Inman News

With delinquencies and debt-to-income ratios on the rise, the Trump administration is lifting foreclosure restrictions and eyeing tighter underwriting for borrowers with multiple risk factors

- The FHA’s Mutual Mortgage Insurance Fund reached a record $189 billion with an 11.45 percent capital ratio, over five times the 2 percent statutory minimum, potentially avoiding taxpayer bailouts during a housing downturn.

- Delinquency rates on FHA loans climbed to nearly 12 percent in October, markedly higher than the 3.34 percent average for all mortgages, raising concerns about borrower payment challenges amid rising debt-to-income ratios.

- New FHA rules tightened loan modification eligibility, requiring trial payment plans and limiting repeat home retention options to curb costly redefaults and improve fund sustainability.

- The FHA identified growth in “risk layered loans” with multiple borrower risk factors, which default at higher rates; these now comprise 8.4 percent of loans and warrant increased scrutiny to protect the insurance fund.

The Federal Housing Administration has socked away record levels of cash in its mortgage insurance fund and could weather a housing crash without a taxpayer bailout, the agency said in its Dec. 31 annual report to Congress.

But with delinquencies on FHA loans on the rise and more homebuyers taking on budget-busting monthly mortgage payments, the Trump administration is eyeing tighter underwriting requirements for borrowers with multiple risk factors.

The FHA has also streamlined the process for initiating foreclosure proceedings on homeowners who repeatedly fall behind on their payments.

The FHA Mutual Mortgage Insurance (MMI) fund, which protects mortgage lenders when borrowers default, grew by 9 percent during the fiscal year ending Sept. 30, to $189 billion, HUD reported.

But FHA’s “ongoing support for American homebuyers requires strong oversight of the MMI Fund to protect taxpayers from unnecessary risk,” Housing Secretary Scott Turner said in a foreword to the Dec. 31 report.

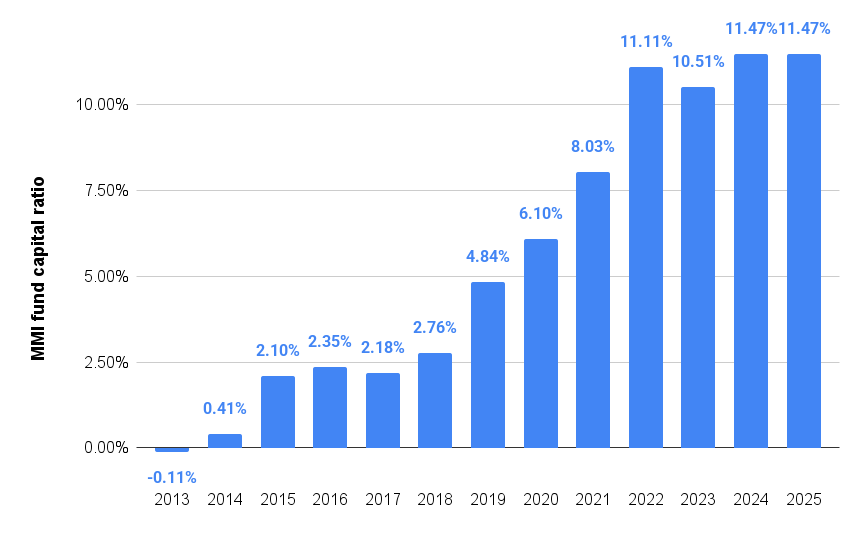

Insurance fund capital ratio ties record high

Source: FHA 2025 annual report to Congress.

The MMI fund’s capital ratio dropped below its 2 percent statutory minimum from 2009 through 2014 following the subprime housing crash, requiring a $1.69 billion taxpayer bailout.

FHA premium hikes and improving housing market conditions have since helped replenish the fund, which has sustained a record high 11.45 percent capital ratio for two years in a row — more than five times the statutory minimum.

The Mortgage Bankers Association maintains that the FHA’s “robust capital reserves” could justify providing homebuyers some relief by cutting FHA premiums, as the Biden administration did in 2023.

“Any such changes should be calibrated responsibly and informed by a careful evaluation of the program and the economic factors behind the rising serious delinquency rate to ensure the program remains safe, sound, and sustainable,” MBA President Bob Broeksmit said in a statement.

