Calculated Risk

By Bill McBride

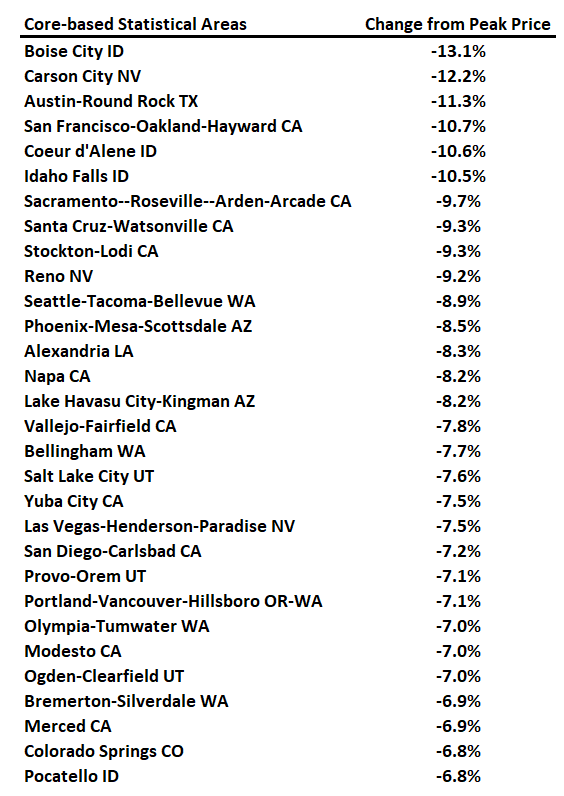

Boise leads Cities with 13.1% declined from Peak, Seasonally Adjusted

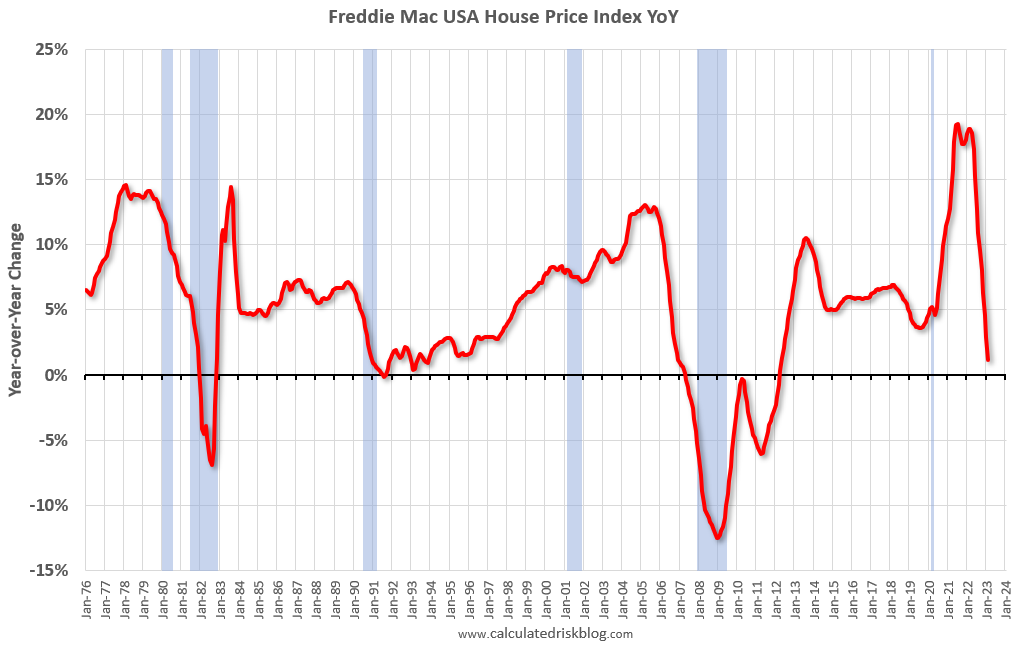

Freddie Mac reported that its “National” Home Price Index (FMHPI) declined for the eighth consecutive month on a seasonally adjusted basis in February, putting the National FMHPI down 2.5% from its June 2022 peak, and down 4.7% Not Seasonally Adjusted (NSA) from the peak.

