Inman News

In the past 2 months, the total number of homesellers in the market has fallen from a peak of 1.96M in May to 1.95M in July, Redfin reported

Quick Read

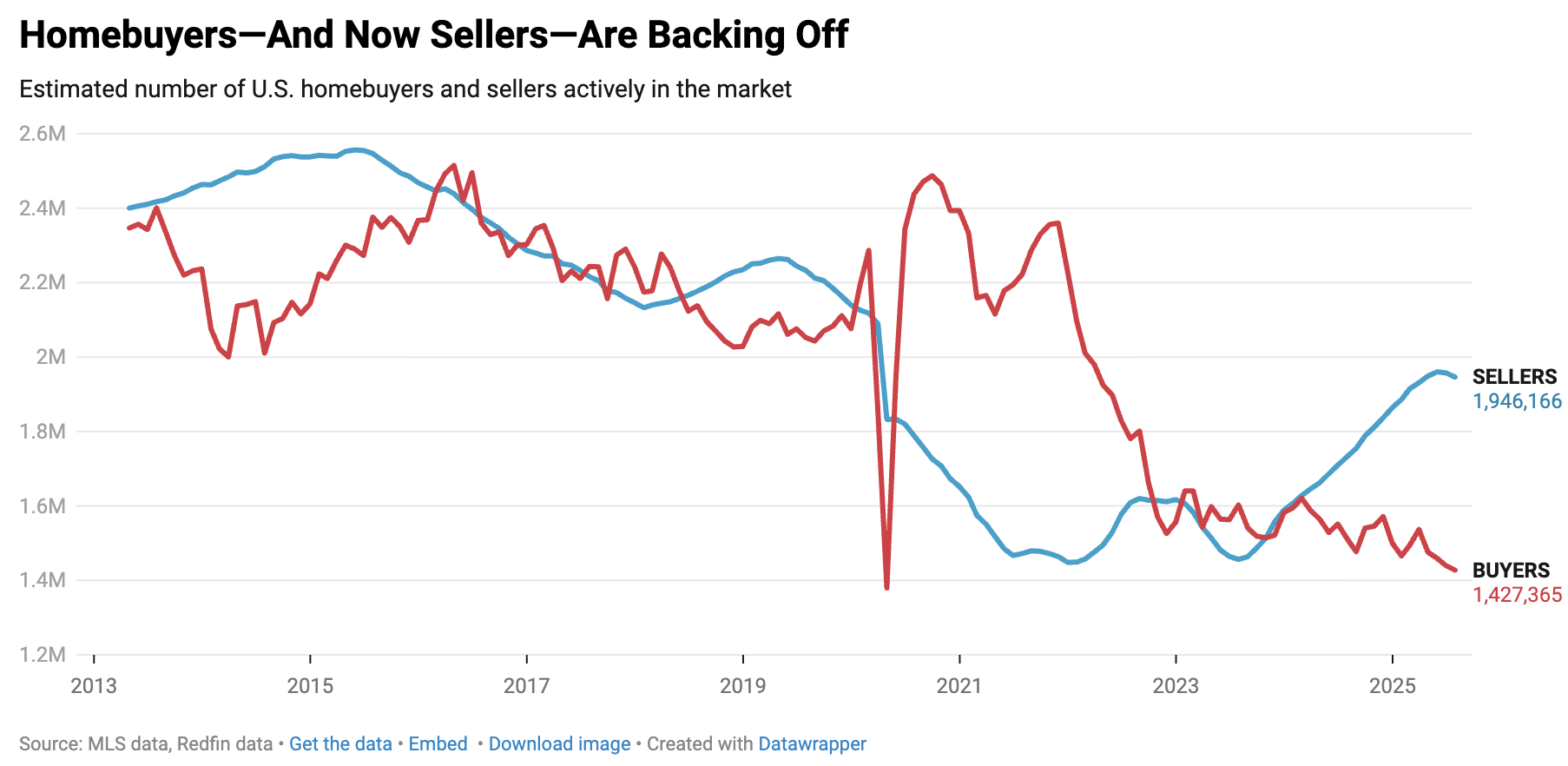

- In July 2025, U.S. homesellers dropped slightly from 1.96 million in May to 1.95 million, per Redfin data.