The FHA’s stress tests show that if another downturn of the magnitude of the Great Recession came along again, the insurance fund’s capital ratio would drop to 4.42 percent — still more than twice the minimum set by Congress.

But private mortgage insurers who compete with the FHA say that if the agency’s insurance fund had to meet the same standards they are subject to, it would be considered undercapitalized by $32 billion.

“FHA must remain well-capitalized in order to perform its critical countercyclical function in America’s housing market and enable access to mortgage credit for those who may not otherwise be able to secure financing through the conventional and portfolio mortgage markets that are backed by private capital,” U.S. Mortgage Insurers, an association representing private mortgage insurers, said in a statement.

Private mortgage insurers compete with FHA and VA loan programs to serve homebuyers who can’t make a big down payment. Fannie Mae and Freddie Mac require private mortgage insurance when homebuyers put less than 20 percent down.

FHA premium cuts in 2015 and 2023 made FHA loans more attractive than conforming mortgages with private mortgage insurance for many borrowers putting down less than 5 percent, according to an analysis by the Urban Institute.

But borrowers with FICO scores at or above 700 can often get a better deal by taking out a conforming loan backed by Fannie or Freddie with private mortgage insurance, the analysis found.

In the fiscal year ending Sept. 30, the FHA backed 876,502 mortgages totaling $275 billion, bringing the total number of mortgages insured to more than 8.1 million with $1.6 trillion in unpaid principal balance.

A 3.26 percent increase in 2026 FHA loan limits allows FHA-approved lenders to finance single-family home purchases of up to $541,287 in low-cost markets and as much as $1.249 million in high-cost markets like New York, San Francisco and Washington, D.C.

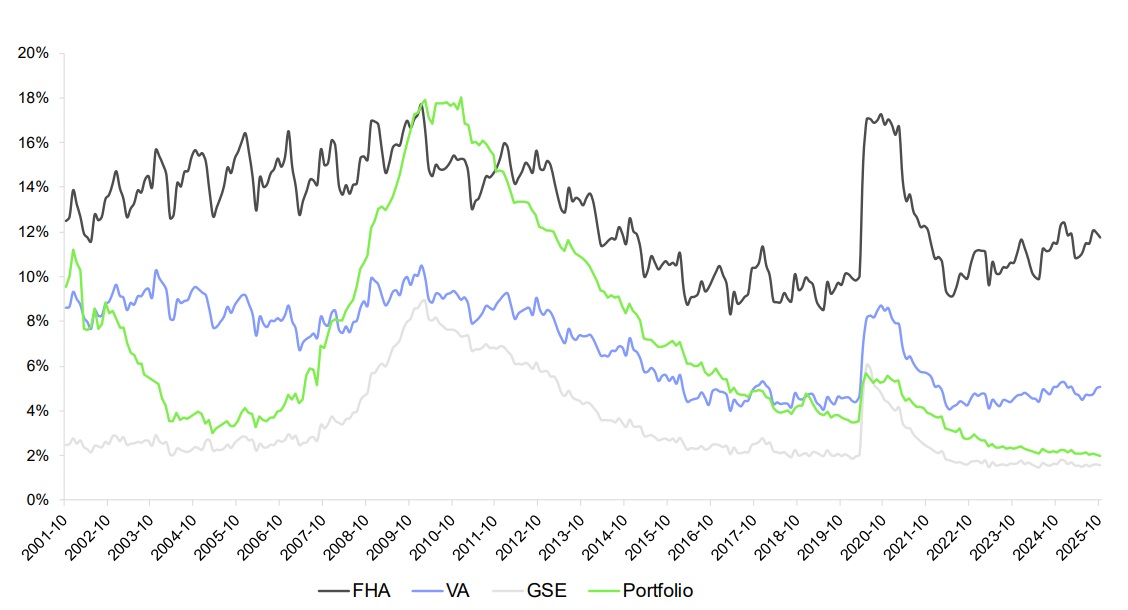

But delinquency rates on FHA loans are on the rise, with borrowers more than five times as likely to be behind on their payments than those relying on conventional loans backed by Fannie Mae and Freddie Mac (the government-sponsored entities, or “GSEs”).

FHA delinquencies on the rise

Mortgage delinquency rates by loan type. Source: ICE Mortgage Monitor, December 2025.

