Inman News

Rise in mortgage rates defies expectations as unusually wide ‘spread’ between 10-year Treasury yields and mortgages reflects investor fears of another refi wave

Homebuyer demand for purchase loans slipped last week as inventory remains scarce in many markets and mortgage rates inched up, defying expectations that rates are poised to come down in the long run.

A weekly survey of lenders by the Mortgage Bankers Association shows applications for purchase loans were down a seasonally adjusted 4.8 percent last week when compared to the week before and 26 percent from a year ago. Requests to refinance were down 8 percent week over week and 43 percent from a year ago.

Demand for purchase mortgages was the lowest in a month, as buyers “remain wary of this rate volatility, but also as for-sale inventory in many parts of the country remains scarce,” MBA Deputy Chief Economist Joel Kan said, in a statement.

The even bigger drop in refi demand reflects the fact that most borrowers have lower rates on their mortgages, and those who are in the market “are extremely rate sensitive,” Kan said.

With Federal Reserve policymakers signaling they’re probably done hiking rates and inflation showing signs of easing, housing industry economists expect mortgage rates to decline this year and next.

Kan noted that one thing that’s keeping mortgage rates from falling at the moment is the unusually wide “spread” between 10-year Treasury yields and 30-year fixed-rate mortgages.

Primary mortgage spread widens

Source: Federal Reserve and Optimal Blue data retrieved from FRED, Federal Reserve Bank of St. Louis

At 2.97 percentage points as of May 15, the primary mortgage spread was 84 basis points above the six-year average of 2.13 percentage points, according to data compiled by Optimal Blue and the Federal Reserve.

“Mortgage rates increased last week even as Treasury yields were essentially flat,” Kan noted.

The spread between Treasury yields and mortgage rates started widening last year as the Fed began to hike interest rates to fight inflation.

Mortgage investors have been demanding unusually high premiums compared to yields on government debt in part because of prepayment risk, according to an analysis by the Urban Institute. That’s because mortgages taken out now are at greater risk of being refinanced if rates come back down.

In the long run, economists still expect mortgage rates to retreat this year and next as the economy slows and potentially enters a recession.

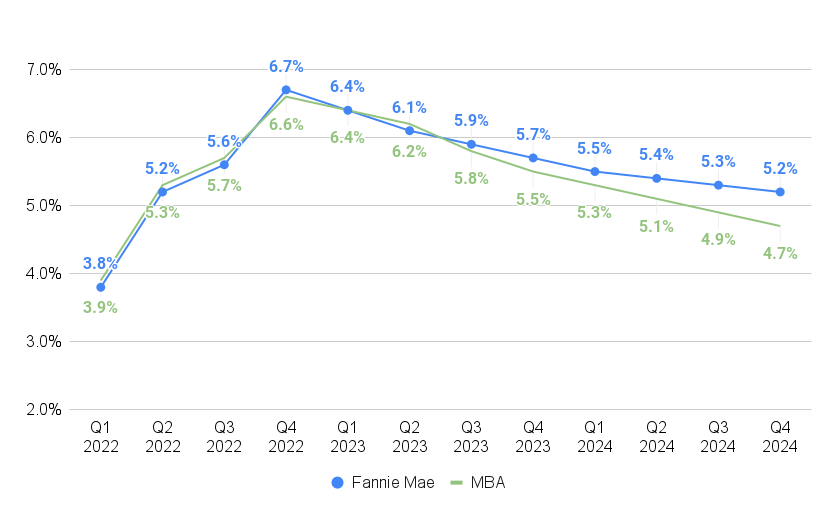

Mortgage rates expected to ease

Source: Mortgage Bankers Association, Fannie Mae Housing Forecast, April 2023

Until recently, consumers have been expecting that mortgage rates will keep going up. But Fannie Mae’s most recent monthly National Housing Survey shows more consumers were getting the message in April that rates are likely to go down over the next year as the economy cools.

Surveys of consumer sentiment by the University of Michigan suggest they’re also increasingly worried about a recession and the prospects of a crisis over the U.S. debt ceiling, which could send mortgage rates soaring above last year’s peaks.

Mortgage rates on the upswing

See Interactive Graph

The Optimal Blue Mortgage Market Indices, which track daily ups and downs in mortgage rates, show rates on 30-year fixed-rate conforming mortgages dipped as low as 6.34 percent last week but have been on the upswing this week.

For the week ending May 12, the MBA reported average rates for the following types of loans:

- For 30-year fixed-rate conforming mortgages (loan balances of $726,200 or less), rates averaged 6.57 percent, up from 6.48 percent the week before. With points remaining at 0.61 (including the origination fee) for 80 percent loan-to-value ratio (LTV) loans, the effective rate also increased.

- Rates for 30-year fixed-rate jumbo mortgages (loan balances greater than $726,200) averaged 6.46 percent, up from 6.33 percent the week before. Although points decreased to 0.38 from 0.51 (including the origination fee) for 80 percent LTV loans, the effective rate also increased.

- For 30-year fixed-rate FHA mortgages, rates averaged 6.39 percent, down from 6.41 percent the week before. With points decreasing to 0.97 from 1.01 (including the origination fee) for 80 percent LTV loans, the effective rate also decreased.

- Rates for 15-year fixed-rate mortgages averaged 5.96 percent, up from 5.91 percent the week before. With points increasing to 0.68 from 0.58 (including the origination fee) for 80 percent LTV loans, the effective rate also increased.

- For 5/1 adjustable-rate mortgages (ARMs), rates averaged 5.71 percent, up from 5.35 percent the week before. With points increasing to 1.1 from 0.79 (including the origination fee) for 80 percent LTV loans, the effective rate also increased.