Inman News

The benchmark rate is now in the 5.25-5.5% range, the highest level in 22 years. Fed Chair Jerome Powell and company keep their options open for another rate hike in September, but futures markets investors and some economists think the Fed is probably done hiking rates.

Federal Reserve policymakers raised a key short-term interest rate Wednesday and kept their options open for another rate hike in September, but futures markets investors and some economists think the Fed is probably done hiking rates.

The small, 25-basis point adjustment unanimously approved by Fed policymakers brought the federal funds rate to a target of between 5.25 percent and 5.5 percent, the highest level since 2001.

In a statement, members of the Federal Open Market Committee said they remain “highly attentive to inflation risks” and would be prepared to “adjust the stance of monetary policy as appropriate if risks emerge” to their goal of getting inflation back down to 2 percent.

The move had been expected, so the focus at the press conference following the meeting immediately shifted to what the Fed might do at its remaining three meetings this year. Having skipped a June rate hike, the first question Fed Chair Jerome Powell faced from reporters was whether the Fed will refrain from hiking in September but implement another increase in November.

“We haven’t made a decision to go to every other meeting,” Powell said. “We’re going to be going meeting by meeting. As we go into each meeting we’re asking ourselves the same question. We haven’t made any decisions about any future meetings including the pace at which we consider hiking. But we’re going to be assessing the need for further tightening that may be appropriate.”

In addition to raising short-term rates, Fed policymakers said the central bank will also continue to withdraw the support it had provided to mortgage markets during the coronavirus pandemic, letting $35 billion in mortgage-backed securities and $60 billion in Treasurys roll off its balance sheet each month as part of “quantitative tightening” that began last summer.

Hiking rates to fight inflation

View Interactive Graph

In their efforts to tame inflation, Fed policymakers have now approved 11 increases in the federal funds rate since March 2022. Last year the Fed hiked rates by a total of 4.25 percentage points, raising the benchmark federal funds rate by 50- or 75-basis points at a time. This year it’s approved four smaller, 25-basis point increases — in February, March, May and June.

The CME FedWatch Tool, which monitors futures markets to gauge investor sentiment of the Fed’s next moves, puts the odds that the Fed will hike again in September at just 20 percent.

“We think the data will tell the Fed not to hike again, though the risk probably is higher” than futures markets would suggest, Pantheon Macroeconomics Chief Economist Ian Shepherdson said in a note to clients.

But if the economy continues to slow or tips into a recession, as forecasters at Fannie Mae predict, the Fed is expected to reverse course and begin lowering rates next year.

The Fed is keeping a close eye not only on inflation but the labor market, and “both are now moving in a direction which could allow this hike to be the Fed’s last for this cycle,” said Mortgage Bankers Association Chief Economist Mike Fratantoni in a statement. “We expect that to be the case, but for the Fed to hold off on any rate cuts until we are well into 2024.”

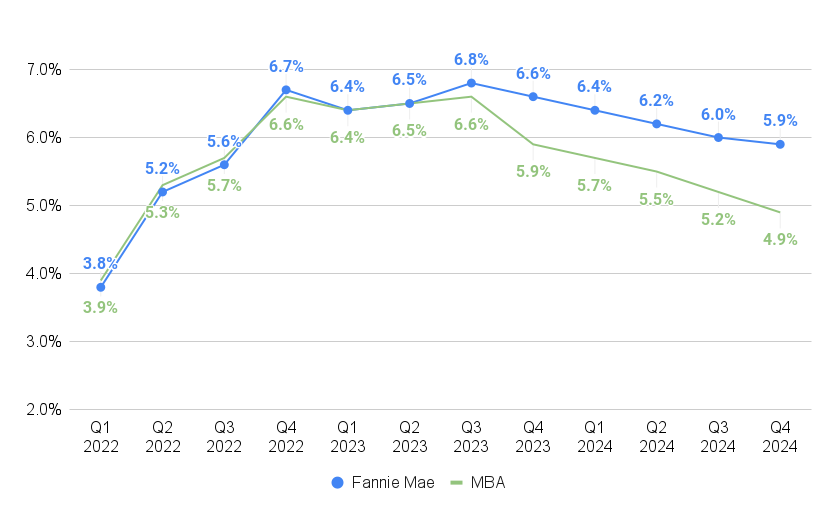

Thanks to the recent unexpected strength in the economy, Fannie Mae forecasters don’t see mortgage rates coming down below 6 percent until the final three months of next year.

