Inman News

Mortgage rates are expected to ease as markets anticipate Federal Reserve policymakers will raise rates just 1 more time this year and then reverse course

Homebuyer demand for purchase mortgages picked up last week despite an uptick in rates as markets anticipate Federal Reserve policymakers will raise rates one more time when they meet next week, according to a survey of lenders by the Mortgage Bankers Association.

The MBA’s Weekly Mortgage Applications Survey shows requests for purchase loans were up by a seasonally adjusted 5 percent last week compared to the week before, but down 28 percent from a year ago. Applications to refinance were up 2 percent week over week but declined 51 percent from a year ago.

“Although incoming data points to a slowdown in the U.S. economy, markets continue to expect that the Fed will raise short-term rates at its next meeting, which have pushed Treasury yields somewhat higher,” MBA Deputy Chief Economist Joel Kan said in a statement. “As a result of the higher yields, mortgage rates increased for the second straight week to their highest level in over a month.”

Mortgage rates level off

View Interactive Graph

The Optimal Blue Mortgage Market Indices, which track daily ups and downs in mortgage rates, show rates on 30-year fixed-rate conforming mortgages have retreated from last week’s highs, and remain below a 2023 peak of 6.84 percent registered on March 8.

For the week ending April 21, the MBA reported average rates for the following types of loans:

- For 30-year fixed-rate conforming mortgages (loan balances of $726,200 or less), rates averaged 6.55 percent, up from 6.43 percent the week before. With points unchanged at 0.63 (including the origination fee) for 80 percent loan-to-value ratio (LTV) loans, the effective rate also increased.

- Rates for 30-year fixed-rate jumbo mortgages (loan balances greater than $726,200) averaged 6.40 percent, up from 6.28 percent the week before. Although points decreased to 0.5 from 0.51 (including the origination fee) for 80 percent LTV loans, the effective rate also increased.

- For 30-year fixed-rate FHA mortgages, rates averaged 6.41 percent, up from 6.33 percent the week before. With points increasing to 1.04 from 0.94 (including the origination fee) for 80 percent LTV loans, the effective rate also increased.

- Rates for 15-year fixed-rate mortgages averaged 6.03 percent, up from 5.89 percent the week before. Although points decreased to 0.56 from 0.65 (including the origination fee) for 80 percent LTV loans, the effective rate also increased.

- For 5/1 adjustable-rate mortgages (ARMs), rates averaged 5.47 percent, down from 5.56 percent the week before. But with points increasing to 1.18 from 0.72 (including the origination fee) for 80 percent LTV loans, the effective rate decreased.

At their March 22 meeting, Fed policymakers raised the benchmark federal funds rate by 25 basis points to a target range of 4.75 percent to 5 percent.

In their latest forecast, Fannie Mae economists said they expect the Federal Reserve to implement a final 25-basis rate hike in May and then begin bringing rates back down by the end of the year as the economy enters what’s envisioned as a “modest recession.”

With inflation still exceeding the Fed’s goal of 2 percent, futures markets tracked by the CME FedWatch Tool are pricing in a 73 percent chance that Fed policymakers will approve one final 25 basis-point increase in the federal funds rate when they meet next on May 3.

The CME FedWatch Tool shows bond market investors see only a 16 percent chance of another rate hike when the Fed meets in June, and expect policymakers to reverse course and begin lowering the benchmark interest rate this fall.

Mortgage rates expected to ease

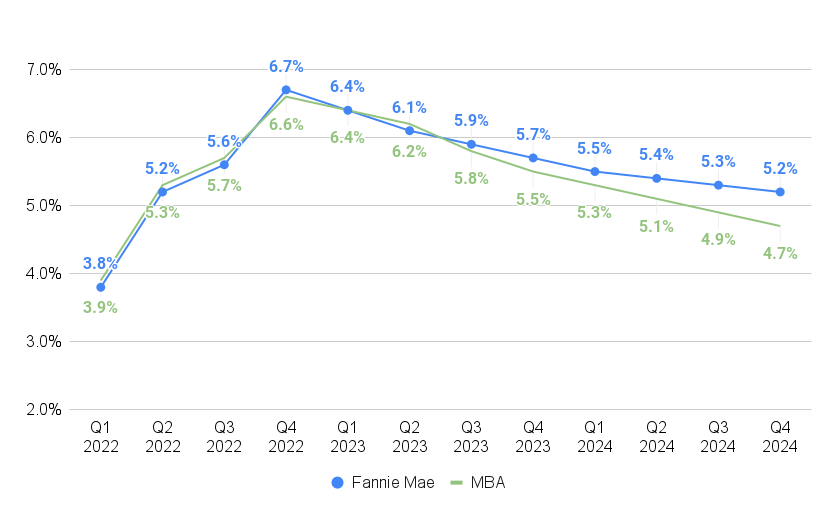

Source: Mortgage Bankers Association, Fannie Mae Housing Forecast, April 2023

With the Fed thought to be nearing the end of a rate-hike campaign that kicked off last year, economists at the MBA and Fannie Mae expect mortgage rates will continue to decline from 2022 peaks.

In an April 17 forecast, MBA economists said they expect rates on 30-year fixed-rate mortgages to average 5.5 percent by the fourth quarter of this year and drop below 5 percent in the third quarter of next year.

Fannie Mae forecasters don’t expect rates to dip below 5 percent, saying Federal Reserve policymakers are still analyzing how recent bank failures and tighter lending conditions will impact inflation.