On a year-over-year basis, the National FMHPI was up 1.1% in February, down from 2.9% YoY in January. The YoY increase peaked at 19.2% in July 2021.

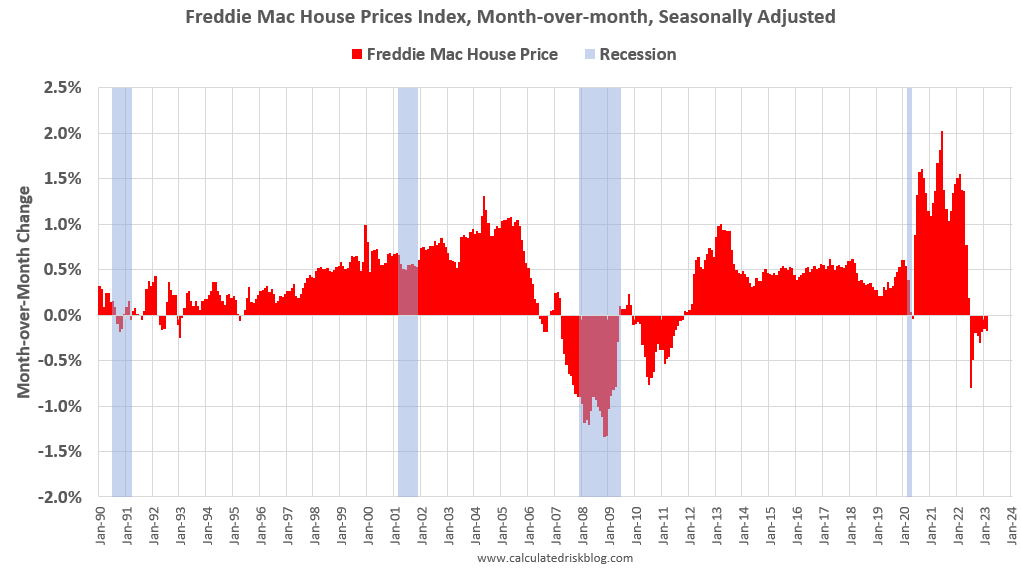

The second graph shows the month-over-month change in the national FMHPI, seasonally adjusted. The index has declined MoM for eight consecutive months.

29 States and D.C. have seen price declines Seasonally Adjusted

In February, 29 states and D.C. were below their 2022 peaks, Seasonally Adjusted. The largest seasonally adjusted declines from the recent peak were in Idaho (-10.0%), Nevada (-8.4%), Washington (-7.5%), Arizona (-7.1%), California (-6.9%), Utah (-6.8%), and D.C. (-6.7%).

In February, house prices in 10 states and D.C. were down YoY, led by Idaho (-7.3% YoY), D.C. (-6.7%) and Nevada (-5.6%).

For cities (Core-based Statistical Areas, CBSA), here are the 30 cities with the largest declines from the peak, seasonally adjusted.