Nearly 12 percent of FHA borrowers were behind on their payments in October, compared with the 3.34 percent average for all mortgage holders and less than 2 percent for loans backed by Fannie and Freddie, according to data tracked by ICE Mortgage Technology.

Because they start out with less equity in their homes, ICE data shows FHA buyers are also more likely to end up underwater or in foreclosure when home prices fall.

Tightened eligibility for loan mods

To reduce its exposure to future claims, the FHA in April announced that it was tightening eligibility requirements for programs that are designed to help struggling borrowers.

The new rules, which took effect on Oct. 1, require seriously delinquent borrowers to successfully complete a trial payment plan before being granted more generous “permanent” solutions like a loan modification.

Borrowers who have been granted a “permanent home retention option” in the last two years are no longer eligible to receive another one, up from the previous limit of 18 months.

In its annual report, the FHA said it wants to avoid “the cycle of churning redefaults and interventions” that increase losses.

“While early COVID-19 loss mitigation interventions were relatively successful, FHA is currently approaching a 60 percent redefault rate, which is unsustainable and a detriment to the MMI Fund,” the agency reported.

Before the pandemic, only 2 percent of FHA borrowers had been granted two or more home retention options in the past five years. By September 2025, that figure had risen to 40 percent.

Going forward, borrowers who redefault within 24 months of receiving a loss mitigation home retention option “will now be ineligible for additional home retention options and will proceed more quickly through loss mitigation, disposition, or foreclosure if necessary,” the report said. “These loans are expected to reach termination sooner. As a result, FHA forecasts a short-term increase in default and claim rates.”

In the long run, however, FHA said it expects to save $1 billion by resolving “serial redefault cases.”

Casting a wary eye on ‘risk layered loans’

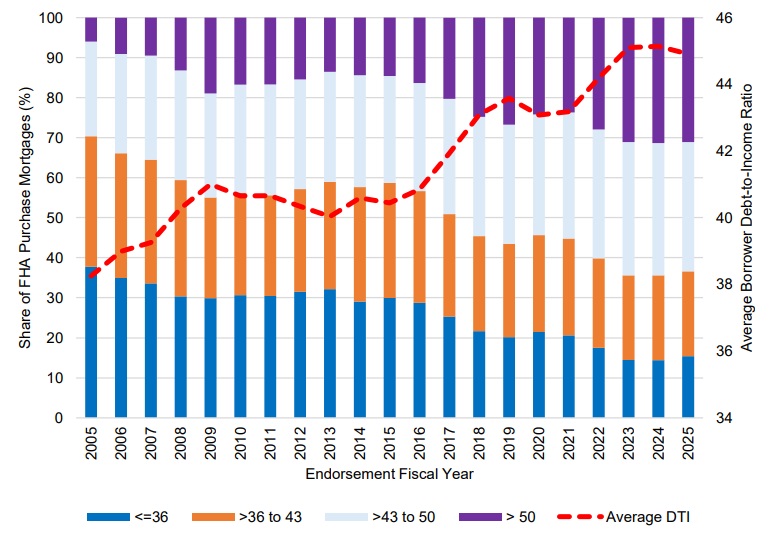

In addition to “restoring common sense safeguards for loss mitigation,” the FHA says it is “working to remedy an emerging trend in risk layered loans” made to borrowers with multiple risk factors — low credit scores and high loan-to-value (LTV) and debt-to-income (DTI) ratios.

Such “risk layered loans” experience early payment defaults at nearly three times the rate of other loans, and a loss rate that’s 2.5 times higher, the agency found.

Average credit scores on FHA loans have been rising over the past four years, hitting a 10-year high of 679 last year. Loan-to-value ratios on purchase loans have averaged between 95 percent and 96 percent for more than a decade.

But thanks to rising home prices and mortgage rates, FHA borrower debt-to-income ratios have climbed from less than 40 percent during the 2005-2006 housing bubble to over 45 percent during the last three years.

Rising borrower debt-to-income ratios

The FHA says the percentage of loans with all three risk layers is now over three times larger than 12 years ago, rising from 2.6 percent in 2013 to 8.4 percent in 2025.

Loans with all three risk layers “have an elevated cost to the MMI Fund and therefore warrant additional scrutiny and monitoring,” the report said.