CALCULATED RISK

Early Reporting Markets Suggest Sales Down Less YoY in May than in April NSA

By Bill McBride

This is a look at a few early reporting local markets in May. I’m tracking about 40 local housing markets in the US. Some of the 40 markets are states, and some are metropolitan areas. I’ll update these tables throughout the month as additional data is released.

Closed sales in May were mostly for contracts signed in March and April. Since 30-year fixed mortgage rates were in the 6% to 6.5% range in March and April – compared to the 4% to 5% range the previous year – closed sales were down significantly year-over-year in May.

For review on mortgage rates, here is a table of the Freddie Mac Primary Mortgage Market Survey® data (includes points, so lower than the rate with no point rates).

Local Comments

From the Northwest MLS: Northwest MLS brokers report improving inventory and year-to-date gains in sales, prices

Northwest MLS statistics for May show the area-wide median price of $615,000 is down 6.8% from the year-ago figure of $660,000, but it’s up nearly 10.4% since January when the median sales price was $557,250. The figures reflect sales of single family homes and condominiums across 26 counties.

“Median prices have continued to decline year-over-year in the overall NWMLS service area,” said John Deely, executive vice president of operations at Coldwell Banker Bain. …

House-hunters could choose from 9,079 active listings in the MLS database at the end of May, the highest level since December. Compared to a year ago, there are about 3.2% more listings. Despite the increase, inventory remains tight with only 1.44 months of supply.

emphasis added

Las Vegas REALTORS® (LVR): LVR reports local home prices on the rise, but still below last year’s peak LVR housing statistics for May 2023

LVR reported that the median price of existing single-family homes sold in Southern Nevada through its Multiple Listing Service (MLS) during May was $442,120. That’s up 2.8% from $430,000 in April, but down 8.3% from the all-time record home price of $482,000 set in May of 2022 …

Meanwhile, fewer homes are changing hands compared to last year. LVR reported a total of 3,000 existing local homes, condos and townhomes sold in May. Compared to May 2022, sales were down 20.3% for homes and down 19.6% for condos and townhomes.

Active Inventory in May

Here is a summary of active listings for these early reporting housing markets in April.

Inventory in these markets were up 156% YoY in January and are now only up 6% YoY. This is a significant change.

Inventory for these markets were up 27.5% in April and it is likely that inventory in these markets will be down YoY in June.

Notes for all tables:

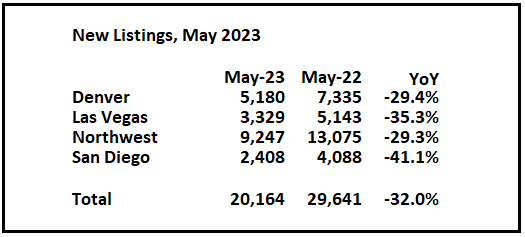

New Listings in May

And here is a table for new listings in May (some areas don’t report new listings). For these areas, new listings were down 32.0% YoY. Potential sellers that are locked into their current homes with low mortgage rates has pushed down new listings.

Last month, new listings in these markets were down 34.0% YoY. The decline in new listing in May – for these areas – was about the same as the YoY decline in April.

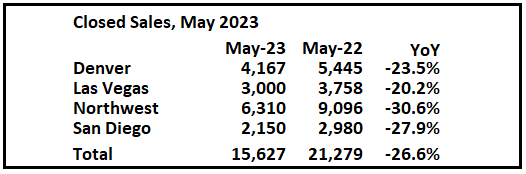

Closed Sales in May

And a table of May sales.

In May, sales in these markets were down 26.6%. In April, these same markets were down 34.4% YoY Not Seasonally Adjusted (NSA).

This is a smaller YoY decline NSA than in April for these early reporting markets, however seasonally adjusted, it is closer. Note that there was one less selling day in April this year than in April 2022, but the same number of selling days each year in May.

Another factor in the smaller YoY decline was that sales were steadily declining last year due to higher mortgage rates. This graph shows existing home sales by month for 2022 and 2023, on a Seasonally Adjusted Annual Rate (SAAR) basis.

This early data suggests the May existing home sales report will show another significant YoY decline – probably close to the April sales rate (SA) – and the 21st consecutive month with a YoY decline in sales.

This was a just a few early reporting markets. Many more local markets to come!