Inman News

Even though buyers have the upper hand over sellers nationally, many have stuck to the sidelines anyway due to the high cost of homeownership and economic uncertainty

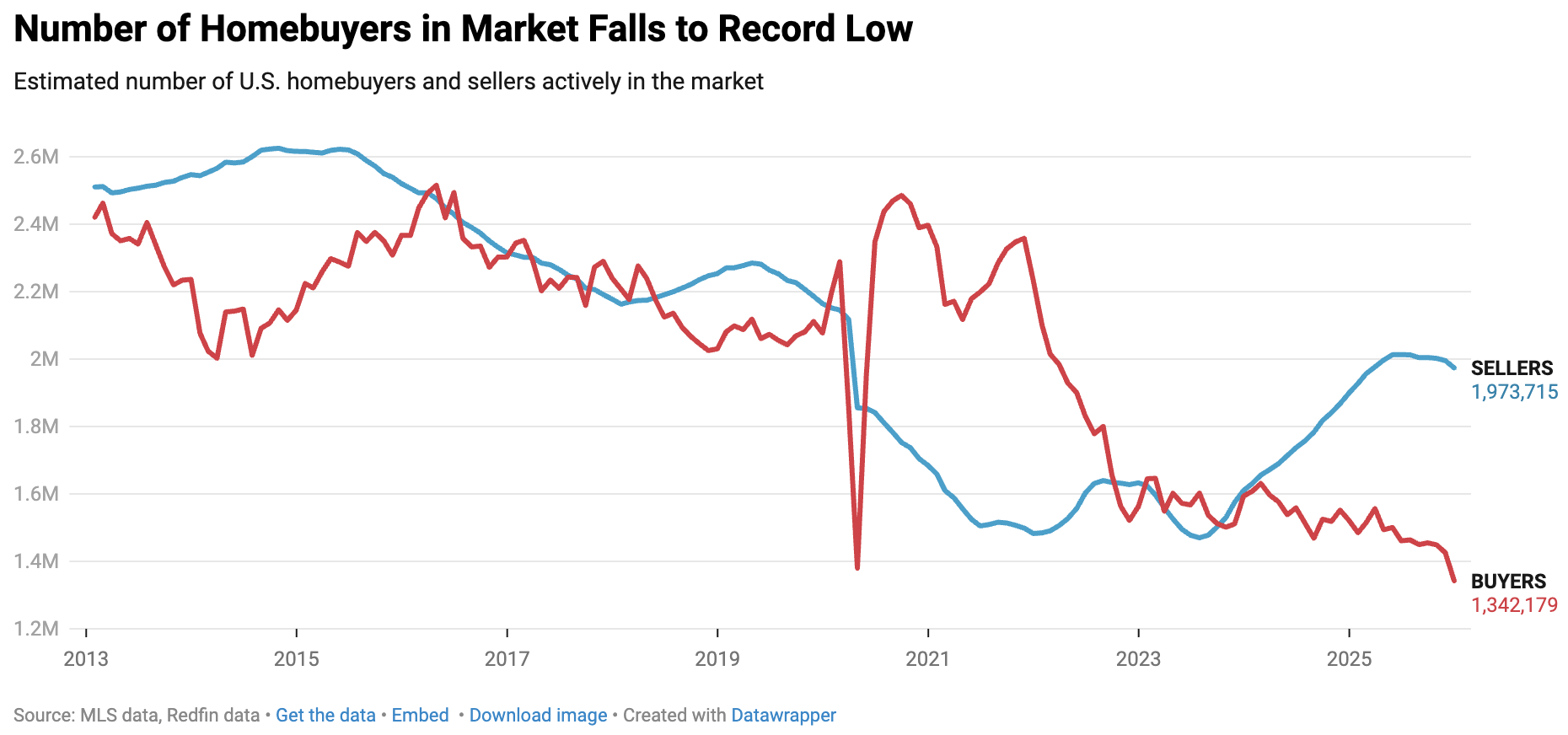

The number of homesellers that outnumbered homebuyers hit a new record in December, giving buyers added leverage in their transactions.

There were roughly 47 percent more homesellers than buyers last month (or around 631,535 more), which is the largest gap seen between the two groups since 2013, Redfin reported. That’s also up 7.1 percentage points from the previous month, and 22.2 percentage points from the year before. December also marked the largest monthly increase in homesellers since Sept. 2022.

Since this differential is well above the threshold Redfin uses to define a buyer’s market (over 10 percent more sellers than buyers) the market in December was considered to be in solid buyer’s market territory.

Even with that mismatch in numbers, the high cost of homeownership and economic uncertainty have continued to push some buyers to the sidelines.

“Some homesellers are underwater because Dallas does not have enough housing demand to meet supply, which hit a record high this year,” Dallas Redfin Premier agent Connie Durnal said in the company’s report. “I have one seller who overpaid for his home at the peak of the pandemic market and is now taking a 10 percent loss. He’s being realistic about the fact that the market has shifted in buyers’ favor, but a lot of sellers are in denial and won’t budge on price. If you don’t price your home reasonably, it will sit on the market.”

Dallas, a market that experienced a construction boom in recent years, now has about 86.8 percent more sellers than buyers in the market, according to Redfin. That has helped contribute to a 7.6 percent decline in the median home sale price over the past year.

On a national level, home prices increased by only 0.1 percent month over month and 2.2 percent year over year in December, according to the Redfin Home Price Index, an index that measures how sales prices of homes have changed since their previous sale. That slight annual increase in price marked the slowest home price growth since 2012.

Home price growth slowed, but did not halt altogether, because as homebuyers continued to pull back, sellers also pulled back from the market slightly — by 1.1 percent month over month.

Moving into 2026, affordability is expected to improve, with mortgage rates down and the typical monthly home payment at its lowest level in two years, as of early January.

“The trend toward stable home price growth took hold in 2025, and it’s staying ‘in’ for 2026,” Redfin Head of Economic Research Chen Zhao said in the company’s report. “While they’re still historically very high, the fact that home prices are reliably growing at a slow and steady pace should make the market a little more welcoming to buyers, who already have the upper hand in most parts of the country.”

The number of homebuyers nationally fell by 5.9 percent month over month in December, which is the largest drop seen since March 2023 and a low not seen since 2013.

Sun Belt cities are seeing the strongest buyer’s markets right now in the wake of ramped-up construction during the pandemic, when buyers flocked to those cities as they became recipients of more flexible work-from-home policies. More buyers are now priced out of those areas, however, resulting in an oversupply.

By Redfin’s count, 36 of the 50 most populous metro areas in the U.S. qualified as buyer’s markets in December. Nine of those largest metros were balanced markets, and five were seller’s markets. Seller’s markets were largely located in the Midwest and on the East Coast.