Inman News

Reports released on Thursday by Redfin and Realtor.com show that homesellers are increasingly motivated to sell, especially in lower price ranges and on single-family homes

As the housing market continues to move at a crawl, homesellers are trying to sweeten the deal for buyers.

Sellers may not have the power to move elevated mortgage rates, combat inflation or change economic uncertainty — all factors that are deterring buyers — but something that is within their control is the ability to offer a discount.

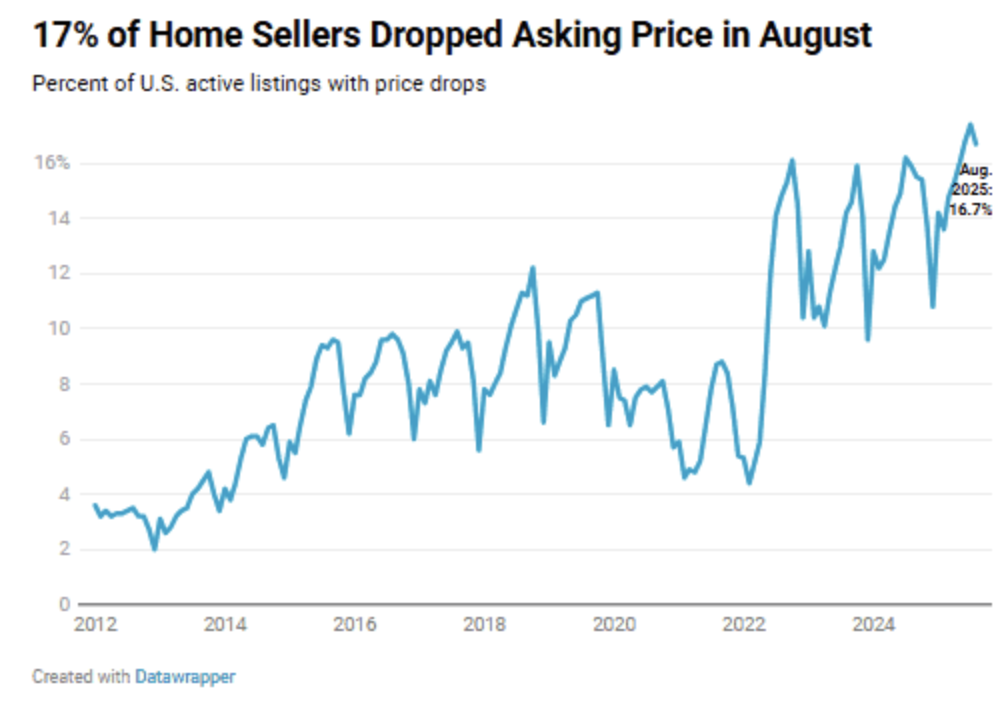

As of August, 16.7 percent of U.S. homesellers dropped their asking price, up from 15.9 percent the year before, and the highest share for that month since 2012, Redfin reported Thursday.

Meanwhile, in September, nearly 20 percent of all homes for sale in the U.S. saw price reductions, which was up 1.2 percent points year over year, Realtor.com reported, also on Thursday.

Credit: Redfin

Redfin also noted that the trend has been relatively steady for some months: The share of listings with price cuts in June hit 16.8 percent, and 17.4 percent of listings in July saw price cuts.

The typical discount on a home sale is also the steepest it has been since before the pandemic, Redfin’s report noted. The typical home sold during August went for 3.8 percent less than the initial asking price, which is the steepest discount seen in August since 2019.

