Inman News

Listing Inventory ticked up 5% in December as homes languish for months on average and prices decline.

The housing market ended 2018 on a low note, with listing inventory up five percent nationwide and by as much as 10 percent in several of the nation’s largest metros, while homes sold on an average pace of 80 days in December, according to a new study by realtor.com released Thursday.

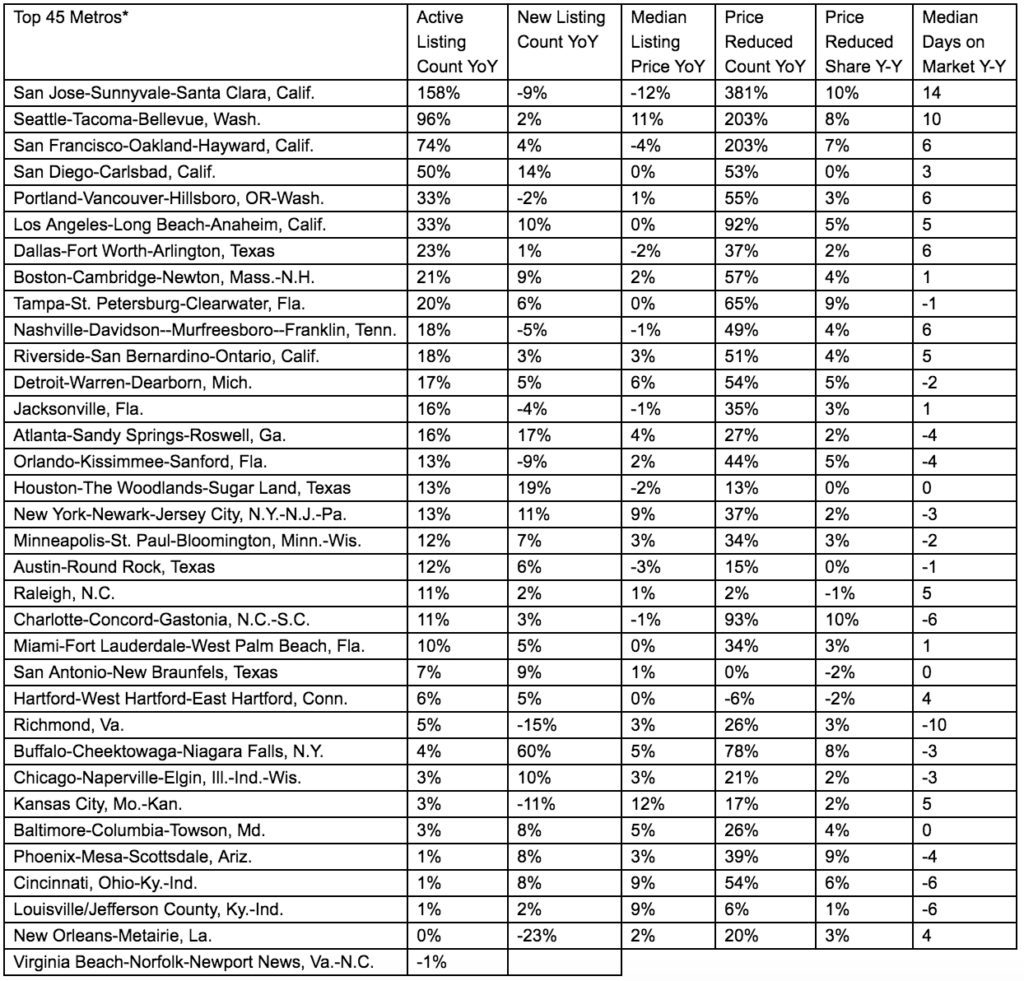

In previously hot markets like San Diego, Los Angeles, Atlanta, Houston and Chicago, inventory grew by double-digit percentage points last month, according to realtor.com’s December housing report.

“Sellers are adjusting their strategies, especially in slowing, pricey markets with growing availability of homes for sale,” realtor.com Chief Economist Danielle Hale said. “Although buyers may not find a bargain, the price discounts and recently lower borrowing costs may entice upper-tier buyers back into the market. By contrast, entry-level shoppers continue to contend with declining availability of homes for purchase, albeit at a slower rate.”

(Credit: realtor.com)

The percentage of listings that saw price reductions is also up, with 15 percent of homes for sale seeing price reductions in December, up from 13 percent a year ago. That increase is being driven by the nation’s top markets, of which 38 of 45 cities included in the study saw an increase in the share of price reductions. Charlotte, North Carolina, and San Jose, California, both experienced double-digit increases in the percentage of price reductions.

The median listing price grew by 7 percent, year-over-year to $289,000 in December, according to the study. That’s lower than last year’s increase of 8 percent and only 11 of the major metros surveyed outpaced the national growth rate of 7 percent.

Milwaukee at 14 percent, Indianapolis at 12 percent, and Kansas City, Missouri at 12 percent, were all markets major where price growth was over 10 percent.

The biggest price declines came in San Jose and San Francisco, where the median listing price fell 12 percent and 4 percent, respectively.