US commercial real estate gains strength.

(Reuters) – The collapse of the U.S. commercial real estate bubble will not be as crushing as many had anticipated, a top executive for real estate services company Jones Lang LaSalle Inc (JLL.N) said on Monday at the Reuters Global Real Estate and Infrastructure Summit in New York.

After investment firm Lehman Brothers collapsed in September 2008, real estate investors worried there would be a widespread sell-off of debt-laden commercial properties.

While the values of office buildings and other commercial properties have fallen, the anticipated flood of foreclosures and bankruptcies has not occurred — and probably will not, said James Koster, president of Jones Lang LaSalle’s capital markets group.

“We should be in a relatively good position to not have this other shoe drop,” said Koster.

U.S. regulators have allowed banks to extend, restructure and modify loans. That has given the real estate markets a chance to regroup and for values to rise above their rock-bottom levels.

For properties whose mortgages have been securitized, delinquency rates have soared. The percentage of borrowers whose loans have been securitized into commercial mortgage-backed securitized (CMBS) and who are 30 days late with payments reached 8.42 percent in May, according to Trepp, which tracks CMBS performance.

Still, special servicers, who oversee these troubled loans, are not selling the properties at fire sale prices. Instead they are holding them and collecting fees for managing them, Koster said.

Meanwhile, institutional investors and real estate investment trusts (REITs) have money waiting for good but debt-laden real estate to hit the market. When those properties do, they will be priced higher than they would have two years ago, he said.

“There is fresh capital coming in,” he said. “It’s a better market now.”

Analysis: Commercial Real Estate Market Springs Back to Life

Morningstar

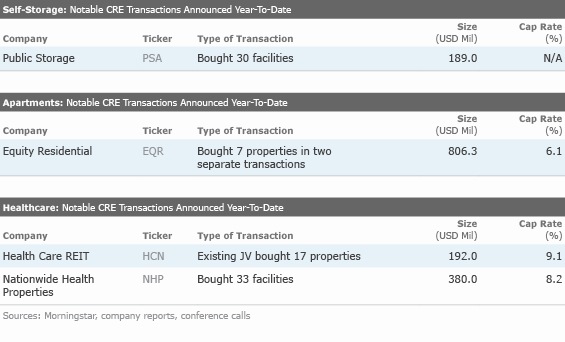

An Upcoming Buying Spree for Commercial Real Estate ?

We think conditions could favor a flurry of deals in this once-troubled sector.

In our opinion, the environment will support commercial real estate purchase transactions, perhaps for many years to come. In its February report, the Congressional Oversight Panel concluded that about $700 billion in commercial real estate loans that come due between 2010 and 2014 are underwater. We think a sizable amount of the additional $700 billion in commercial real estate loans coming due during that time frame are loans that could not get refinanced at existing levels in the current lending environment. This suggests that there are at least hundreds of billions of dollars of incremental equity capital that need to be injected into commercial real estate to establish a “proper” leverage level. In fact, The Real Estate Roundtable, an industry group comprised of representatives from public and private real estate firms, has estimated this equity gap at about $1 trillion over the longer term.