Inman News

Mortgage rates may level off despite the biggest short-term interest rate hike in 20 years thanks to the certainty the Fed is providing about its plans to shrink its nearly $9 trillion balance sheet.

Mortgage rates may level off even as the Federal Reserve implements the biggest short-term interest rate hike in 20 years, thanks to the certainty the Fed is also providing about its plans to shrink its nearly $9 trillion balance sheet.

In a unanimous vote Wednesday, Fed policymakers wrapped up a two-day meeting by announcing that they would raise their target for the short-term federal funds rate — the rate banks charge each other for overnight loans — by half a percentage point, to between 0.75 and 1 percent.

That move — and additional increases to short-term rates the Fed is expected to make this year — will ripple through financial markets, increasing the rates consumers pay on credit cards and other debt.

But the real estate and mortgage lending industries are focused on long-term rates, which the Fed doesn’t have direct control over. The Fed is just one of many players in bond markets that determine yields. The more demand there is for Treasurys and mortgage-backed securities, the less pressure there is on rates.

During much of the pandemic, the Fed drove down long-term interest rates to historic lows by buying up $80 billion in Treasurys and $40 billion in mortgage-backed securities each month. That “quantitative easing” — along with similar purchases the Fed made during the 2007-2009 recession — left the Fed holding nearly $9 trillion in government bonds and mortgage debt.

Now the Fed says that starting June 1, it will begin letting those investments roll off its balance sheet. But it will do so in “a predictable manner,” reducing its mortgage investments by no more than $17.5 billion a month at first, and then increasing the cap to $35 billion a month after three months. The caps for Treasurys will be higher — $30 billion a month at first, increasing to $60 billion a month after three months.

Although the Fed had discussed the pace at which it would shrink its balance sheet in March, the details provided in today’s announcement should bring certainty to markets that could allow long-term rates to stabilize, said Mike Fratantoni, chief economist at the Mortgage Bankers Association.

“The runoff will ramp up over the course of three months, which should allow markets to absorb this excess supply,” Fratantoni said.

While some inflation hawks had been urging the Fed to take a more aggressive stance in rolling off its holdings of mortgage debt, for now policymakers are taking a more measured approach.

“Importantly, neither the statement nor the balance sheet plan repeated the goal of returning the balance sheet to all Treasurys, and there was no mention about the potential for active MBS sales,” Fratantoni said. “Musing about active sales has likely increased volatility in the MBS market recently, as investors do not know how to interpret the vague signals that had been given.”

At a press conference, Federal Reserve Chairman Jerome Powell said the Fed may not even hit the initial $17.5 billion cap on rolloffs of its mortgage-backed securities at first.

“At the current level of mortgage rates, the actual pace of agency MBS runoff would likely be less than this monthly cap amount,” Powell said.

Fratantoni said the Mortgage Bankers Association is forecasting that mortgage rates “are likely to plateau near current levels. The financial markets have attempted to price in the impact of Fed actions over this cycle, and they are likely also pricing in the economic slowdown that will result. Once we are past this rate spike and associated volatility, MBA expects that potential homebuyers may be more willing to re-enter the market.”

Yields on 10-year Treasury notes — which often predict which way mortgage rates are headed — eased after the Federal Open Market Committee released details about its plans to trim its balance sheet.

The Fed’s $9 trillion balance sheet

Assets held by the Federal Reserve through quantitative easing purchases now include $5.76 trillion in long-term Treasurys and $2.7 trillion in mortgage-backed securities. Source: Board of Governors of the Federal Reserve System, Federal Reserve Bank of St. Louis.

Ian Shepherdson, chief economist at Pantheon Macroeconomics, said the Fed is likely to raise the short-term federal funds rate by another 50 basis points — half a percentage point — in June, “but it’s not a done deal.”

Unless there’s an emergency, the Fed usually makes smaller adjustments of 25 basis points when raising short-term interest rates. It last implemented a 50-basis point increase in the federal funds rate in May 2000, on the eve of the dot-com stock market bust.

“We are on a path to move our policy rate expeditiously to more normal levels, assuming that economic and financial conditions evolve in line with expectations,” Powell said. “There is a broad sense on the committee that additional 50-basis point increases should be on the table at the next couple of meetings.”

The federal funds rate

Gray bands indicate recessions. Source: Board of Governors of the Federal Reserve System, Federal Reserve Bank of St. Louis.

After the June meeting, Shepherdson said, “all bets are off” for additional drastic moves in short-term rates, “given the likelihood of a steep, sustained drop in inflation, a clear softening in manufacturing, and a meltdown in housing market activity.”

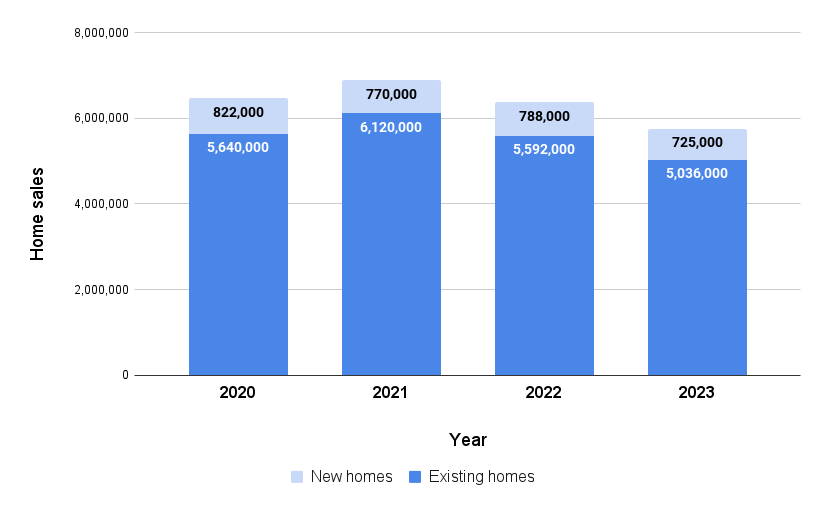

Economists at Fannie Mae are forecasting a 9.7 percent decline in 2023 home sales, and that there’s a chance of a “modest recession” in the second half of next year.

Home sales projected to decline

Source: Fannie Mae Housing Forecast, April 2022.