- Sellers outnumber buyers by about 36%, the widest gap since 2013.

- July’s median home price rose 1.4% year-over-year to a record $434,189, as declining seller inventory constrains supply and supports prices.

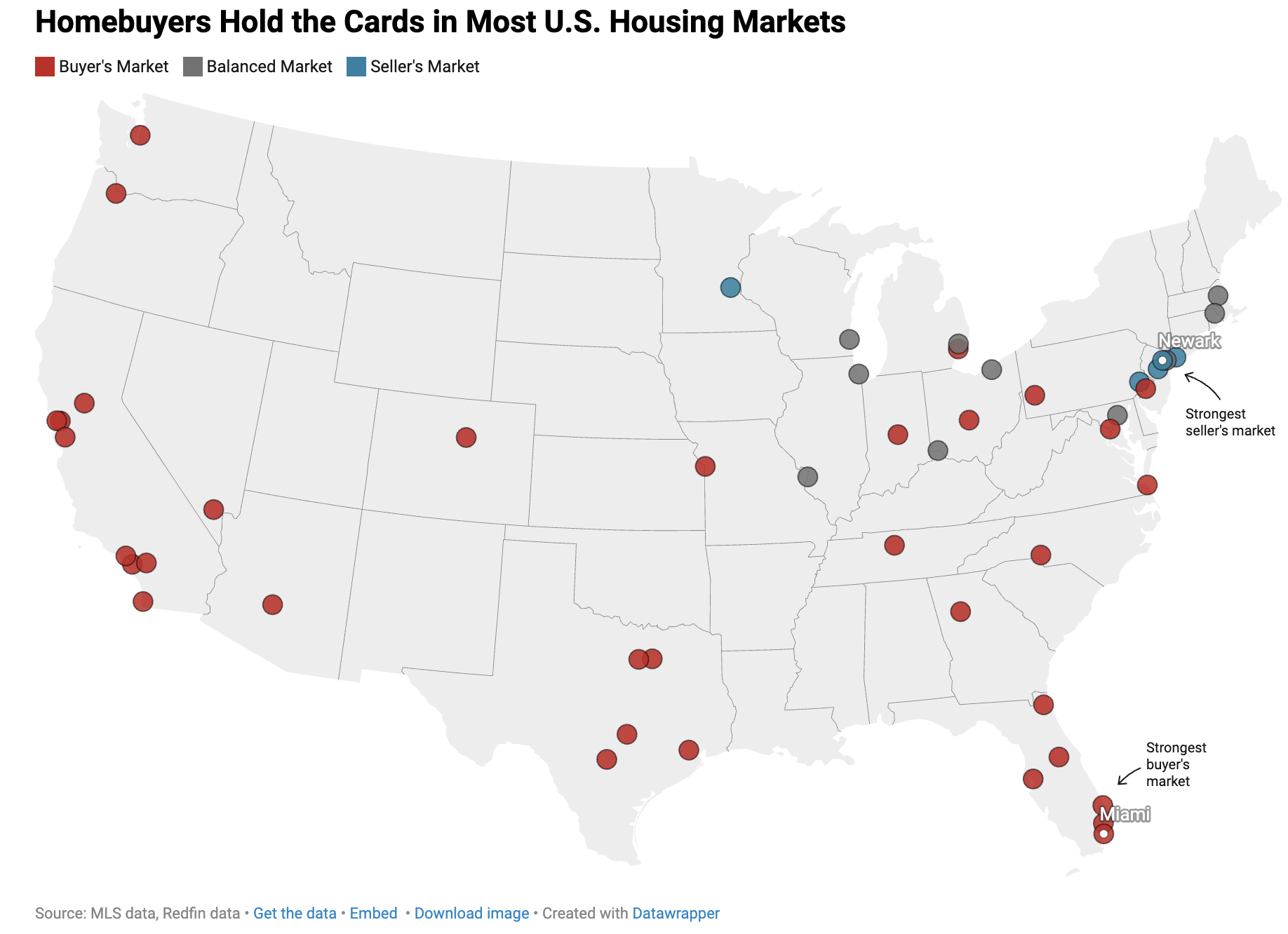

- Of the 50 largest U.S. markets, 35 are buyer’s markets, 10 balanced, and 5 seller’s markets

Now that sellers are starting to register that the market is shifting in favor of buyers, some are deciding to opt out altogether.