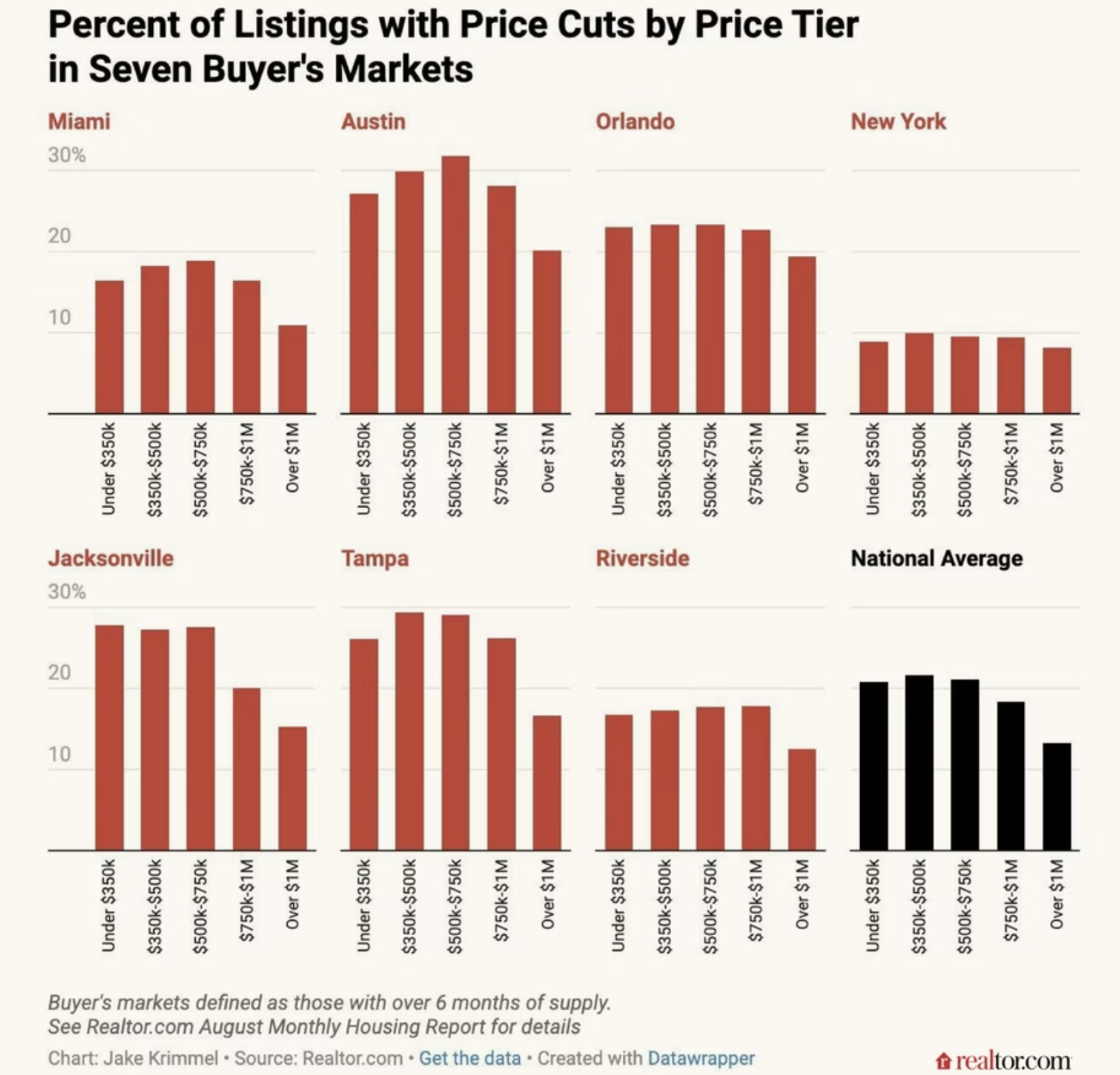

Nationwide, within certain price ranges, price cuts were especially prevalent in September, Realtor.com’s analysis found. Homes in the $350,000 to $500,000 range, or at the lower end of the market, saw the most price cuts. But high-end sellers were much more reluctant to proffer discounts.

More than 20 percent of listings in the U.S. priced below $350,000 sold with a price reduction, but only 13.3 percent of listings priced above $1 million sold for less than asking.

“This is consistent with more motivated sellers at the bottom of the housing ladder, who need to sell in order to buy their next home, compared to patient or price-anchored sellers at the top,” Realtor.com Senior Economist Jake Krimmel said in the company’s report.

However, in seven buyer markets (those with six months or more of inventory) that Realtor.com identified, there was no clear pattern for what price bracket in which discounts were most likely to take place, which shows that conditions can also vary widely by market.

Credit: Realtor.com

But price cuts are also coming as a result of inventory outpacing demand, Redfin’s analysis said. Homesellers outnumbered hombuyers by more than 500,000 in August, which was the second-largest gap between the two groups in at least the last decade. Some homesellers are also having a hard time adjusting to the reality of the buyer’s market, and failing to price accordingly.

“While some homesellers have come to terms with the realities of today’s housing market, many are still hoping to cash in on the pandemic-era housing market, when high demand was pushing many sale prices way over asking,” Redfin Senior Economist Asad Khan said in the company’s report.

“Price drops can signal weakness to buyers and lead to further cuts, so homesellers should consult a local agent to set a realistic price from the beginning. It’s also wise for sellers to be patient, understand that it may take a few weeks or even a few months to offload their home in today’s slower-than-usual market, and be open to making concessions.”

Single-family homes have also been much more likely to have price cuts than other property types, Redfin said. During the month of August, 18.3 percent of single-family listings had a price cut, while just 12.8 percent of condo listings and 11.5 percent of townhouse listings saw price cuts.