Inman News

De-listings jumped 48% nationally, but the trend is particularly noticeable in Miami

If the price doesn’t feel right, many homesellers are willing to say, “forget it.”

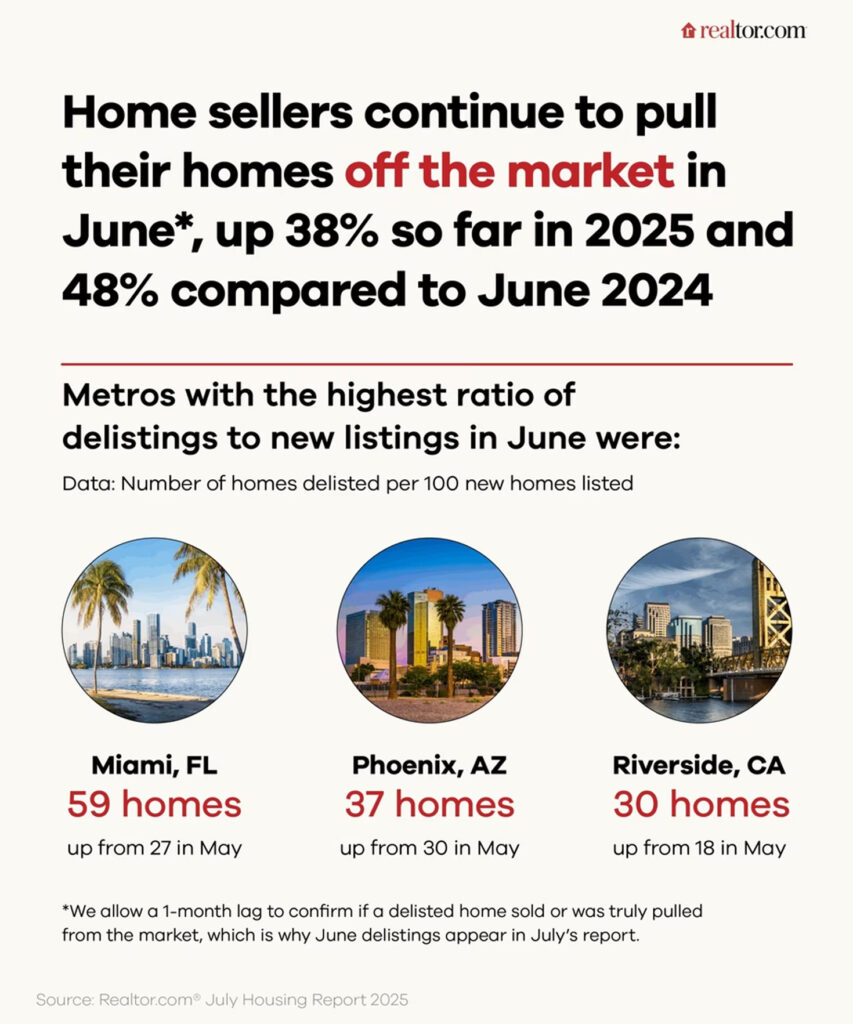

De-listings jumped 48 percent nationally in June 2025 from a year earlier, according to the Realtor.com® July monthly housing trends report. It’s a surprising sign that almost half of all sellers would be willing to wait rather than negotiate.

Delistings are up 38 percent from the same period. (Delisting data is reported with a one-month lag in order to determine whether a delisted home was actually sold or truly delisted.)

The increase is partly due to the overall expansion in active inventory — up 25 percent in July from a year earlier. Newly listed homes increased 7.3 percent year over year.

Delistings are outpacing new listings — with 21 homes delisted in June for every 100 homes newly hitting the market.

Miami leads the nation in delistings

While the national delisting average was 0.21 in June 2025, this trend is especially noticeable in the South and West.

The metros with the highest ratio of delistings to new listings in June were:

- Miami, Florida: 0.59 (59 homes delisted per 100 new homes listed — up from 27 in May)

- Phoenix, Arizona: 0.37 (37 homes delisted per 100 new homes listed — up from 30 in May)

- Riverside, California: 0.30 (30 homes delisted per 100 new homes listed — up from 18 in May)

The increase in delistings follows a surge in price reductions, as some sellers with unrealistic expectations faced a softer market with limited buyers.

“Unlike past housing cycles where falling prices pressured underwater homeowners to sell, today’s homeowners benefit from record-high levels of home equity, so they have the flexibility to wait it out,” says Realtor.com® senior economist Jake Krimmel. “This allows many sellers to withdraw their homes from the market if their asking price isn’t met.”

