Calculated Risk

By Bill McBride

Near Record Number of Housing Units Under Construction in February 2023

Housing Starts Increased to 1.450 million Annual Rate in February

From the Census Bureau: Permits, Starts and Completions

Housing Starts:

Privately‐owned housing starts in February were at a seasonally adjusted annual rate of 1,450,000. This is 9.8 percent above the revised January estimate of 1,321,000, but is 18.4 percent below the February 2022 rate of 1,777,000. Single‐family housing starts in February were at a rate of 830,000; this is 1.1 percent above the revised January figure of 821,000. The February rate for units in buildings with five units or more was 608,000.

Building Permits:

Privately‐owned housing units authorized by building permits in February were at a seasonally adjusted annual rate of 1,524,000. This is 13.8 percent above the revised January rate of 1,339,000, but is 17.9 percent below the February 2022 rate of 1,857,000. Single‐family authorizations in February were at a rate of 777,000; this is 7.6 percent above the revised January figure of 722,000. Authorizations of units in buildings with five units or more were at a rate of 700,000 in February.

emphasis added

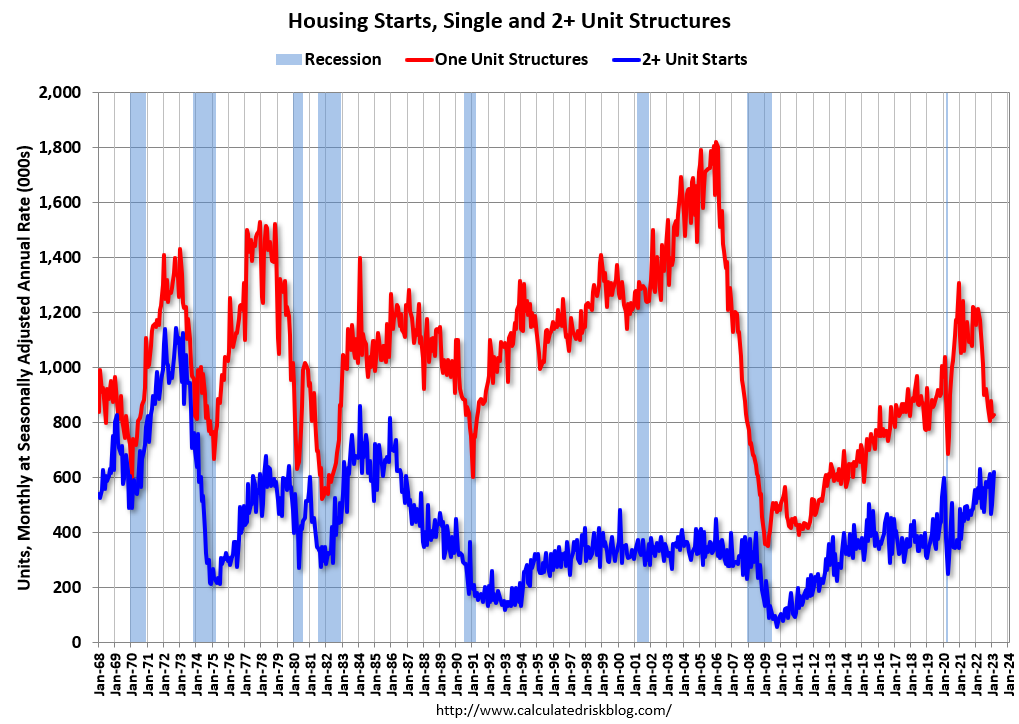

The first graph shows single and multi-family housing starts since 2000 (including housing bubble).

Multi-family starts (blue, 2+ units) decreased in February compared to January. Multi-family starts were up 9.9% year-over-year in February. Single-family starts (red) increased slightly in February and were down 31.6% year-over-year.

Note that the weakness over the last year has been in single family starts (red), and the increase in total starts in February was due to the volatile multi-family starts.

The second graph shows single and multi-family starts since 1968. This shows the huge collapse following the housing bubble, and then the eventual recovery – and the recent collapse in single-family starts.

Total housing starts in February were above expectations, however, starts in December and January were revised down, combined.

The third graph shows the month-to-month comparison for total starts between 2022 (blue) and 2023 (red).

Total starts were down 18.4% in February compared to February 2022. Starts have been down year-over-year for ten consecutive months, and that streak will continue in 2023 and I expect starts to be down significantly this year.

