Inman News

Applications for purchase mortgages hit a seasonally adjusted 2025 high last week, with FHA, VA, and USDA applications for less pricey homes driving the surge, MBA lender survey shows

Homebuyer demand for purchase loans hit a seasonally adjusted 2025 high last week, fueled by FHA, VA, and USDA mortgage applications for less pricey homes, the Mortgage Bankers Association reported Wednesday.

Demand for purchase loans was up by a seasonally adjusted 8 percent last week when compared to the week before, and 20 percent higher than a year ago, the MBA’s Weekly Applications Survey showed.

While the average purchase loan request was $427,200, FHA, VA and USDA homebuyers were seeking much smaller loans — $349,900 on average.

Government-backed loans accounted for more than one in four purchase loan applications (26.5 percent), led by FHA (13.7 percent) and VA (12.1 percent) applications, and a smaller number of USDA (0.7 percent) applications.

It was the strongest demand for FHA, VA and USDA purchase loans since 2023, MBA Deputy Chief Economist Joel Kan said.

“Despite slowing home-price growth and lower mortgage rates, affordability remains a challenge in many markets and government loan programs remain appealing to qualified buyers looking to purchase a home,” Kan said in a statement.

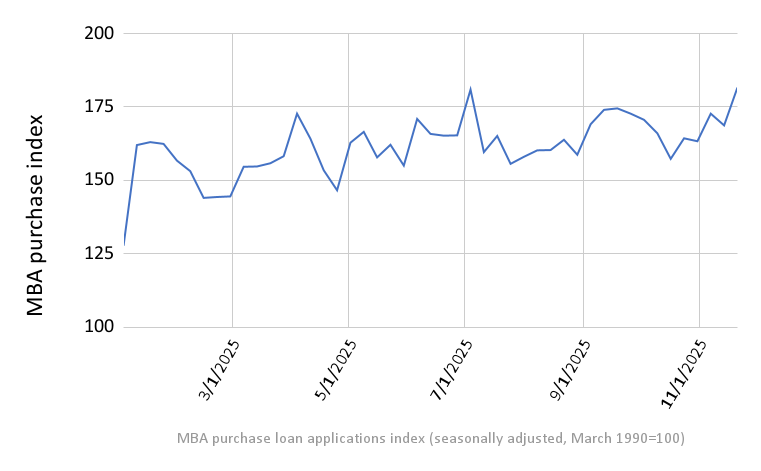

Homebuyer demand hits 2025 high

Source: MBA Weekly Applications Survey.

At 181.6, the MBA’s purchase loan index for the week ending Nov. 21 was at its highest level of the year, after adjusting for seasonal factors, despite mortgage rates being slightly higher last week compared to their 2025 low.

Rates for 30-year fixed-rate conforming loans hit a new 2025 low of 6.12 percent on Oct. 28, but bounced back as high as 6.25 percent several times in November due to uncertainty about the prospects for a December Fed rate cut.

But a Dec. 10 Fed rate cut is back on the table with the latest payroll and unemployment data released on Nov. 20 showing the unemployment rate rose to 4.4 percent in September, with 7.6 million Americans out of work.

Mortgage rates trending down again

By Tuesday, rates for 30-year fixed-rate loans had retreated to 6.17 percent, and rates on FHA loans averaged 5.98 percent, according to lender data tracked by Optimal Blue.

The latest unemployment claims data — released Wednesday by the Department of Labor — shows hiring “remains too weak to absorb the low numbers of people losing their jobs,” adding to the case for a December Fed rate cut, Pantheon Macroeconomics Chief U.S. Economist Samuel Tombs said in a note to clients.

While initial jobless claims fell to 216,000 during the week ending Nov. 22, continuing claims rose to 1.96 million.

“Unemployment likely is rising faster than the claims data would usually imply, given that recent graduates who are struggling to find their first job and former federal workers who volunteered for buyout offers earlier this year are ineligible to claim,” Tombs said. “Most people also lose eligibility for benefits after claiming for 26 weeks, so the rise in longer-term unemployment this year, which has accounted for about half of the total increase, will not show up in jobless claims either.”

Forecasters at Pantheon Macroeconomics expect unemployment to peak at 4.75 percent in the first quarter of 2026, maintaining pressure on Fed policymakers to continue cutting rates.

The central bank brought the short-term federal funds rate down by 1/4 of a percentage point on Sept. 17 and again on Oct. 29.

Pantheon Macroeconomics is forecasting that the Fed will bring short-term interest rates down by a full percentage point in the months ahead, with a 1/4 percentage point cut on Dec. 10 and three equal size cuts at every other meeting in 2026.

The CME FedWatch tool, which tracks futures markets to predict the probability of future Fed moves, on Wednesday put the odds of a Dec. 10 rate cut at 85 percent, up from 30 percent on Nov. 19.

Fed rate cuts don’t always bring mortgage rates down, since they’re determined largely by investor demand for mortgage-backed securities (MBS). After the Fed approved three rate cuts totaling a full percentage point at the end of 2024, mortgage rates went up by an equal amount when inflation surged.

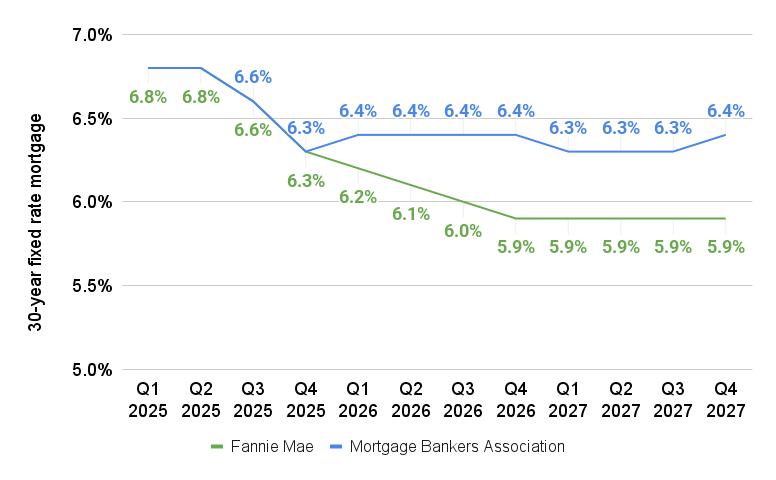

Mortgage rate forecasts diverge

Source: Fannie Mae and Mortgage Bankers Association November, 2025 forecasts.

Fannie Mae economists predict rates on 30-year fixed-rate loans will fall below 6 percent by the end of next year, but MBA forecasters expect they’ll average 6.4 percent in 2026.