house prices). The composite 20, in real terms, is 3% above the bubble peak.

People usually graph nominal house prices, but it is also important to look at prices in real terms. As an example, if a house price was $300,000 in January 2010, the price would be $433,000 today adjusted for inflation (44% increase). That is why the second graph below is important – this shows “real” prices.

The third graph shows the price-to-rent ratio, and the fourth graph is the affordability index. The last graph shows the 5-year real return based on the Case-Shiller National Index.

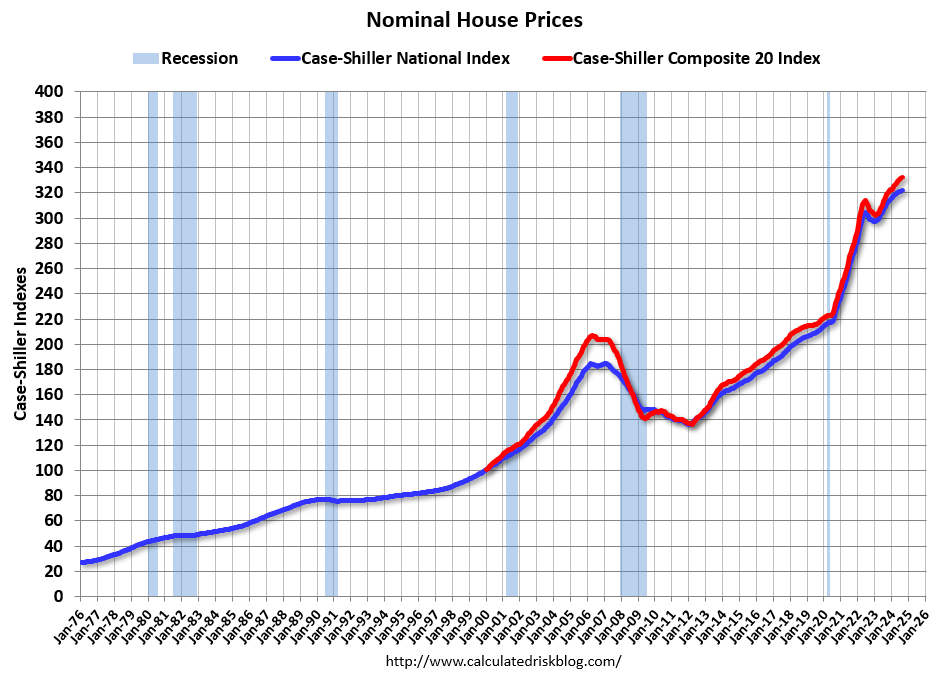

Nominal House Prices

The first graph shows the monthly Case-Shiller National Index SA, and the monthly Case-Shiller Composite 20 SA in nominal terms as reported.

In nominal terms, the Case-Shiller National index (SA) and the Case-Shiller Composite 20 index (SA) are both at all times highs. Both indexes increased in June.

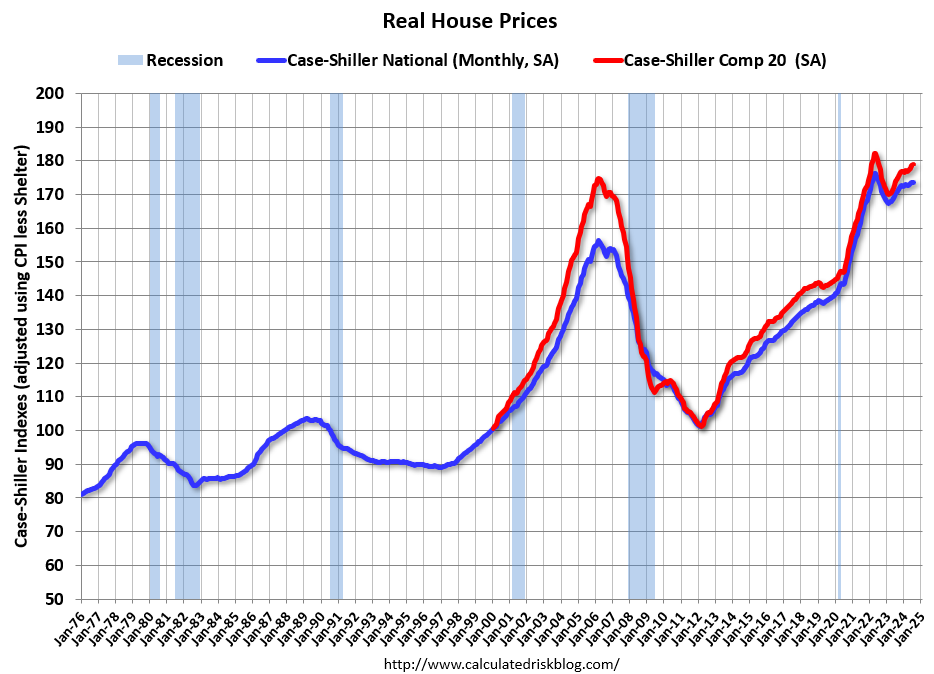

Real House Prices

The second graph shows the same two indexes in real terms (adjusted for inflation using CPI).

