Inman News

Experts surveyed by Fannie Mae expect national home prices to slow to 3.4% this year. Median list prices are down by 10% or more from a year ago in 69 markets

Housing experts surveyed by Fannie Mae expect national home price appreciation to cool this year as inventories continue to swell, with dozens of local markets already seeing double-digit annual declines in median list price.

Fannie Mae’s latest Home Price Expectations Survey (HPES), released Tuesday, showed more than 100 housing and mortgage industry experts expect home price growth to slip to 3.4 percent in 2025, down from 5.8 percent last year.

The latest quarterly survey shows experts are less optimistic than they were in January, when they were forecasting 3.8 percent price appreciation in 2025.

The HPES panel expects price appreciation to continue to cool to 3.3 percent next year, down from the 3.6 percent forecast for 2026 issued in January.

Pessimists see home price appreciation flattening

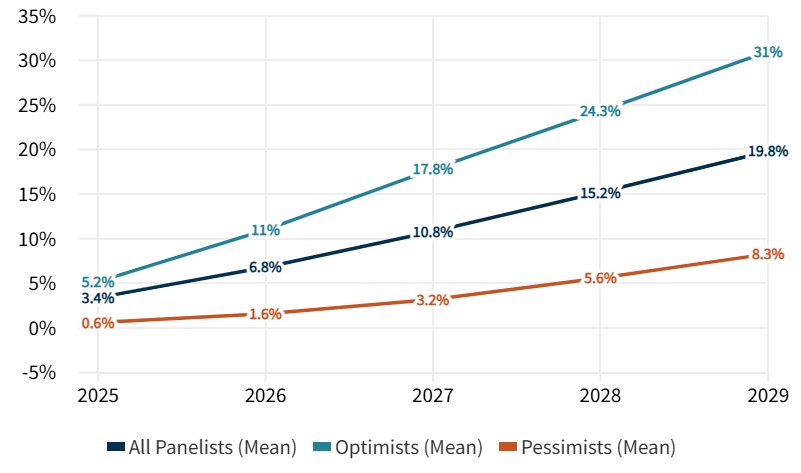

Projected cumulative home price growth from Q4, 2024. Source: Fannie Mae / Pulsenomics LLC.

But the most pessimistic quartile of survey panelists sees national home price appreciation flattening to 0.6 percent this year and remaining weak until 2028.

While prices could go up more sharply in some markets, they’re also expected to fall in some metros where listings come onto the market faster than buyers can snatch them up.

At the national level, there were 1.75 million new and existing homes on the market in February, up 15 percent from a year ago, according to data tracked by the National Association of Realtors and the U.S. Census Bureau.

Inventory of new and existing homes

View Interactive Graph

The inventory of existing homes grew by 17 percent, to 1.24 million, according to NAR data, while the number of new single-family homes on the market grew by 7 percent, to 500,000, the Census Bureau reported.

Realtor.com was tracking 1.3 million listings in March, up 17 percent from a year ago.

The latest readings from the S&P CoreLogic Case-Shiller Indices showed national home prices were up 4.1 percent from a year ago in January, with Tampa the only market in the 20-City index to see prices slip over that period, by 1.5 percent

But the second half of the year “told a different story,” S&P Down Jones Indices’ Nicholas Godec said in a press release, with only four of 20 cities — New York, Chicago, Phoenix and Boston — managing to “eke out” price increases during that period.

San Francisco posted the largest six-month decline at 3.4 percent, followed by Tampa at 3.2 percent, Godec said.

Selma Hepp, chief economist at Cotality (formerly CoreLogic), said flattening home price changes over the last six months “suggest further price deceleration is ahead.”

“While this year’s cold winter and large natural disasters play a role in dampening demand, falling consumer sentiment suggests potential homebuyers are wary of the short-term economic outlook and future inflation,” Hepp said in a March 30 report.

Home prices are driven by local supply and demand, and Realtor.com data shows median list prices in 69 metros were down by 10 percent or more from a year ago in March.

Median list price: Big declines in 69 market

Markets experiencing double-digit annual declines in median list price included Steamboat Springs, Colorado (-34.2 percent); Winona, Minnesota (-32.6 percent); Wenatchee, Washington (-22.1 percent); Flint, Michigan (-21.1 percent); Marion, Indiana (-19.7 percent); Enid, Oklahoma (-17.6 percent); Santa Fe, New Mexico (-14.5 percent); Ukiah, California (-13.7 percent); Dublin, Georgia (-13.4 percent); Montgomery, Alabama (-11.3 percent); Cedar Rapids, Iowa (-10.9 percent); Wausau, Wisconsin (-10.5 percent); and Boulder, Colorado (-10.2 percent).

“There are many ways to slice and dice housing data,” Realtor.com Chief Economist Danielle Hale said in her most recent weekly housing market update. “Through the lens of geography, our data reveals some commonalities.”

Realtor.com’s last Hottest Housing Markets report found that homes are selling more quickly in many markets in the Northeast and Midwest, and that a separate Down Payment Trends report showed buyers were putting more down on homes in the Northeast and Midwest and less in the South and West.

Last month, Fannie Mae economists said a pullback in mortgage rates should provide a “small boost” to home sales this year, in part because tariffs implemented by the Trump administration might inflate prices and slow economic growth. But tariffs announced this month have sent mortgage rates on the rebound, jeopardizing such forecasts.