CALCULATEDRISK

By Bill McBride

Yesterday, in Part 1: Current State of the Housing Market; Overview for mid-July 2025 I reviewed home inventory, housing starts and sales. I noted that the key stories for existing homes are that inventory is increasing sharply, and sales are essentially flat compared to last year (and sales in 2024 were the lowest since 1995). That means prices are under pressure. And there are significant regional differences too.

In Part 2, I will look at house prices, mortgage rates, rents and more.

These “Current State” summaries show us where we came from, where we are, and hopefully give us clues as to where we are going!

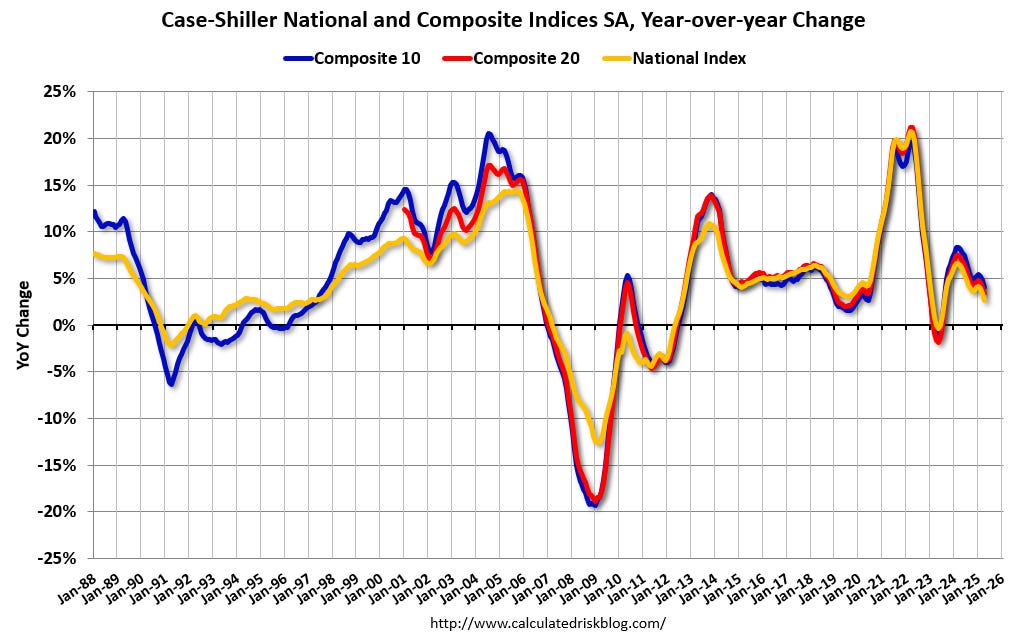

House Prices

The Case-Shiller National Index increased 2.7% year-over-year (YoY) in April and will likely be lower year-over-year in the May report compared to April (based on other data).

The Composite 10 NSA was up 4.1% year-over-year. The Composite 20 NSA was up 3.4% year-over-year. The National index NSA was up 2.7% year-over-year.

The MoM decrease in the seasonally adjusted (SA) Case-Shiller National Index was at -0.51% (a -4.8% annual rate). This was the second consecutive MoM decrease.

In the January report, the Case-Shiller National index was up 4.2%, in February up 3.9%, in March up 3.4%, and now, in the April report, up 2.7%.

And the April Case-Shiller index was a 3-month average of closing prices in February, March and April. (“April” is a 3-month average of February, March and April closing prices). February closing prices include some contracts signed in December!

Not only is this trending down, but there is a significant lag to this data.

Let’s review some more timely house price data …

Other measures of house prices suggest prices will be up a less YoY in the May Case-Shiller index as in the April report. The NAR reported median prices were up 1.3% YoY in May, down from 1.8% YoY in April, and down from 2.6% in March. (Note that median prices are impacted by the mix).

ICE reported prices were up 1.3% YoY in mid-June, down from 1.6% YoY in May, and down from 2.0% in April. Freddie Mac reported house prices were up 2.2% YoY in May, down from 2.6% YoY in April.

Here is a comparison of year-over-year change in the FMHPI, median house prices from the NAR, and the Case-Shiller National index.

The FMHPI and the NAR median prices appear to be leading indicators for Case-Shiller. Based on recent monthly data, and the FMHPI, the YoY change in the Case-Shiller index will likely be lower in May than in April.

Based on the trend, it is possible that national house prices will be down year-over-year in 2025. So far. I’m stick with my forecast of “mostly flat prices nationally in 2025”.

In real terms, the Case-Shiller National index is down 1.7% from the peak in 2022, seasonally adjusted. It has now been 35 months since the real peak in house prices. Typically, after a sharp increase in prices, it takes a number of years for real prices to reach new highs.