Near Record Number of Housing Units Under Construction

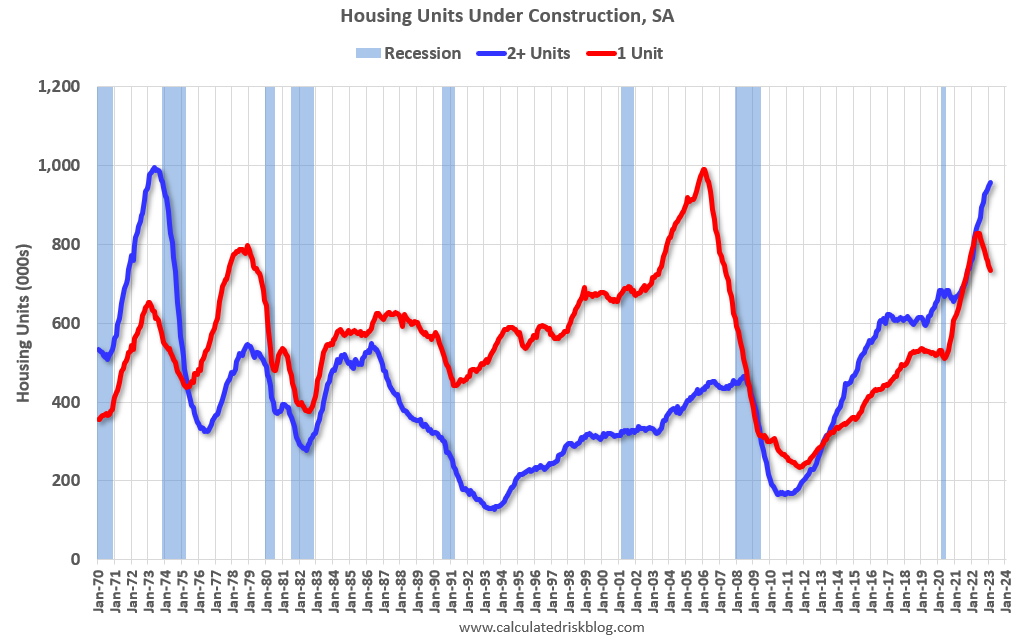

The fourth graph shows housing starts under construction, Seasonally Adjusted (SA).

Red is single family units. Currently there are 734 thousand single family units (red) under construction (SA). This was down in February compared to January, and 81 thousand below the recent peak in April and May 2022. Single family units under construction have peaked since single family starts are now declining. The reason there are still so many homes under construction is probably due to supply constraints.

Blue is for 2+ units. Currently there are 957 thousand multi-family units under construction. This is the highest level since November 1973! For multi-family, construction delays are probably also a factor. The completion of these units should help with rent pressure.

Combined, there are 1.691 million units under construction, just below the all-time record of 1.711 million set in October 2022.

Length of Time from Authorization to Start and from Start to Completion

Census released the annual data on the length of time from start to completion, and this showed construction delays in 2022.

In 2022, it took an average of 8.3 months from start to completion for single family homes, up from already elevated 7.2 months in 2021. For 2+ unit buildings, it took 17.0 months for buildings with 2 or more units in 2022, up from 15.4 months in 2021. This will be even longer for multi-family in 2023 as many of these units that have been under construction are completed this year.

The delays following the housing bubble were due to many projects being mothballed for several years. The recent delays were due to pandemic related supply constraints.

From Authorization to Start, it took 1.3 months in 2022 for single family homes, up from 1.3 months in 2021, and it took 2.8 months in 2021 for 2+ Unit buildings, up from 2.2 months.

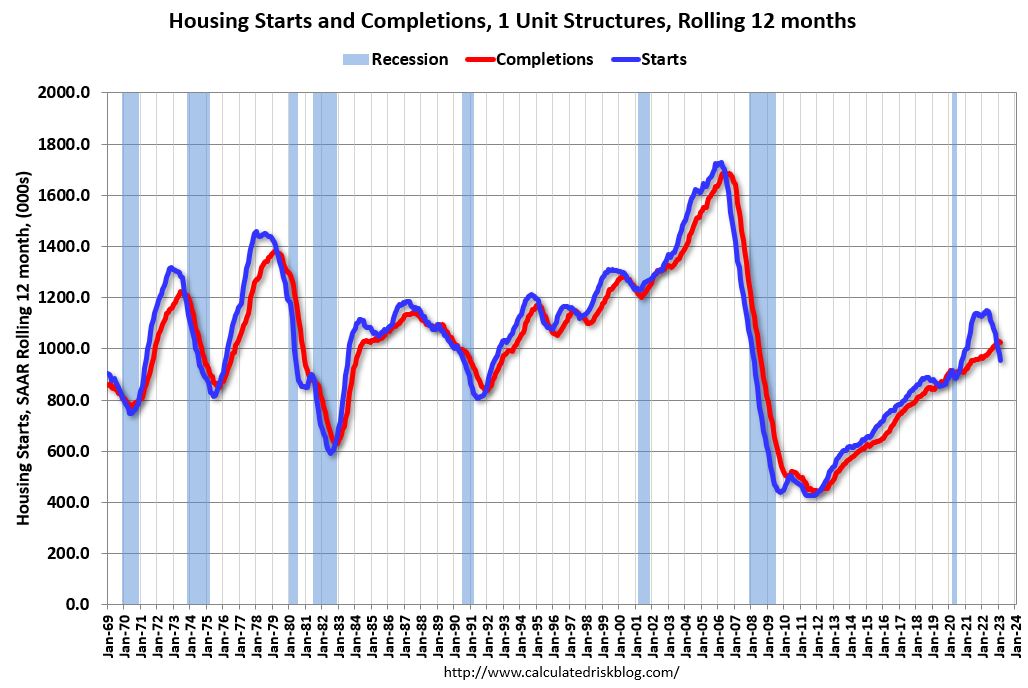

Comparing Starts and Completions

Below is a graph comparing multi-family starts and completions. Since it usually takes over a year on average to complete a multi-family project, there is a lag between multi-family starts and completions. Completions are important because that is new supply added to the market and starts are important because that is future new supply (units under construction is also important for employment).

These graphs use a 12-month rolling total for NSA starts and completions.

The blue line is for multifamily starts and the red line is for multifamily completions. Builders are still starting more multifamily units than they are completing. Multifamily starts (blue) have slowed, and completions (red) are picking up – although the gap is still huge.

The last graph shows single family starts and completions. It usually only takes about 6 months between starting a single-family home and completion – so the lines are much closer than for multi-family. The blue line is for single family starts and the red line is for single family completions.

The recent gap between starts and completions has disappeared, and builders are now completing more single-family homes than they are starting. Completions will follow starts down in a few months.

Conclusions

Total housing starts in February were above expectations, however, starts in December and January were revised down, combined. The weakness in 2022 was mostly for single family starts. I expect multi-family starts to turn down in 2023.

A near record number of total housing units are under construction due to construction delays, but the number of single-family housing units under construction is now declining. This means a large number of multi-family housing units will be delivered in 2023.