Calculated Risk

18 June 2013

The bottom for inventory is a key topic for 2013 …

From Tim Ellis at Redfin: Here Comes the Inventory

Increasing home prices are giving more sellers sufficient equity to sell, and sellers who already had equity are being lured into the market after seeing their neighbor’s homes sell in record time and in fierce bidding wars.

More inventory begets more inventory, too. “I have several clients who are ready to take the plunge and list their homes—they’ve even decluttered and we have the listing ready to hit the MLS,” explained Redfin listing specialist Paul Stone. “The sellers are just waiting to get under contract on a home to buy, at which point we’ll pull the trigger and list their current home.”

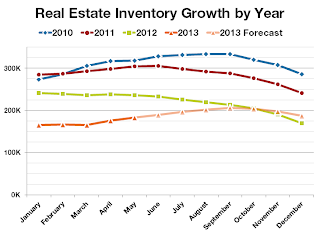

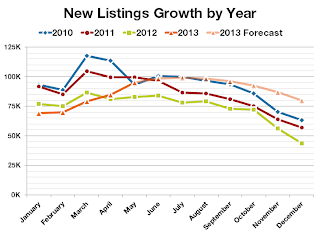

Here’s what the inventory recovery looks like so far, along with a forecast for the rest of the year, should the trend hold:

Total active listings are still down 22% from a year ago as of May, but even that is an improvement compared to the 32% year-over-year drop we experienced in January.

New listings have turned around completely in just four months, from a 10% year-over-year decline in January to a 15% year-over-year increase in May.

…

As supply and demand are brought back into balance bidding wars will ease and price gains will moderate.

CR Notes: In tracking inventory very closely this year, Ellis thinks (first graph) that inventory in the areas Redfin tracks will continue to build until September or October, and only decline slightly at the end of the year. He thinks inventory will be up year-over-year towards the end of this year. (that is pretty close to the current outlook for inventory).

As more inventory comes on the market, buyer urgency will wane and price increases will slow and even decline seasonally in many areas this winter. This may be another step towards a more normal housing market.