CALCULATEDRISK

By Bill McBride

In 2021, we saw rapidly rising home prices and rents indicating strong demand for both owner occupied and rental units. This suggested a sharp increase in household formation.

Subsequent research indicated this was correct.

If we look at the Historical Households Tables (based on the Current Population Survey), we see that from 2010 to 2019, about 1.1 million additional households were formed each year. However, in 2020 due to the pandemic, the number of households declined by over 100 thousand.

Then household formation picked up in 2021 and 2022 but slowed in 2023.

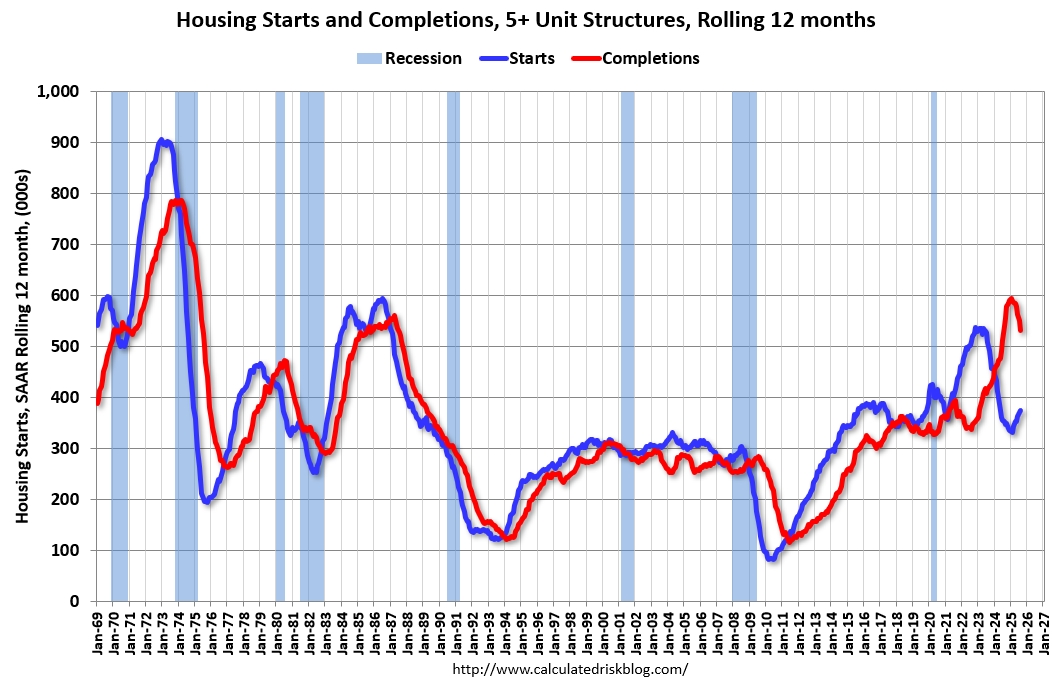

Builders responded to the sharp increase in rents in 2021 and started a large number of multi-family housing units. Then, due to pandemic related construction delays, it took longer than normal to complete these units. This new supply has kept asking rents mostly unchanged for the last couple of years.

What are the implications looking forward?

A key question is what will happen with household formation going forward.

First, here is a graph based on the 2023 Census projections showing three different projections for the year 2035 by 5-year age groups: the Main series, low immigration and no immigration.

Note that most of the projected immigration is in 0 to 50 age groups. Less or no immigration will lower household formation and the demand for housing.

In April, the Census Bureau released their estimates of the U.S. population by age for July 2024. The following graph is based on the release for 2024, and I’ve circled two key cohorts on the graph. The first group – in their early-to-mid 30s – are at a key home buying age. This was a factor in the surge in home buying in 2020, 2021 and early 2022 (along with low mortgage rates). The cohort that follows this group is smaller, so there will be less homebuying demand going forward.

The second group is the leading edge of the Baby Boom generation that are now around 78. No cohort is monolithic – some people will age-in-place until they pass away, others will move in with family (or family will move in with their parents), and some will move to retirement communities. There is no magic age that people reach and start to transition to retirement homes, but looking at prior generations, it seems to start when people are around 80 years old.

My sense is there will be a pickup in Boomers selling their homes in a few years and lasting until 2040 or so. These homes will be older – and most will need updating – but many of these homes will be in prime locations.

Put together, the 1st circle suggests less homebuying demand in the next decade and the 2nd circle suggests more existing supply. There are other factors (like immigration), but demographics will likely hold down house prices.