The number of homesellers in the U.S. housing market fell in July for the first time since July 2023, when rising mortgage rates made many Americans step back from the market.

And in the past two months, the total number of homesellers in the market has fallen from a peak of 1.96 million in May to 1.95 million in July, according to new data from Redfin.

Even with the number of sellers declining, they still outnumber homebuyers by about 36 percent, the widest gap between the two groups since at least 2013, Redfin said. Meanwhile, the number of buyers on the market in July was 1.43 million, the lowest number of buyers on record aside from a low of about 1.38 million in April 2020 during the early days of the COVID-19 pandemic.

“Homebuyers are spooked by high home prices, high mortgage rates and economic uncertainty, and now sellers are spooked because buyers are spooked,” Redfin Senior Economist Asad Khan said in a statement. “Some sellers are delisting their homes or choosing not to list at all after seeing other houses sit on the market for weeks or months, only to fetch less than the asking price.”

With more sellers deciding to hold off, inventory is also slowly starting to decline, leading to higher home prices. As of July, the median home sale price was up 1.4 percent year over year to $434,189, which is the highest July median home price on record. By contrast, home price growth was shrinking in early 2025.

Many consider a market where inventory exceeds the number of active buyers in the market a “buyer’s market.” Redfin defines a buyer’s market specifically as one in which there are over 10 percent more homesellers than buyers in the market, which is where the market squarely stands today.

“We’re likely in the most buyer-friendly housing market since the 2008 financial crisis,” Khan said in Redfin’s report. “Back then, inventory piled up as foreclosures surged, and demand was weak, meaning buyers had negotiating power. We’re not headed for another 2008, though; many of today’s homeowners have built substantial equity thanks to the recent surge in home values, and today’s borrowers must meet stricter lending standards. Plus, there are more option for avoiding foreclosure if a homeowner is at risk of defaulting, such as loan modification.”

Even though buyers have an advantage right now when it comes to inventory and having more options, many still struggle with affordability, with mortgage rates still elevated much higher than pandemic lows and home prices at a seasonally record high. The recent drop in rates, however, may be enough to incentivize some to jump back into the market.

Although it’s currently a buyer’s market nationally, there are, of course, variations from market to market, Redfin’s report shows. Out of the 50 most populous markets in the U.S., 35 are currently buyer’s markets, 10 are balanced and five are seller’s markets.

Miami and Fort Lauderdale, Florida, currently have the strongest buyer’s markets, with more than twice as many sellers as buyers operating in the market. Newark, New Jersey, and Nassau County, New York, are now the strongest seller’s markets, with just about half as many sellers as buyers.

Balanced markets include Boston, Massachusetts; Providence, Rhode Island; Baltimore, Maryland; New York, New York; Cleveland, Ohio; Cincinnati, Ohio; Warren, Michigan; Chicago, Illinois; Milwaukee, Wisconsin; and St. Louis, Missouri.

Redfin determines the number of homesellers based on the number of active listings in the multiple listing service (MLS).

The company estimates the number of active homebuyers in the market based on the estimated number of homesellers, the probability that a seller matches with a buyer (which is based on MLS data) and the probability that a buyer matches with a seller each month (which is based on Redfin’s own proprietary data), all while incorporating data on the typical time it takes from a buyer’s first home tour to close.

Redfin then uses a standard matching model that is employed in economics literature on buyer and seller dynamics in housing, and plugs in Redfin data to make better matched estimates for every region of the country.