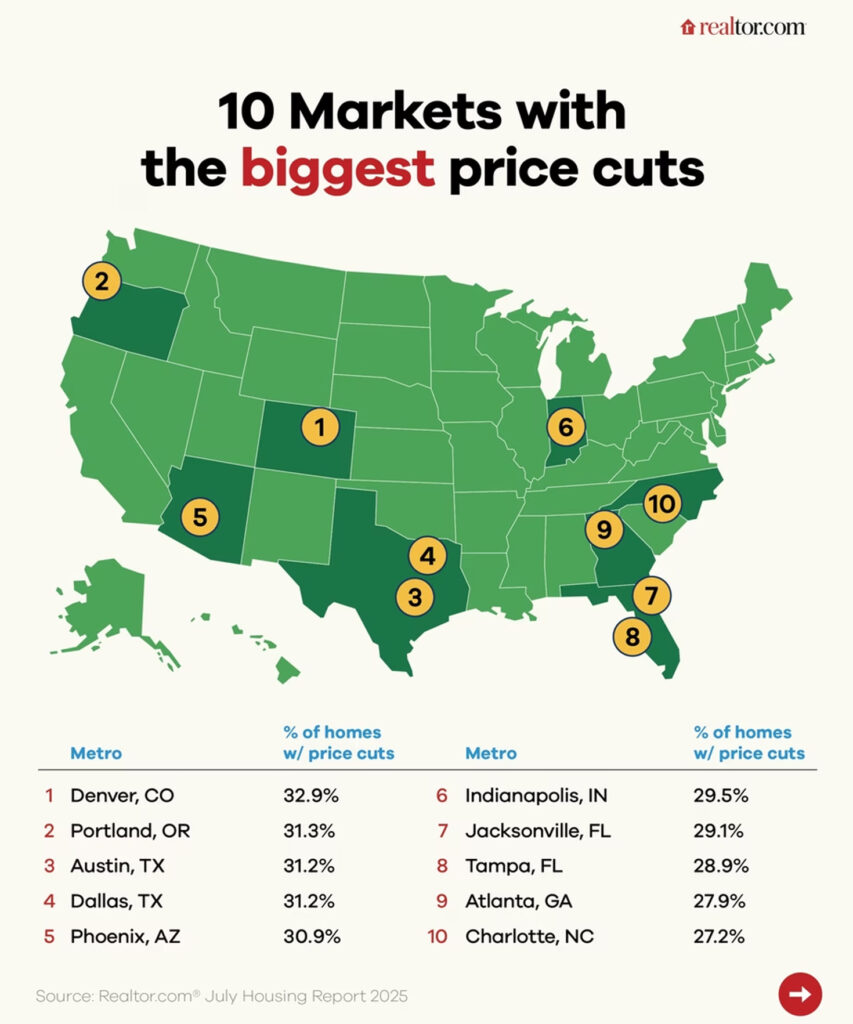

That’s not to say that some sellers aren’t still slashing their prices. In July, 20.6 percent of home listings had price reductions.

Even with more price cuts, however, the national median list price in July held steady at $439,990, but was essentially flat over the past two months.

“While the market may be becoming more buyer-friendly, sellers still hold a trump card: delist the home and fish for that high asking price at a later date,” says Krimmel.

With homes staying on the market longer than pre-pandemic norms (about 58 days in July), many sellers are considering pulling their listing rather than slashing the price.

“Buyers are seeing more choices than they’ve had in years, but many sellers, anchored by peak price expectations and upheld by strong equity positions, are deciding to step back if they don’t get their number,” says Danielle Hale, chief economist of Realtor.com.

Increased inventory is shifting the market

Nationally, active listings topped 1.1 million.

Location also has an effect on the number of homes for sale, with inventory in metro areas in the Northeast and Midwest remaining relatively tight, while those in the South and West are tilting in a more buyer-friendly direction.

“This market susses out the real sellers from those who will only sell if they get their price, and we are not in a market for that — unless a home is the trifecta in that it has layout, lot and location, plus updates, in a highly coveted area where rarely anything ever comes for sale,” says Cara Ameer, a bicoastal agent with Coldwell Banker who is licensed in California and Florida.

Those sellers who can afford to wait may choose to step out of the scene until things equilibrate.

“Delisting may help the market, because there is no sense for buyers to look at overpriced homes where the seller isn’t truly interested in negotiating,” says Ameer.