Inman News

The share of mortgaged homeowners with rates of at least 6 percent has risen to nearly 20 percent, Redfin said, signaling the potential end of a years-long ‘lock-in effect’

The Federal Reserve’s decision to make a series of historic short-term rate cuts at the height of the pandemic has proven to be a double-edged sword, with the sharpest point being the percentage of would-be homesellers locked into their homes by 2 percent to 3 percent mortgage rates. However, Redfin’s latest analysis suggests that the lock-in effect may be easing — a welcome sign during a sluggish sales market.

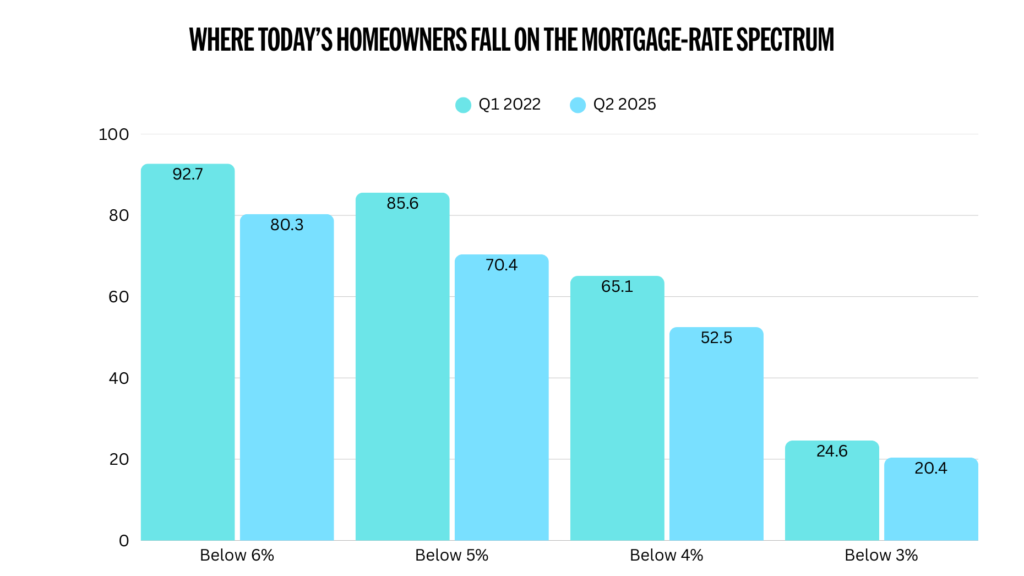

During the second quarter of 2025, the share of mortgaged homeowners with rates of at least 6 percent rose to 19.7 percent — the highest level since 2015. The number of mortgaged homeowners with rates below 6 percent and rates below 4 percent also declined from record highs, dropping by the double digits to 80.3 percent and 52.5 percent, respectively.

Data: Redfin | Chart: Marian McPherson

Redfin, which analyzed data from the National Mortgage Database from 2013 to 2025, said these numbers signal that Americans are finally adjusting to the shift in mortgage rates.

“More homeowners are deciding it’s worth moving, even if it means giving up a lower mortgage rate,” Redfin Head of Economics Research Chen Zhao said. “Life doesn’t stand still — people get new jobs, grow their families, downsize after retirement or simply want to live in a different neighborhood.”

“Those needs are starting to outweigh the financial benefit of clinging to a rock-bottom mortgage rate,” she added. “As a result, more homes are hitting the market than we’ve seen in years, giving buyers a wider range of choices.”

A previous Redfin report revealed there were 35.2 percent — or 505,915 — more homesellers than buyers in the U.S. market in August, creating the strongest buyers’ market in more than a decade. Listings are plentiful, multiple reports have said, with overall inventory rising nearly 20 percent year over year at the beginning of September.

However, new listing trends indicate that homeowners are starting to pull back, as homebuyers are reluctant to embrace mortgage rates of 6 percent to 7 percent with the same gusto.

“A lot of people want to buy and they’re just hanging around waiting,” said Mariah O’Keefe, a Redfin Premier real estate agent in Seattle, in the report. “Rates have not gone down significantly enough to move the needle — prospective buyers need to see a bigger difference in their potential monthly payment before things are going to change.”

“If rates tick down below 6 percent, that will bring a lot of people back into the market,” she added.

August’s pending sales data provided some hope for buyer sentiment and activity, as contract signings increased on both a monthly and annual basis due to recent rate declines. However, economists have warned agents to temper their excitement about a potentially hot fall homebuying season.

“In addition to lower mortgage rates, buyers in August also benefited from more inventory on the market,” Bright MLS Chief Economist Dr. Lisa Sturtevant told Inman in a previous story. “But it is possible that inventory could actually shrink this fall, and that is another reason why we should expect a slow fall housing market.”