CALCULATEDRISK

Black Knight House Price Index Hits New High, but “Mixed signals”

By Bill McBride

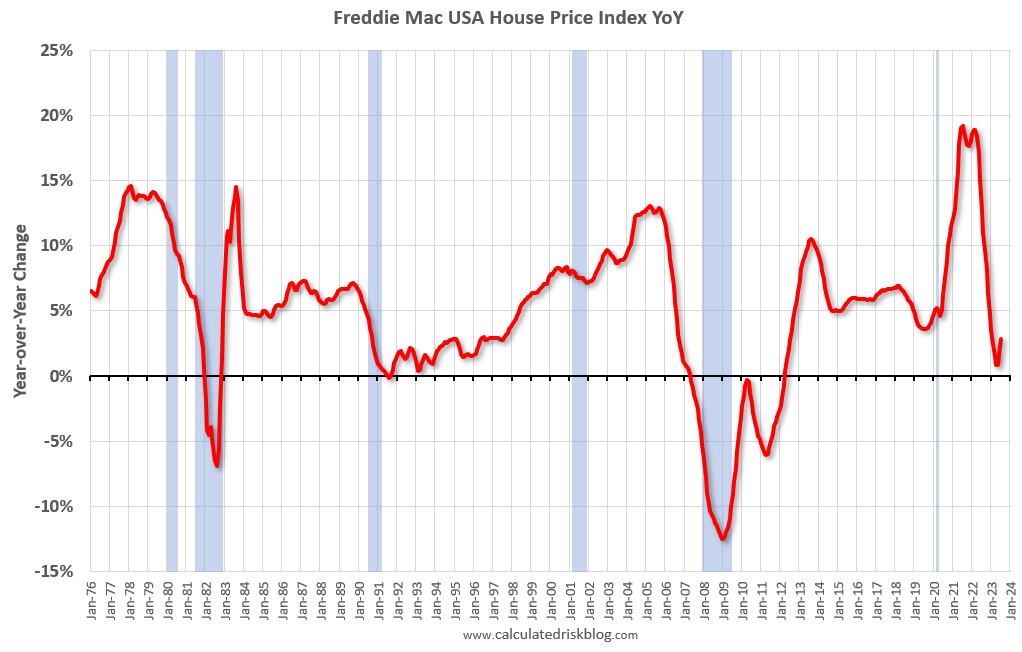

Note: The Freddie Mac index is a repeat sales index using only loans purchased by Fannie and Freddie and includes appraisals. See FAQs here. Freddie has data for all states and many cities. For house prices, I’m currently following Case-Shiller, FHFA, CoreLogic, Black Knight, the NAR median prices, and this Freddie Mac index.

Freddie Mac reported that its “National” Home Price Index (FMHPI) increased 0.7% month-over-month on a seasonally adjusted (SA) basis in July, putting the National FMHPI up SA from its previous peak in June 2022.

On a year-over-year basis, the National FMHPI was up 2.9% in July, from up 1.6% YoY in June. The YoY increase peaked at 19.2% in July 2021.

The second graph shows the month-over-month change in the national FMHPI, seasonally adjusted. The index has increased for seven consecutive months after declining MoM for seven consecutive months.

14 States and D.C. have seen price declines Seasonally Adjusted

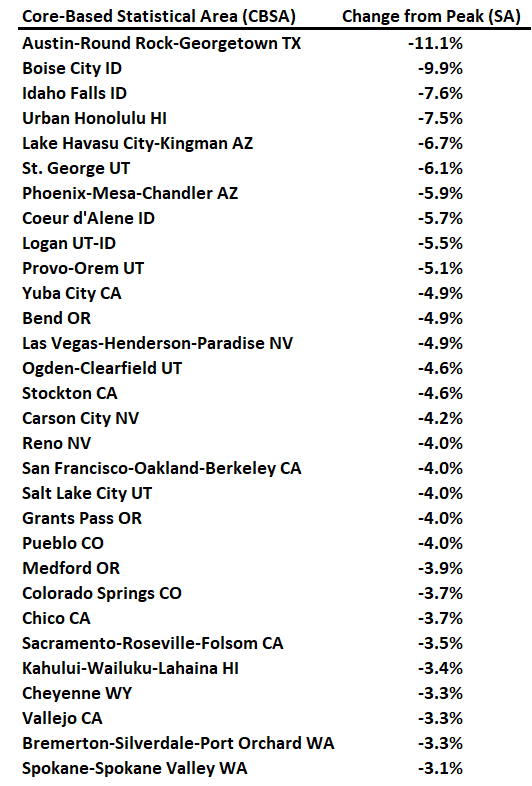

In July, 14 states and D.C. were below their previous peaks, Seasonally Adjusted. The largest seasonally adjusted declines from the recent peak were in Hawaii (-6.4%), Idaho (-5.9%), Nevada (-4.6%), Utah (-4.2%), and Arizona (-4.1%).

For cities (Core-based Statistical Areas, CBSA), here are the 30 cities with the largest declines from the peak, seasonally adjusted.

Here is a comparison of year-over-year change in the FMHPI, median house prices from the NAR, and the Case-Shiller National index.

The FMHPI and the NAR median prices appear to be leading indicators for Case-Shiller. The Case-Shiller index was down slightly YoY in June. The FMHPI is suggesting the YoY change in the Case-Shiller index will likely by up in the July report.

Black Knight House Price Index Hits New High in July

The Black Knight House Price Index (HPI) is a repeat sales index. Black Knight reports the median price change of the repeat sales.

From Black Knight: Black Knight HPI for July 2023: Annual Growth Rate Accelerates as Home Prices Set New Record High, Though Mixed Signals Suggest Market May Be Shifting

Even with interest rates hovering near 7.25%, home price growth continued in July to push home prices to yet another record high. However, as Black Knight Vice President of Enterprise Research Andy Walden explains, there were some mixed signals in the market data for July, raising questions about a potential downshift.

“Home prices continued to rise in July, hitting a new record high for the third month running,” said Walden. “After picking up some small momentum in May and June following 14 straight months of slowing, the annual growth rate spiked to 2.3% in July. Further reacceleration is likely on tap for August as well, given that adjusted prices are already up 4.4% so far this year. Even if seasonally adjusted prices were to stop rising tomorrow, annual home price growth would climb to +2.9% by August and cross +4% by November, simply due to price gains that are already ‘baked in.’ If price gains were to maintain their current pace – which is unlikely given how tight affordability has become – it would result in annual gains returning above 7.5% by the end of the year. Either way, further acceleration in annual appreciation is almost a certainty for August. But that’s only half the story in July’s data – the housing market is sending somewhat mixed signals.

“While home prices rose on both seasonally adjusted and non-adjusted bases, July’s 0.23% non-adjusted month-over-month growth was smaller than the 0.34% non-adjusted increase July has seen on average over the past 25 years, suggesting a possible transition may be underway,” Walden continued. “Indeed – in addition to monthly gains slowing below long-term averages – Black Knight rate lock and sales transaction data also points to lower average purchase prices and seasonally adjusted price per square foot among recent sales. All of these factors combined underscore the need to focus on seasonally adjusted month-over-month movements rather than simply relying on the traditional annual home price growth rate.”

The Black Knight suggests we will see new highs for the next few months, but that there may be some house price weakness late this year.