Inman News

De-listings outpaced inventory growth in June even as price cuts surged, showing that a growing number of sellers are unwilling to compromise when it comes to their selling goals

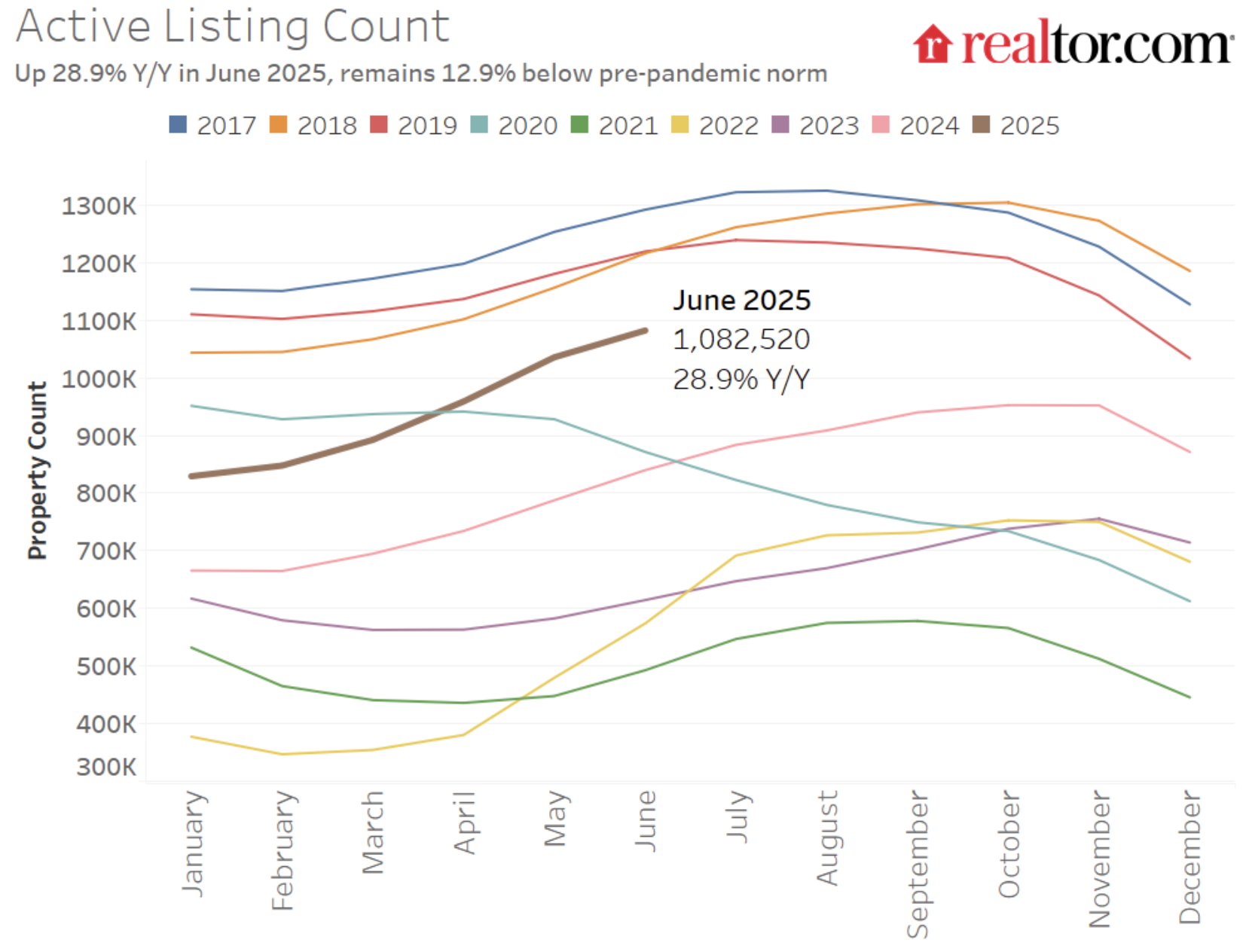

Active inventory hit a post-pandemic high in June as it grew 28.1 percent year over year, yet sellers are showing signs of becoming impatient with slower buyers, as de-listings are also on the rise.

