Inman News

Home sales now expected to decline by 7.4% this year and 9.7% in 2023, a dramatic adjustment from March, when Fannie Mae forecast a 4.1% decrease in home sales this year and a 2.7% decrease in 2023.

Economists at Fannie Mae have dramatically downgraded their home sales forecasts for this year and next, saying they expect a “modest recession” in the second half of next year in the face of Fed tightening and the war in Ukraine.

In their latest forecast Tuesday, Fannie Mae economists said the projected downturn “is not expected to resemble the severity or duration of the Great Recession,” but that higher mortgage rates are likely to cause home sales to decline by 7.4 percent this year and by 9.7 percent in 2023.

Fannie Mae had previously forecast that home sales would drop by 4.1 percent this year and 2.7 percent next year.

“Since our last forecast, monetary policy guidance has shifted in a hawkish direction, and markets have responded with rapid increases in interest rates, signaling a belief that brisker tightening is likely to occur,” Fannie Mae forecasters said. “While a ‘soft landing’ for the economy is possible, which is where inflation subsides without economic contraction, historically such an outcome is an exception, not the norm.”

If there is a recession, Fannie Mae economists don’t expect it will be as severe or as long as the Great Recession of 2007-09, due to “multiple factors.”

From a housing market perspective, factors weighing against a severe downturn include “stronger mortgage credit quality, a far less-leveraged residential real estate and mortgage finance system, and a better equipped mortgage servicer and public policy apparatus, as well as ongoing housing supply constraints relative to demographic demand for housing.”

But rising mortgage rates don’t bode well for already tight housing inventories in many markets, forecasters at the mortgage giant said.

“Households with a 3 percent, 30-year, fixed-rate mortgage are unlikely to give that up in favor of a mortgage closer to 5 percent, and we expect this so-called ‘lock-in’ effect to weigh on home sales,” Fannie Mae Chief Economist Doug Duncan said in a statement. “Moreover, if mortgage rates remain relatively elevated, we expect the added affordability constraint to price out some would-be first-time homebuyers and contribute to the slowing of demand.”

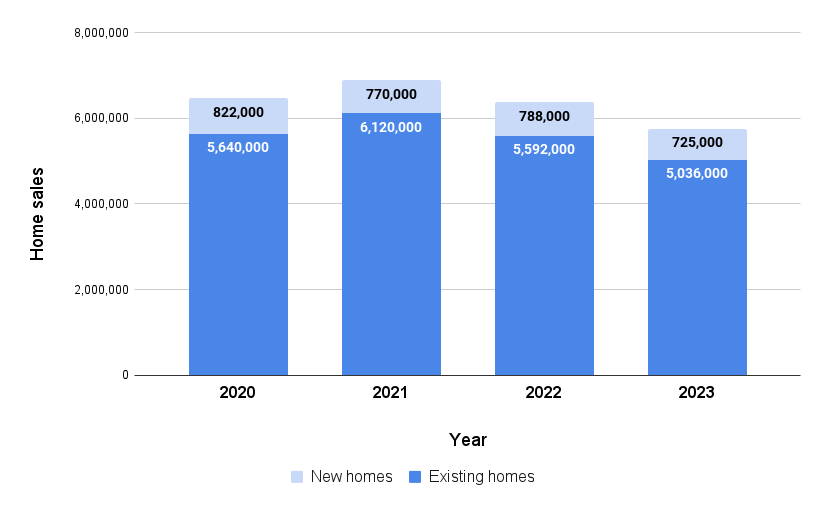

Home sales projected to decline

Source: Fannie Mae Housing Forecast, April 2022.

Shortages of existing homes have builders working overtime to complete new houses, and Fannie Mae still sees new home sales growing by 2.3 percent this year, to 788,000 homes, even with sales of existing homes projected to drop by 8.6 percent, to 5.6 million.

But the “lock-in” effect of rising mortgage rates and worsening affordability “will eventually weigh on new sales as well,” Fannie Mae economists said of their prediction that sales of new homes will drop by 8 percent in 2023, to 725,000.