In real terms (using CPI), the National index is 1.5% below the recent peak, and the Composite 20 index is 1.6% below the recent peak in 2022. Both indexes increased in August in real terms.

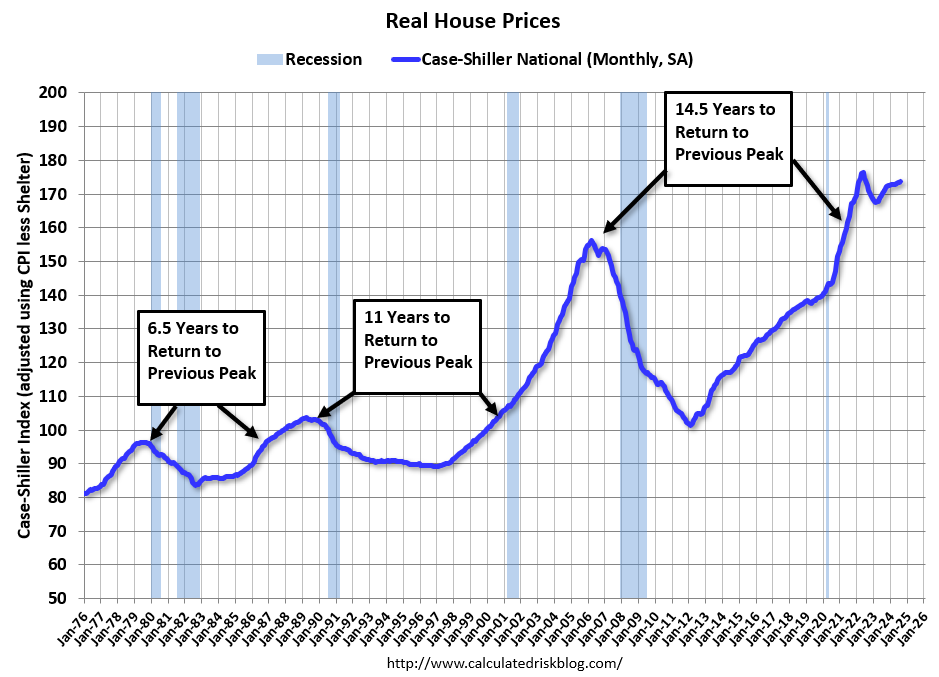

It has now been 27 months since the real peak in house prices. Typically, after a sharp increase in prices, it takes a number of years for real prices to reach new highs. There is nothing magic about “7 years”, it just made a good post title! Here is an update to the graph I included in that article:

In real terms, national house prices are 11.1% above the bubble peak levels. There is an upward slope to real house prices, and it has been over 18 years since the previous peak, but real prices are historically high.

