CALCULATED RISK

By Bill McBride

Housing Starts at 1.401 million Annual Rate in April

From the Census Bureau: Permits, Starts and Completions

Housing Starts:

Privately‐owned housing starts in April were at a seasonally adjusted annual rate of 1,401,000. This is 2.2 percent above the revised March estimate of 1,371,000, but is 22.3 percent below the April 2022 rate of 1,803,000. Single‐family housing starts in April were at a rate of 846,000; this is 1.6 percent above the revised March figure of 833,000. The April rate for units in buildings with five units or more was 542,000.

Building Permits:

Privately‐owned housing units authorized by building permits in April were at a seasonally adjusted annual rate of 1,416,000. This is 1.5 percent below the revised March rate of 1,437,000 and is 21.1 percent below the April 2022 rate of 1,795,000. Single‐family authorizations in April were at a rate of 855,000; this is 3.1 percent above the revised March figure of 829,000. Authorizations of units in buildings with five units or more were at a rate of 502,000 in April.

emphasis added

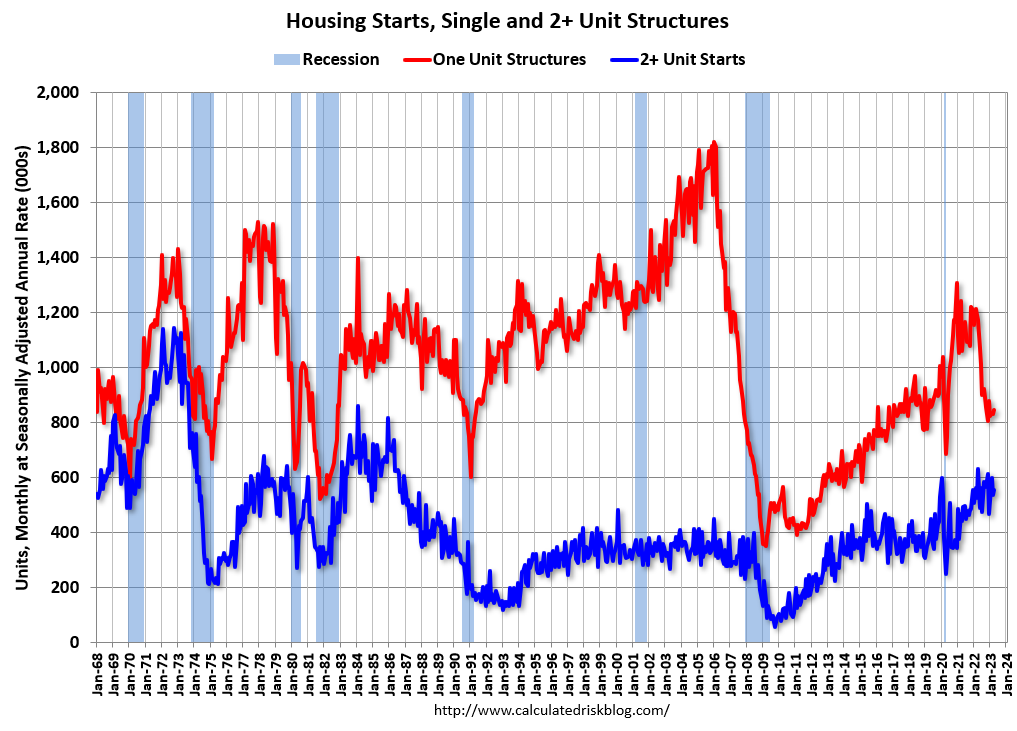

The first graph shows single and multi-family housing starts since 2000 (including housing bubble).

Multi-family starts (blue, 2+ units) increased in April compared to March. Multi-family starts were down 12.2% year-over-year in April. Single-family starts (red) increased in April and were down 27.9% year-over-year.

Note that the weakness over the last year has been in single family starts (red).

The second graph shows single and multi-family starts since 1968. This shows the huge collapse following the housing bubble, and then the eventual recovery – and the recent collapse in single-family starts.

Total housing starts in April were slightly above expectations, however, starts in February and March were revised down, combined.

