Inman News

As listing shortages and supply constraints on homebuilders drive up prices, risk of inflation grows, economists with Fannie Mae’s Economic and Strategic Research Group said.

Listings shortages and constraints on homebuilders are denting home sales and driving up home prices and rents, which could fuel inflation and force the Federal Reserve to adopt a more aggressive monetary policy stance, economists at Fannie Mae say.

In their latest monthly forecast, economists with Fannie Mae’s Economic and Strategic Research Group said they have “meaningfully downgraded” their forecast for second and third quarter home sales, “largely due to the ongoing lack of available listings and a softening pace of new construction due to supply constraints affecting homebuilders.”

In May, Fannie Mae economists were forecasting that home sales would grow 6.3 percent in 2021, to 6.868 million homes. Just four weeks later, 2021 sales are now projected to grow by a more modest 4.2 percent, to 6.732 million.

What’s changed? April’s 2.7 percent pullback of existing home sales was expected. But recent declines in pending home sales and purchase mortgage applications “have been more pronounced than we previously expected,” Fannie Mae researchers said.

That, combined with a shortage of new listings coming onto the market, prompted Fannie Mae economists to trim their projections for second and third quarter home sales — even though they believe there’s still enough demand “to drive a much higher rate of sales if the inventories were available.”

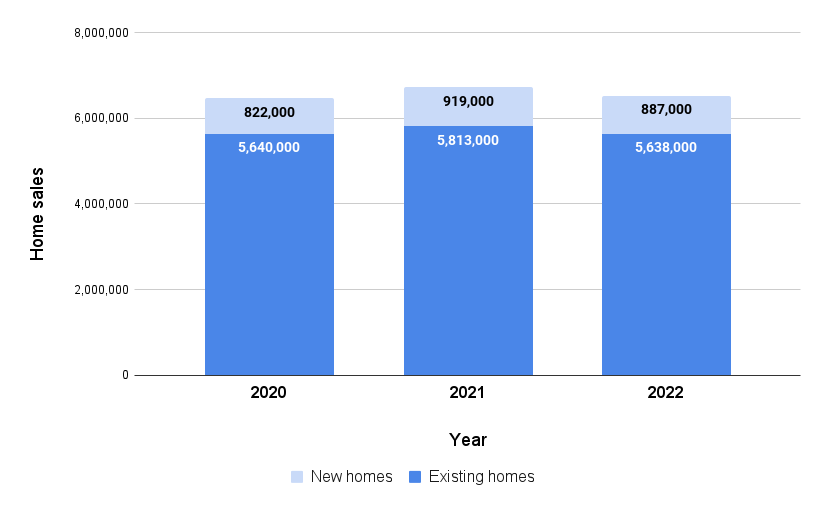

Projected home sales

Sales for 2021 and 2022 are projected. Source: Fannie Mae monthly housing forecast.

Instead of 16.3 percent growth in new home sales, Fannie Mae now projects builders will sell 919,000 new homes in 2021, up 11.8 percent from a year ago. Sales of existing single-family homes, condos and co-ops are now projected to grow by 3.1 percent, to 5.81 million, instead of 4.8 percent as projected in May.

Next year, existing home sales are projected to decline by 3.0 percent, to 5.64 million, with new home sales expected to fall by 3.5 percent, to 887,000.

Home price increases could drive inflation

Not only is the imbalance between housing supply and demand denting sales, but soaring home prices and rents could drive inflation out of the Federal Reserve’s comfort zone. That could result in higher interest rates, which would be another potential drag on sales.

“Strong demand for housing continues to run up against a long-running lack of supply,” Fannie Mae Chief Economist Doug Duncan said in a statement. “We’ve seen this disconnect lead to rapid house prices gains over this past year, but we believe it will soon reveal itself within inflation measures as well.”

The Fed has pledged to keep short-term interest rates near zero for the time being. But Fed policymakers could send long-term rates spiraling just by signaling that they’re preparing to accelerate their timetable for raising short-term rates. The Fed could also broadcast its intention to begin scaling back $120 billion in monthly purchases of bonds and mortgage-backed securities that have helped keep long-term rates low.

“If interest rates rise to reflect the increase in inflation based on an expectation of tighter future monetary policy, home sales would likely moderate along with house price appreciation,” Duncan said.

While some Fed policymakers have said they see signs that inflationary pressures are temporary, a recent Fannie Mae analysis suggests that rising home prices and rents aren’t yet fully baked into measures like the consumer price index.

“Inflation in 2022 could be well above the Fed’s target even if other transitory effects wane,” Fannie Mae Economist Eric Brescia wrote. “If inflationary expectations move up more aggressively than we assumed or house prices fail to decelerate in 2022, inflationary pressure would be even stronger and could persist well into 2023 or 2024. Therefore, we see upside risk to inflation from housing-related dynamics as a key concern, and it may ultimately play a large part in driving the Fed’s eventual policy tightening.”

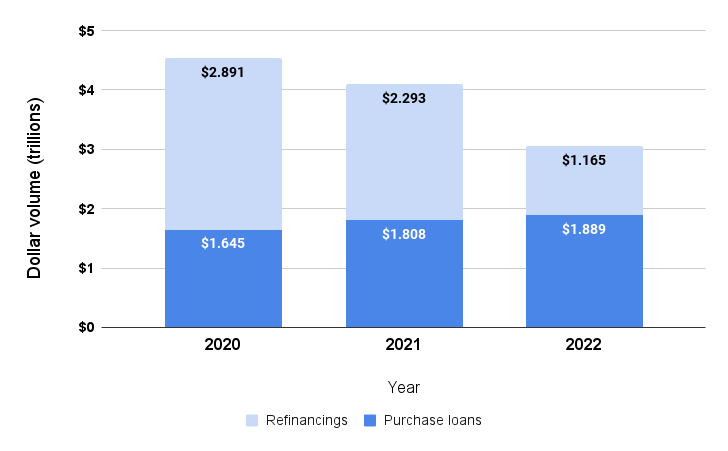

So far, though, mortgage rates have stayed tame, prompting Fannie Mae economists to boost their projection for 2021 mortgage refinance volume to $2.3 trillion. But with rates on 30-year fixed-rate mortgages projected to rise to 3.3 percent in 2022, refinancings are expected to plummet next year to $1.2 trillion.

Since purchase loan volume is expected to hold steady at over $1.8 trillion next year, mortgage lenders are eager to land business from homebuyers.

Originations for 2021 and 2022 are projected. Source: Fannie Mae monthly housing forecast.

When will housing supply catch up with demand?

Fannie Mae sees homebuilders boosting single-family home starts by 20.2 percent this year, to 1.19 million. But labor scarcity and a lack of buildable lots are likely to prevent builders from ramping up the pace of construction much further. In fact, Fannie Mae predicts single-family housing starts will fall by 3.7 percent next year, to 1.15 million.

But relief could also come in the form of existing homeowners who postponed plans to upsize or downsize during the pandemic.

“We are expecting at least a modest increase in listings in coming months as COVID worries wane, some homeowners reassess their living situations once the future of work-from-home arrangements becomes clearer, and mortgage forbearance programs expire,” Fannie Mae economists said in their monthly forecast.

There’s also the question of what will happen to roughly 2 million homeowners who were granted forbearance to stop making payments on their mortgages during the pandemic, and have yet to resume them.

Fannie Mae economists say they “are not expecting a high rate of foreclosure activity to follow later this year, in part due to large gains in homeowner equity this past year, but we anticipate some homes will be put on the market for sale.”