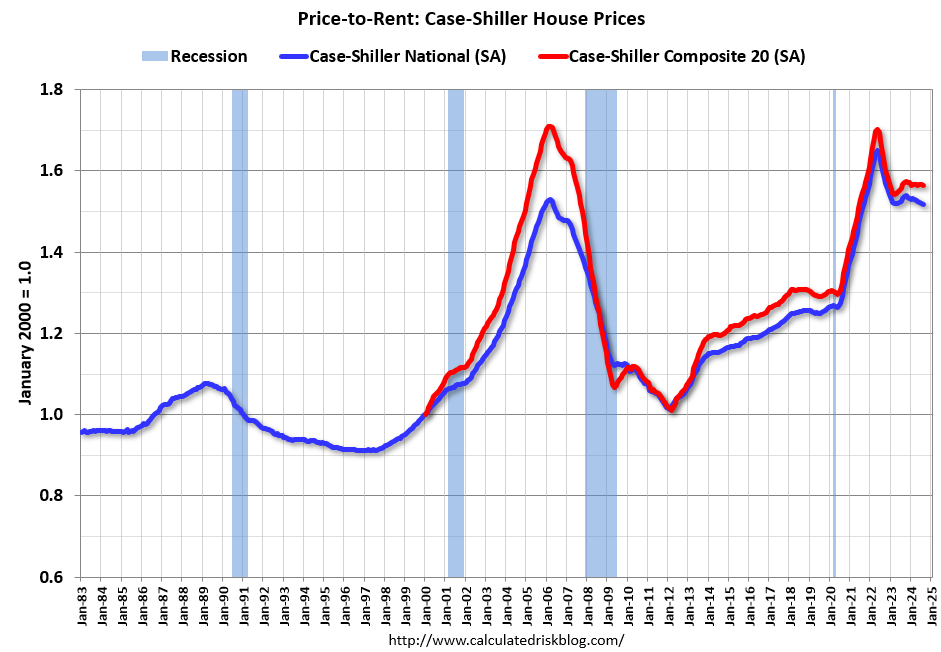

Price-to-Rent Ratio

In October 2004, Fed economist John Krainer and researcher Chishen Wei wrote a Fed letter on price to rent ratios: House Prices and Fundamental Value. Kainer and Wei presented a price-to-rent ratio using the OFHEO house price index and the Owners’ Equivalent Rent (OER) from the BLS.

Here is a similar graph using the Case-Shiller National and Composite 20 House Price Indexes. This graph shows the price to rent ratio (January 2000 = 1.0). The price-to-rent ratio had been moving more sideways but picked up significantly following the onset of the pandemic.

On a price-to-rent basis, the Case-Shiller National index decreased in August. The price-to-rent index for the National index is off 8.1% from the recent peak, and the Composite 20 based index is off 8.2%.

By all of the above measures, house prices are elevated.

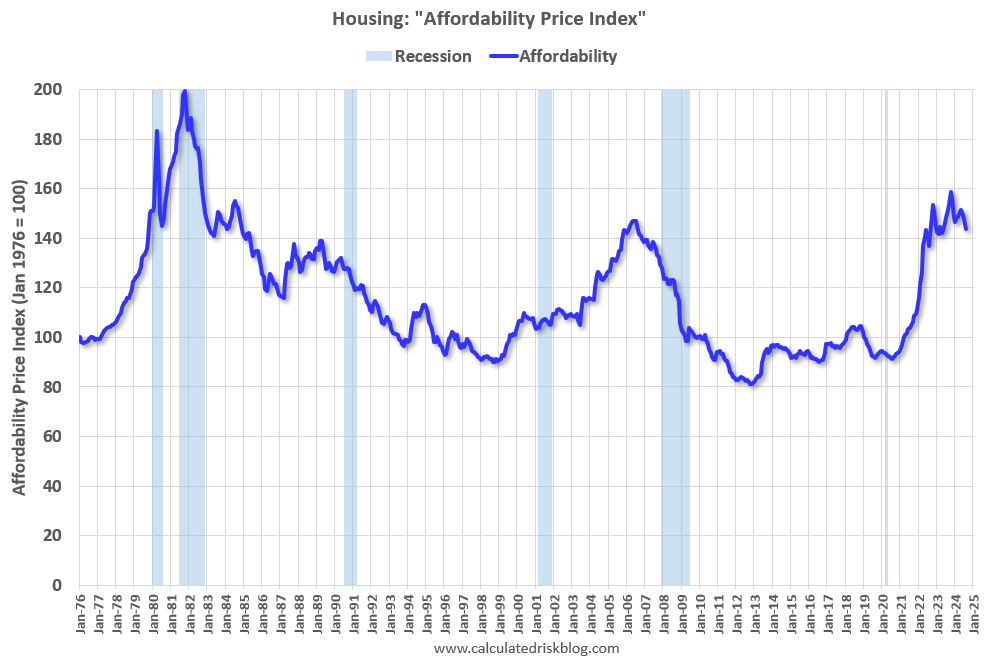

Calculated Risk Affordability Index

I’ve put together my own affordability index – since 1976 – that is similar to the FirstAm approach (more of a house price index adjusted by mortgage rates and the median household income).

I used median income from the Census Bureau (estimated 2024), assumed a 15% down payment, and used a 2% estimate for property taxes, insurance and maintenance. This is probably low for high property tax states like New Jersey and Texas, and too high for lower property tax states. If we were including condos, we’d also include HOA fees too (this is excluded).

For house prices, I used the Case-Shiller National Index, Seasonally Adjusted (SA).

Also, for the down payment – there wasn’t a significant difference between 15% and 20%. For mortgage rates, I used the Freddie Mac PMMS (30-year fixed rates).