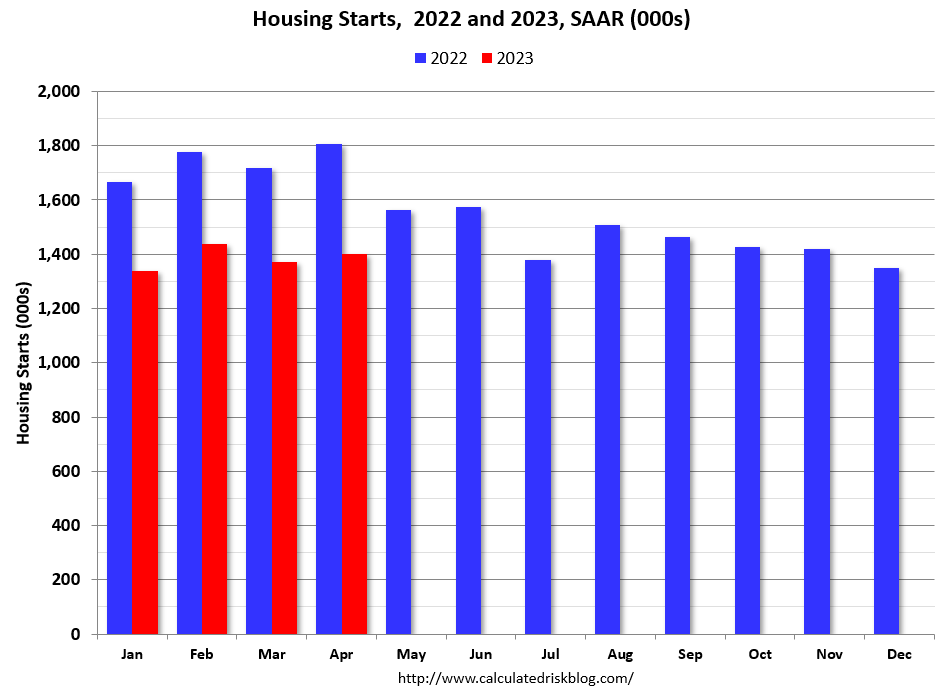

The third graph shows the month-to-month comparison for total starts between 2022 (blue) and 2023 (red).

Total starts were down 22.3% in April compared to April 2022. Starts have been down year-over-year for twelve consecutive months, and I expect starts to be down significantly this year – although the year-over-year comparisons will be easier later in the year.

Near Record Number of Housing Units Under Construction

The fourth graph shows housing starts under construction, Seasonally Adjusted (SA).

Red is single family units. Currently there are 698 thousand single family units (red) under construction (SA). This was down in April compared to March, and 133 thousand below the recent peak in May 2022. Single family units under construction have peaked since single family starts declined sharply. The number of single-family homes under construction will decline further in coming months.

Blue is for 2+ units. Currently there are 977 thousand multi-family units under construction. This is the highest level since September 1973! This is close to the all-time record of 994 thousand in 1973 (being built for the baby-boom generation). For multi-family, construction delays are a significant factor. The completion of these units should help with rent pressure.

Combined, there are 1.675 million units under construction, just 35 thousand below the all-time record of 1.710 million set in October 2022.

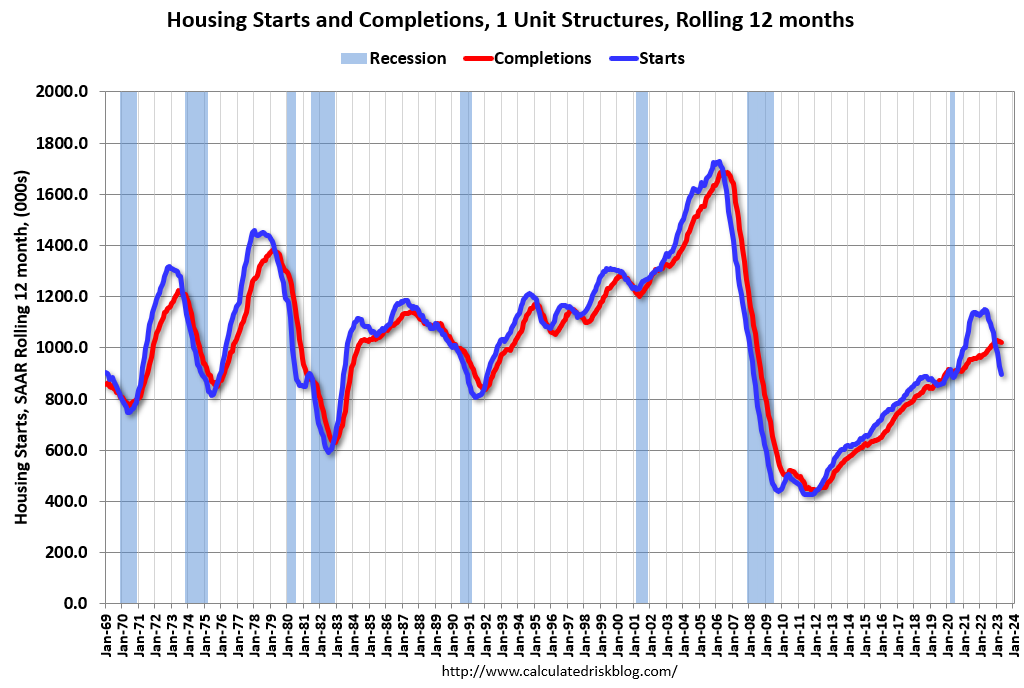

Comparing Starts and Completions

Below is a graph comparing multi-family starts and completions. Since it usually takes over a year on average to complete a multi-family project, there is a lag between multi-family starts and completions. Completions are important because that is new supply added to the market and starts are important because that is future new supply (units under construction is also important for employment).

These graphs use a 12-month rolling total for NSA starts and completions.

The blue line is for multifamily starts and the red line is for multifamily completions. Builders are still starting more multifamily units than they are completing. Multifamily starts (blue) have slowed, and completions (red) are picking up – although the gap is still huge.

The last graph shows single family starts and completions. It usually only takes about 6 months between starting a single-family home and completion – so the lines are much closer than for multi-family. The blue line is for single family starts and the red line is for single family completions.

The recent gap between starts and completions has disappeared, and builders are now completing more single-family homes than they are starting. Completions are beginning to follow starts down.

Conclusions

Total housing starts in April were slightly above expectations, however, starts in February and March were revised down, combined. The weakness in 2022 was mostly for single family starts. However, I expect multi-family starts to turn down in 2023.

A near record number of total housing units are under construction due to construction delays, but the number of single-family housing units under construction is now declining. This suggests a large number of multi-family housing units will be delivered later this year and in 2024.