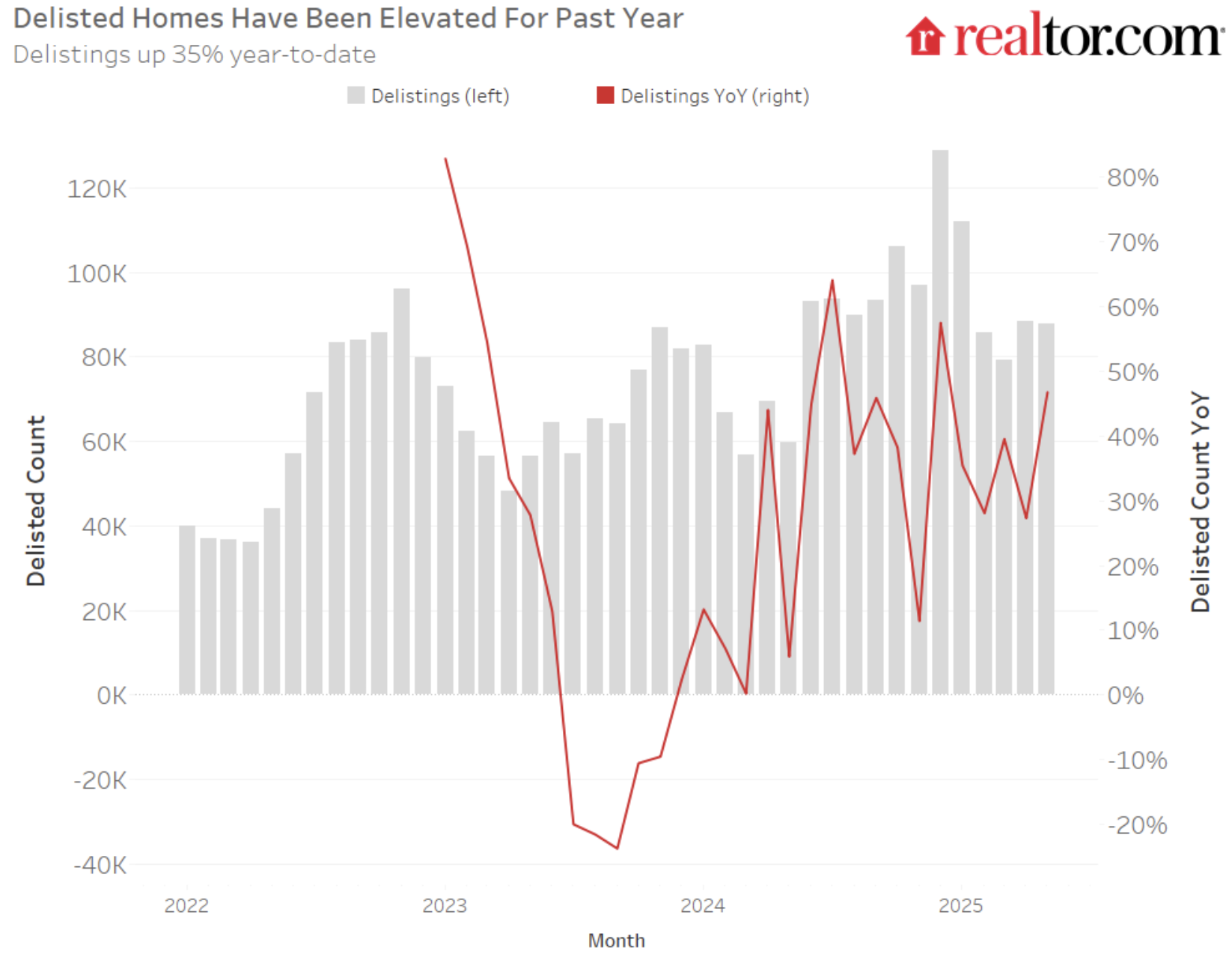

In fact, growth in de-listings outpaced inventory growth, with de-listings up 35 percent year-to-date and up 47 percent year over year in May, according to Realtor.com’s June Housing Trends Report. Even so, de-listings make up a relatively small number of listings — 90,000 out of 452,000 new listings that went up in June.

As inventory continues to grow, it’s putting increased pressure on home prices, spurring some sellers to slash asking prices and causing home prices to decline significantly in some markets.

The data shows that many buyers and sellers today are engaging in a face-off of sorts.

All four major regions in the U.S. saw inventory increase in June, with inventory in the West up by 38 percent and, in the South, up by 30 percent. All 50 top metros saw annual inventory gains, too, with Las Vegas (up 77.6 percent) and Washington, D.C. (up 63.6 percent), in the lead.

Price cuts also surged in June, hitting their highest level for any June since at least 2016, with 20.7 percent of listings reducing their prices. Price cuts and growing inventory have not yet made a dent in the national median list price though, which remained roughly the same year over year at $440,950.

Credit: Realtor.com

“This year’s market is a study in contrasts,” Danielle Hale, chief economist at Realtor.com, said in a statement. “Buyers are seeing more choices than they’ve had in years, but many sellers, anchored by peak price expectations and upheld by strong equity positions, are deciding to step back if they don’t get their number. Looking forward, this dynamic will affect whether we tip from a balanced to buyer’s market, and if so, how quickly that happens.”

There’s no doubt that more homeowners are opting to take their listings off the market now, but even so, buyers still have more options at their fingertips than since the COVID-19 pandemic started. Active listings in the U.S. exceeded 1 million for the second consecutive month, Realtor.com said, placing inventory levels just 13 percent below pre-pandemic levels.

Credit: Realtor.com

Meanwhile, delistings now make up about 4.1 percent of the market, compared to 3.2 percent of all active listings in May 2024.

Even with more active inventory on the market, it seems a growing number of sellers who aren’t gaining attention on their listings at their preferred price today are electing to delist instead of compromise with a price cut or continue to rack up days on market. From March through May, the ratio of delistings to new listings hit 13 percent, compared to the 10 percent seen during the same periods in 2024 and 2023, and the 6 percent seen in 2022.

Agents say that sellers in hot markets (Miami; Phoenix; Riverside, California) are especially likely to be selective about which offers to accept, oftentimes choosing to delist instead of compromising on their selling goals.

“We’re seeing hesitation on both sides of the market,” Anthony Djon, founder of Anthony Djon Luxury Real Estate, said in Realtor.com’s report. “Inventory is rising, giving buyers more options and making them more price-sensitive and selective. At the same time, some sellers — especially those not getting immediate traction — are stepping back. The market has clearly shifted from the urgency and intensity of recent years, and today’s homeowners are having to recalibrate their expectations.”