So here is what the index looks like (lower is more affordable like the FirstAm index):

Affordability improved in August compared to July, as mortgage rates declined, and house prices increases slowed. Affordability will improve in the next report too since mortgage rates declined in September. In October 2023, houses were the least “affordable” since 1982 when 30-year mortgage rates were over 14%.

For August: a year ago, the payment on a $500,000 house, with a 20% down payment and 7.07% 30-year mortgage rates, would be around $2,680 for principal and interest. The monthly payment for the same house, with house prices up 4.2% YoY and mortgage rates at 6.50% in August 2024, would be $2,635 – a decrease of 1.7%.

However, if we compare to three years ago, there is huge difference in monthly payments. In August 2021, the payment on a $500,000 house, with a 20% down payment and 2.84% 30-year mortgage rates, would be around $1,653 for principal and interest. The monthly payment for the same house, with house prices up 21% over three years and mortgage rates at 6.50% in August 2024, would be $3,056 – an increase of 85%!

Note that by this index, during the early ‘80s, homes were very unaffordable due to the very high mortgage rates. During the housing bubble, houses were at about the same level of unaffordability using 30-year mortgage rates, however, during the bubble, there were many “affordability products” that allowed borrowers to be qualified at the teaser rate (usually around 1%) that made houses seem more affordable.

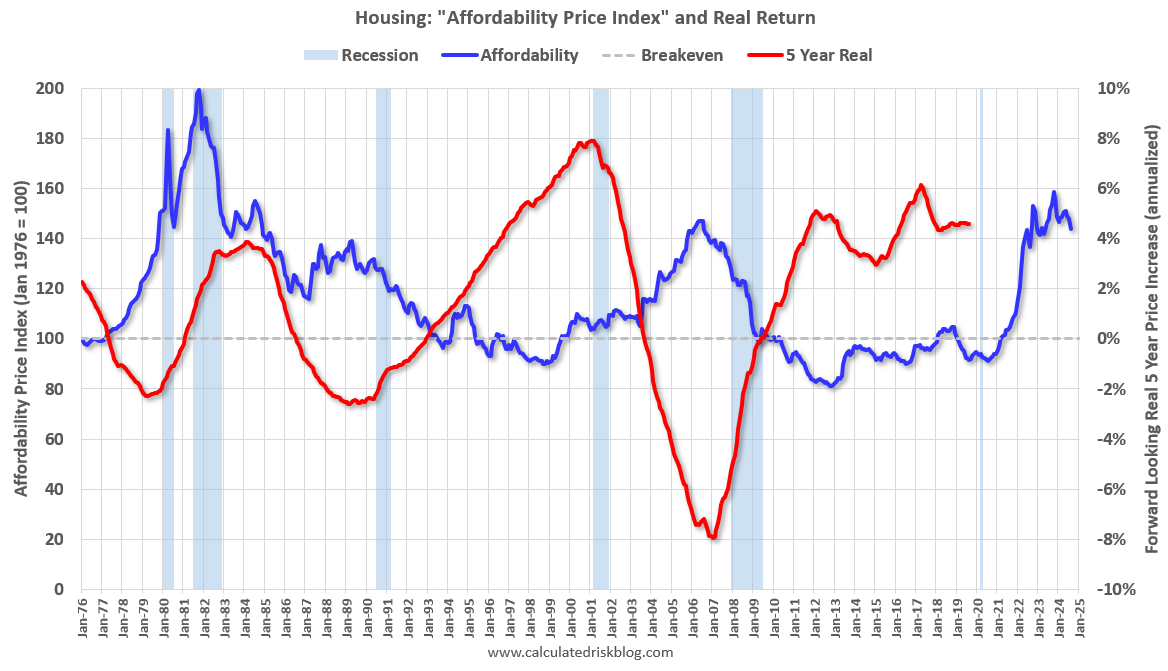

Here is a graph showing affordability, and the 5-year real return (red) on the house purchase (annualized). The 5-year real return is the future return on the Case-Shiller index, adjusted for inflation.

When affordability was poor in the early ‘80s, it was actually a good time to buy. Another good time to buy was in the mid-to-late ‘90s. And another good time was around 2011 or 2012 (When I wrote The Housing Bottom is Here) and for the following several years. The worst time to buy (using a 5-year real return) was in the runup to and during the housing bubble.

Since the real return is based on 5 years, we don’t know the return after August 2019. For those buying in August 2019, the 5-year real return was 4.6% annualized.