Inman News

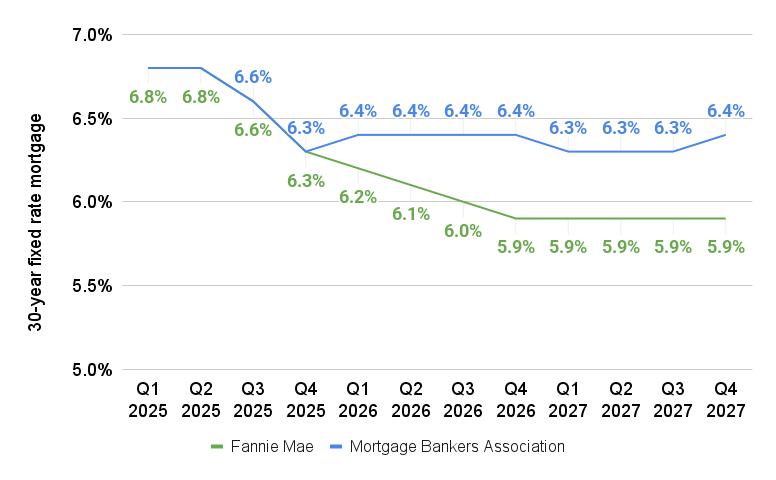

Fannie Mae forecasters are predicting mortgage rates will fall below 6 percent by the end of next year. Economists at the Mortgage Bankers Association don’t see rates coming down at all.

New data showing an uptick in unemployment and encouraging words about inflation from a top Fed policymaker have revived hopes of a December rate cut.

But where mortgage rates are headed next year continues to be anyone’s guess, with Fannie Mae economists predicting rates will fall below 6 percent by the end of next year and forecasters at the Mortgage Bankers Association expecting they’ll be a half percentage point higher.

The latest forecast from Fannie Mae’s Economic and Strategic Research (ESR) Group, released to the public Friday, envisions home sales surging by 7.3 percent next year, to 5.077 million.

The more pessimistic view on mortgage rates held by MBA economists translates into a slightly cooler forecast of 6.2 percent growth in 2026 home sales.

Mortgage rate forecasts diverge

Source: Fannie Mae and Mortgage Bankers Association November, 2025 forecasts.

After hitting a 2025 low on Oct. 28, mortgage rates have been on the rebound as the prospects of a December Fed cut faded.

The picture changed dramatically with Thursday’s release of the latest payroll and unemployment data, which showed the unemployment rate rising to 4.4 percent in September, with 7.6 million Americans out of work.

Unemployment rate hits 4.4%

The CME FedWatch tool, which tracks futures markets to predict the probability of future Fed moves, on Friday put the odds of a Dec. 10 rate cut at 69 percent, up from 39 percent on Thursday.

Investors also took heart from a speech by New York Federal Reserve President John Williams, the vice chair of the rate-setting Federal Open Market Committee (FOMC), who said he’s open to another rate cut to put the Fed in a neutral stance where rates are neither helping nor hindering growth.

Speaking at a conference in Santiago, Chile, Williams said that while tariffs have probably added 1/2 to 3/4 of a percentage point to annual inflation, the effects of tariffs should play out by the first half of next year, and that inflation should get back on track to the Fed’s 2 percent goal in 2027.

At the moment, “inflation expectations are very well anchored, no broad-based supply chain bottlenecks have emerged, labor markets are not creating inflationary pressures, and wage growth has moderated,” Williams said.

MBA Chief Economist Mike Fratantoni said forecasters at the trade group expect another 25-basis-point cut in December in the wake of Thursday’s jobs report, “but also expect a number of dissenting views from FOMC members who will vote to hold rates.”

“The other important takeaway from this report for the housing market is that wages are growing faster than both rents and home prices in many parts of the country, which helps to improve affordability,” Fratantoni said in a statement.

Surprise jump in payrolls ‘defies explanation’

The latest jobs report showed employers added 119,000 jobs in September, more than many forecasters had expected.

But the payroll numbers benefited from an unusually large seasonal adjustment and should be taken with a grain of salt, Pantheon Macroeconomics advised clients in their Nov. 21 U.S. Economic Monitor.

“The seasonal factor used to generate the adjusted headline was the most generous on record” and “defies explanation,” Pantheon forecasters said.

If the seasonal factor used in September 2024 had been applied, payrolls would have risen by only 10,000, they said.

“We retain our forecast for the FOMC to ease policy again in December after yesterday’s labor market report, given clear signs that September’s 119K increase in payrolls overstates the trend, and the further rise in the unemployment rate,” Pantheon forecasters advised.

Due to the government shutdown, the Bureau of Labor Statistics will not publish an October employment report, and the numbers for November won’t be released until Dec. 16 — six days after the Fed’s final meeting of the year.

Steady growth in home sales forecast

Home sales forecast, November 2025. Source: Mortgage Bankers Association.

When the final numbers are in, MBA forecasters think home sales will be up less than 1 percent this year, to 4.8 million, but surge by 6.2 percent next year through the 5 million mark. The MBA’s Nov. 18 forecast envisions continued steady growth in 2027 (3.6 percent) and 2028 (3.2 percent).

Fannie Mae forecasters believe 2025 home sales will be down slightly (-0.3 percent) from 2024, to 4.73 million, but surge by 7.3 percent next year and by 6.9 percent in 2027.

Home price appreciation cooling

Source: Fannie Mae and Mortgage Bankers Association November, 2025 forecasts.

Fannie Mae forecasters are more optimistic than economists at the MBA that home price appreciation will cool, but stay positive, next year.

While Fannie Mae economists envision home price appreciation hitting bottom at 0.9 percent in Q2 2027, the MBA sees national home price appreciation turning slightly negative for a year, from Q3 2026 through Q2 2027.