Mortgage rate forecasts diverge

But in a July 20 forecast, economists at the Mortgage Bankers Association said they still anticipate sub-five percent mortgage rates by the final three months of next year.

“We do expect mortgage rates to trend down once the [Federal Open Market Committee] clearly signals that they have reached the peak for this cycle, as the reduction in uncertainty with respect to the direction of rates should narrow the spread of mortgage rates relative to Treasury benchmarks,” Fratantoni said.

As he typically does when talking to reporters, Powell stressed that future decisions will be data-dependent.

“What are we looking at? The whole broader picture,” Powell said. “We’re looking for moderate growth. We’re looking for supply and demand through the economy coming into better balance. Including in particular the labor market. We’ll be looking at inflation. Asking ourselves does this whole collection of data, do we assess it as suggesting that we need to raise rates further? If we make that conclusion then we will go ahead and raise rates.”

~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~

Real Estate News

Key points:

- The Fed appears determined to get inflation, currently at 3%, down to the target rate of 2%.

- Today’s decision will probably mean elevated mortgage rates in the short term, but they could start slowly ticking down in the coming months.

The Federal Reserve today boosted the federal funds rate by 25 basis points, a sign that the board is determined to do what it takes to further tame inflation.

The rate hike — the 11th since March 2022 — puts the benchmark rate in the 5.25-5.5% range. It’s the highest level since 2001 and may keep mortgage interest rates elevated for the short term. Freddie Mac’s most recent weekly survey pegged the 30-year fixed-rate at 6.78%, although the latest numbers from Mortgage News Daily show rates above 7%.

“Looking ahead, we will continue to take a data-dependent approach in determining the extent of additional policy firming that may be appropriate,” said Federal Reserve Chair Jerome Powell in a press conference after the announcement, noting that the Fed will continue to make decisions meeting-by-meeting.

Powell said the board would consider another rate hike when it meets again in September, but “it’s also possible that we would choose to hold steady.”

The rate hike cements the idea that the Federal Reserve is set on bringing inflation, currently at 3%, down to the 2% target, said Danielle Hale, chief economist at Realtor.com. Based on recent trends, the inflation rate could be back at 2% by the first half of 2024.

“At the same time, I expect Chair Powell to insist that the Fed remains vigilant, which will likely mean that rates remain high for a bit longer, just in case this reading turns out to be an aberration,” Hale said.

Mortgage rates should trend down — barring future hikes

In the meantime, higher rates will likely keep homebuying activity sluggish as low inventory continues to put pressure on prices. It’s a particularly challenging situation for first-time homebuyers as existing homeowners hold onto their below-market mortgage rates, said Ruben Gonzalez, chief economist at Keller Williams.

“If we see mortgage rates trend down, consistent with inflation returning to target levels, it should remove substantial friction from real estate markets,” Gonzalez said.

If the Fed chooses to pause future hikes, Gonzalez said rates should start trending over the remainder of the year.

“However, we expect rate volatility to remain high and the trend lower to be slow. We could see rates move toward 6% by year-end,” Gonzalez said.

Pausing rate hikes is not a certainty, however, and Fed actions during the second half of the year could continue to impact the housing market, said Lisa Sturtevant, chief economist at Bright MLS. Sturtevant is concerned that if the Fed opts for another rate hike later this year, there is a real risk they will overshoot and send the economy into a recession.

“Rising unemployment rates and job losses is the biggest risk to the housing market, which has so far been extremely resilient in the face of higher rates,” Sturtevant said.