CALCULATEDRISK

By Bill McBride

ICE Mortgage Monitor: Falling Rates Lead to Best Homebuying Affordability In 2.5 Years

Intercontinental Exchange, Inc. … today released its October 2025 ICE Mortgage Monitor Report. ICE data reveals that home affordability has reached its best level in 2.5 years, driven by easing mortgage rates.

“The recent pullback in rates has created a tailwind for both homebuyers and existing borrowers,” said Andy Walden, Head of Mortgage and Housing Market Research at ICE. “We’re seeing affordability at a 2.5-year high, which is beginning to bolster purchase demand, while creating more opportunities for homeowners to lower their monthly payments with a rate-and-term refinance loan.”

Key findings from the October Mortgage Monitor include:

- Affordability reaches best level since early 2023

With 30-year mortgage rates averaging 6.26% in mid-September, the monthly principal and interest (P&I) payment on an average-priced home has fallen to $2,148, or 30% of the median U.S. household income. Though still more than five percentage points above its long-run average, P&I costs have declined from 32% earlier this summer and significantly improved from their 35% peak in late 2023. …

- Home prices firm as affordability improves and inventory tightens

Annual home price growth rose to +1.2% in September after eight months of slowing, driven by falling inventory and improved affordability. Nationally, listings remain 17–19% below 2017–2019 norms, as sellers in previously oversupplied markets delay sales to avoid price cuts. …

- Borrower profiles reflect improved financial stability

The average credit score for purchase locks has climbed above 736, the highest recorded in the six-year history of ICE’s origination dataset, indicating a shift toward a more credit-qualified borrower mix. …

Mortgage Delinquencies Increased in August

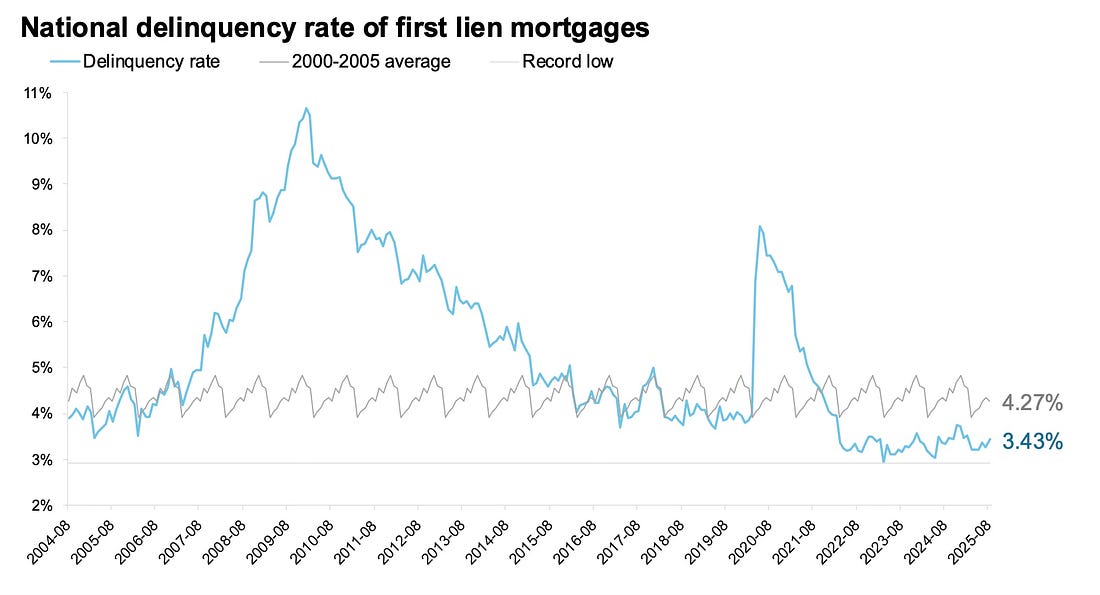

Here is a graph of the national delinquency rate from ICE. Overall delinquencies increased in August but are below the pre-pandemic levels. Source: ICE McDash

- The national delinquency rate rose by 16 basis points (bps) in August to 3.43% and is up 10 bps from the same time last year, marking a return to annual increases after falling in June and July

- While mortgage delinquencies typically face very little seasonal pressure from July to August, August 2025 ended on a Sunday, which created a bump in delinquencies as processing of last-day payments rolled into September

- The 5% increase in short-term delinquencies was in line with the three most-recent previous Sunday-ending Augusts, which experienced an average increase of 5.3%

- FHA loans continue to see the largest annual increases, with the non-current rate (delinquencies plus foreclosures) rising by 86 bps from the same time last year to 12.0% in August, while the non-current rate among VA (+0 bps), GSE (+4 bps) and portfolio-held mortgages (-3 bps) remained relatively flat

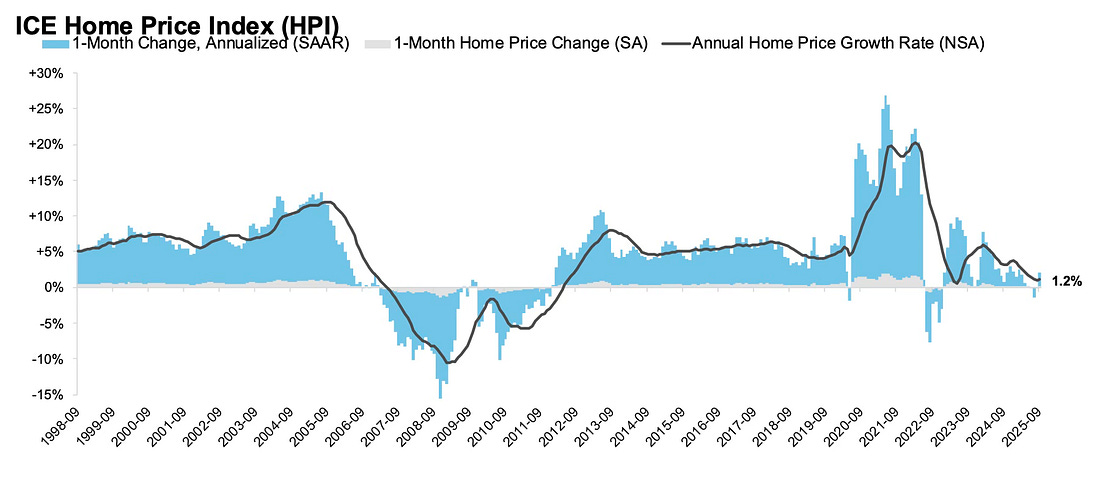

House Prices Up 1.2% Year-over-year

Here is the year-over-year in house prices according to the ICE Home Price Index (HPI). The ICE HPI is a repeat sales index. ICE reports the median price change of the repeat sales. The index was up 1.2% year-over-year in September, up from 1.0% YoY in August.

- Annual home price growth re-accelerated in early September following eight consecutive months of slowing ‒ rising to +1.2% from a revised +1.0% in August – as falling inventory met improved affordability from easing mortgage rates

- On a seasonally adjusted basis, prices rose by +0.17% in the month, equivalent to a seasonally adjusted annualized rate (SAAR) of +2.1%, suggesting the annual home price growth rate may tick modestly higher in coming months

- The bulk of the firming occurred among single family residences, which are up +1.5% from the same time last year, an increase from +1.3% in August

- The condo market remains soft, with prices down -1.8% from the same time last year, a modest improvement from -1.9% in August

- Only 20% of markets saw prices fall on a seasonally adjusted basis in September, the fewest in nine months and down from 55% just two months prior

There is more in the mortgage monitor.