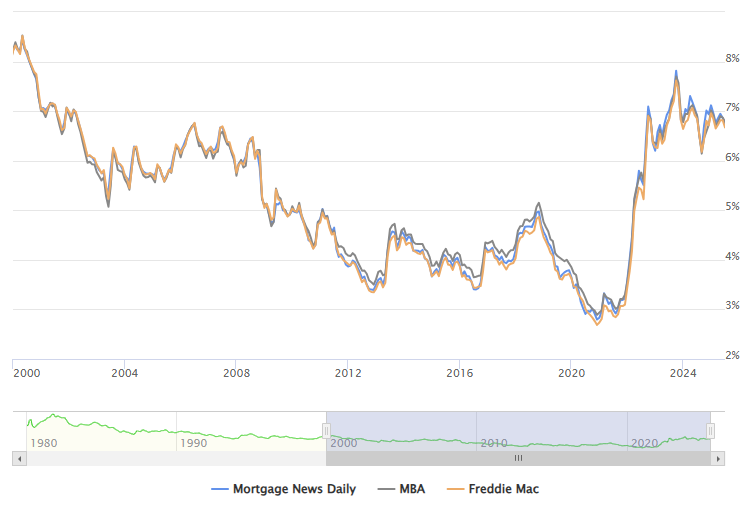

30-Year Mortgage Rates under 7%

The following graph from MortgageNewsDaily.com shows mortgage rates since January 1, 2000. 30-year mortgage rates were at 6.77% on July 9th.

Mortgage rates were low following the financial crisis through the early years of the pandemic. Now rates have returned to a new normal in 30-year mortgage rates in the 6% to 7% range.

A year ago, 30-year mortgage rates were at 7.00%, two years ago rates were at 7.12%, three years ago rates at 5.77%, and four years ago at 3.09%.

It is financially very difficult for homeowners to move and give up their 3% mortgage rates, however time and life changes are slowing leading to more listings.

Note that rates were falling in 2019 – into the high 3s – prior to the pandemic as the economy weakened in 2019.

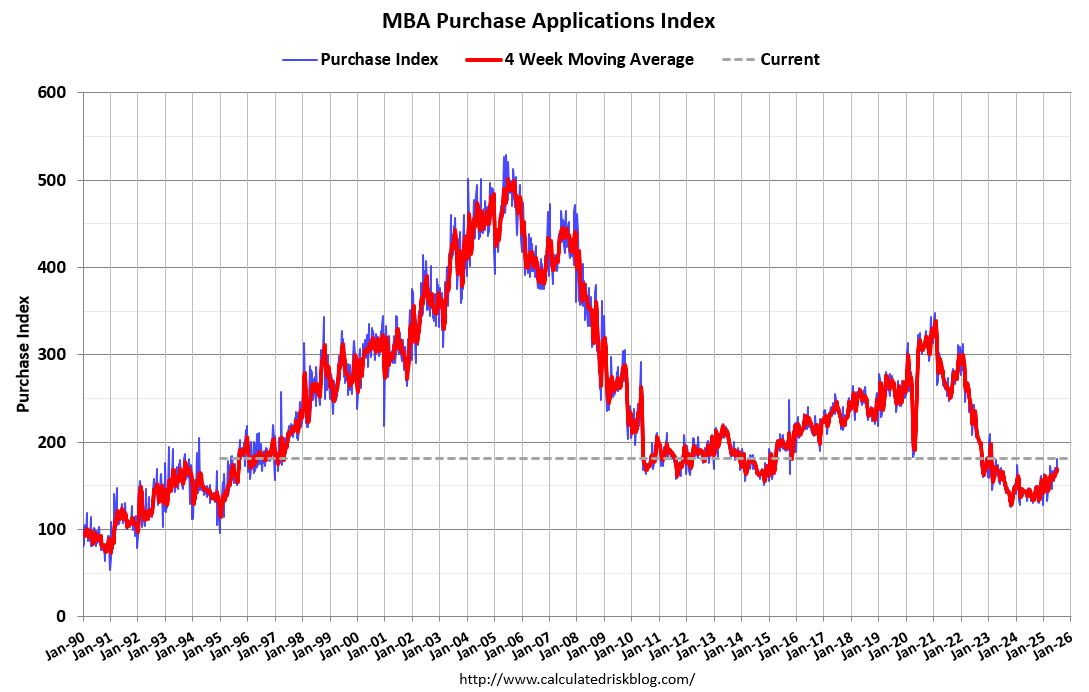

Mortgage Purchase Applications Have Increased

Here is a graph showing the MBA mortgage purchase index released last week. Purchase application activity is up from the lows in late October 2023 and is above the lowest levels during the housing bust.

Be careful using purchase application to make assumptions about sales. First, there are always distortions around holidays (the most recent reading was up sharply adjusted for the 4th of July). And second, recently there has been a decline in cash buyers. Fewer cash buyers, at the same level of sales, pushes up purchase applications.

And the next graph shows the refinance index since 1990. Refinance activity is still very low.

Asking Rents Mostly Unchanged Year-over-year

Here is a graph of the year-over-year (YoY) change for these measures since January 2015. Most of these measures are through May 2025, except Apartment List is through June 2025.

Asking rents are mostly unchanged YoY for multi-family and with new supply coming on the market, we will likely see continued pressure on asking rents.

Current Outstanding Mortgage Rates

Here is some data showing the distribution of interest rates on closed-end, fixed-rate 1-4 family mortgages outstanding at the end of each quarter since Q1 2013 through Q1 2025.

This shows the surge in the percent of loans under 3% starting in early 2020 as mortgage rates declined sharply during the pandemic.

Note that a fairly large percentage of mortgage loans were under 4% prior to the pandemic!

The percent of outstanding loans under 4% peaked in Q1 2022 at 65.1% (now at 53.4%), and the percent under 5% peaked at 85.6% (now at 71.3%). These low existing mortgage rates made it difficult for homeowners to sell their homes and buy a new home since their monthly payments would increase sharply.

This was a key reason existing home inventory levels were so low. However, time is eroding this lock-in effect.