“The most recent reading of homebuilders’ sentiment showed continued strong current expectations for sales, but the index fell sharply for the six-month outlook. While the level was still elevated, indicating good market conditions, the change was one of the largest in series history.”

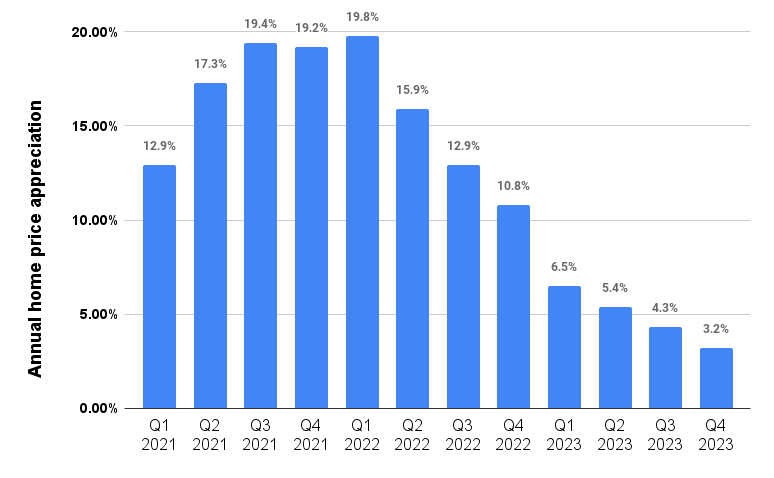

Home price appreciation may also cool

Source: Fannie Mae Housing Forecast, April 2022.

For would-be homebuyers being priced out of the market, the good news is that Fannie Mae economists expect home price appreciation to make a rapid plunge back to the single digits, moderating from a record 19.8 percent during the first quarter of this year to 6.5 percent by the first quarter of 2023 and 3.2 percent by the final three months of next year.

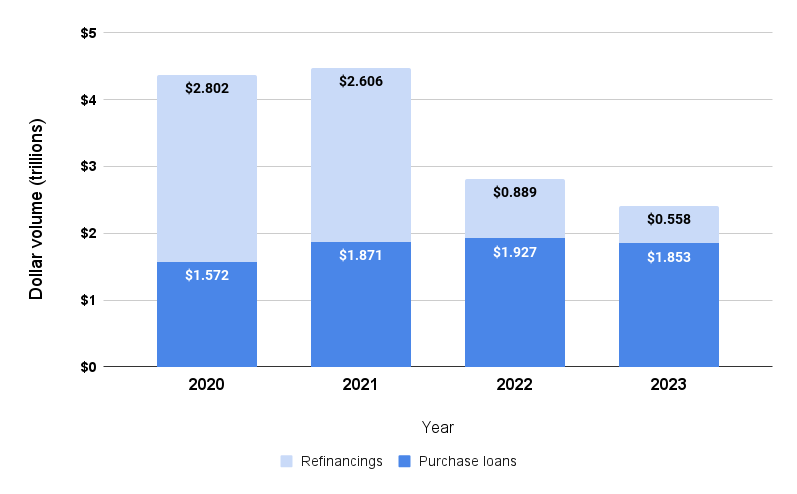

End of the refi boom

Source: Fannie Mae Housing Forecast, April 2022.

Fannie Mae now forecasts single-family mortgage originations will total $2.8 trillion in 2022 and $2.4 trillion in 2023, down from previous forecasts of $3 trillion and $2.7 trillion, respectively.

The prospect that rising mortgage rates will dent home sales prompted Fannie Mae to lower its forecast for 2022 purchase volume by $18 billion, to $1.93 trillion, and by $130 billion in 2023, to $1.85 trillion.

Given the recent run-up in mortgage rates, Fannie Mae now expects $889 billion in refinance volumes in 2022, $148 billion lower than forecast last month.

With mortgage rates at 5.0 percent, just 2.3 percent of all outstanding loan balances have a refinance rate incentive of at least 50 basis points.

“It should be noted that interest rates have moved up further than we had expected since the completion of our interest rate forecast at the start of the month, representing downside risks to our housing forecast,” Fannie Mae economists said.