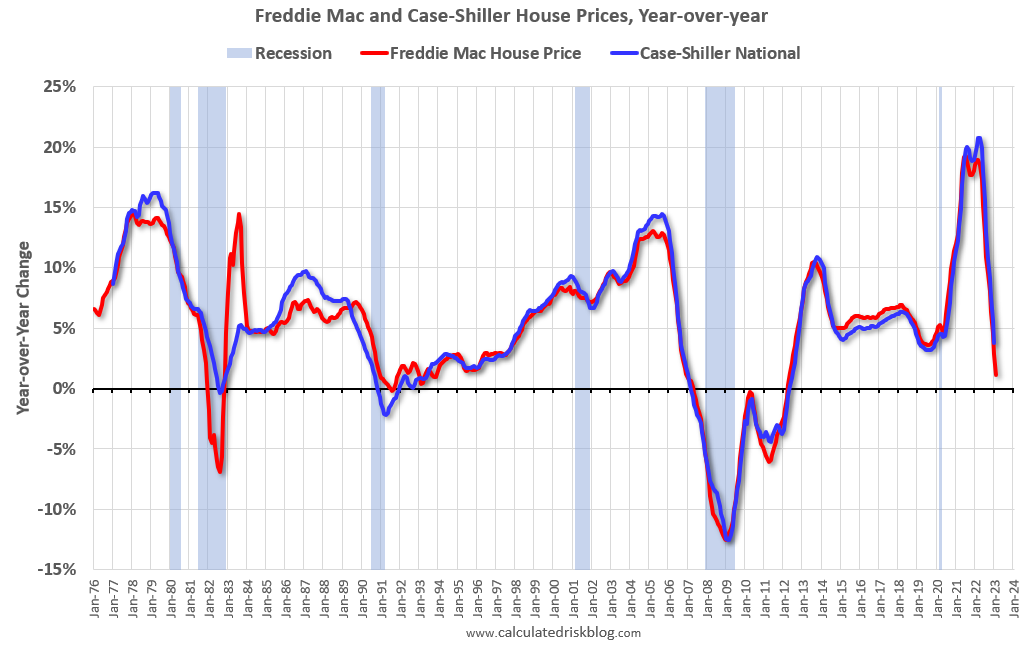

When will Case-Shiller National House Prices be down Year-over-year?

A key advantage of the FMHPI is it is released earlier than the Case-Shiller index. The Case-Shiller released earlier this week was for January and is a three-month average of closed sales in November, December and January – and this could include contracts signed in September. The FMHPI is for February and includes closed sales and appraisals in February.

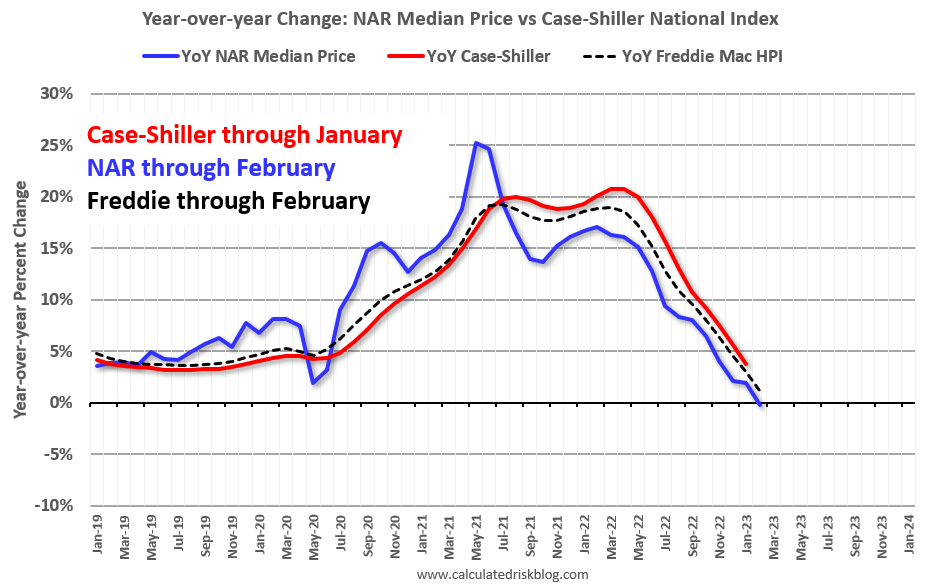

Here is a graph comparing the year-over-year change in the Case-Shiller and FMHPI.

Here is a comparison of year-over-year change in the FMHPI, median house prices from the NAR, and the Case-Shiller National index.

The FMHPI and the NAR median prices appear to be leading indicators for Case-Shiller. The median price was down YoY in February, and based on the recent trend, the FMHPI will be negative year-over-year in March (reported at the end of April) – and Case-Shiller will follow within a few months.