CALCULATEDRISK

By Bill McBride

Median New Home Price is Down 13% from the Peak due to Change in Mix

The Census Bureau reports New Home Sales in June were at a seasonally adjusted annual rate (SAAR) of 627 thousand. The previous three months were revised down, combined.

Sales of new single-family houses in June 2025 were at a seasonally-adjusted annual rate of 627,000, according to estimates released jointly today by the U.S. Census Bureau and the Department of Housing and Urban Development. This is 0.6 percent above the May 2025 rate of 623,000, and is 6.6 percent below the June 2024 rate of 671,000.

emphasis added

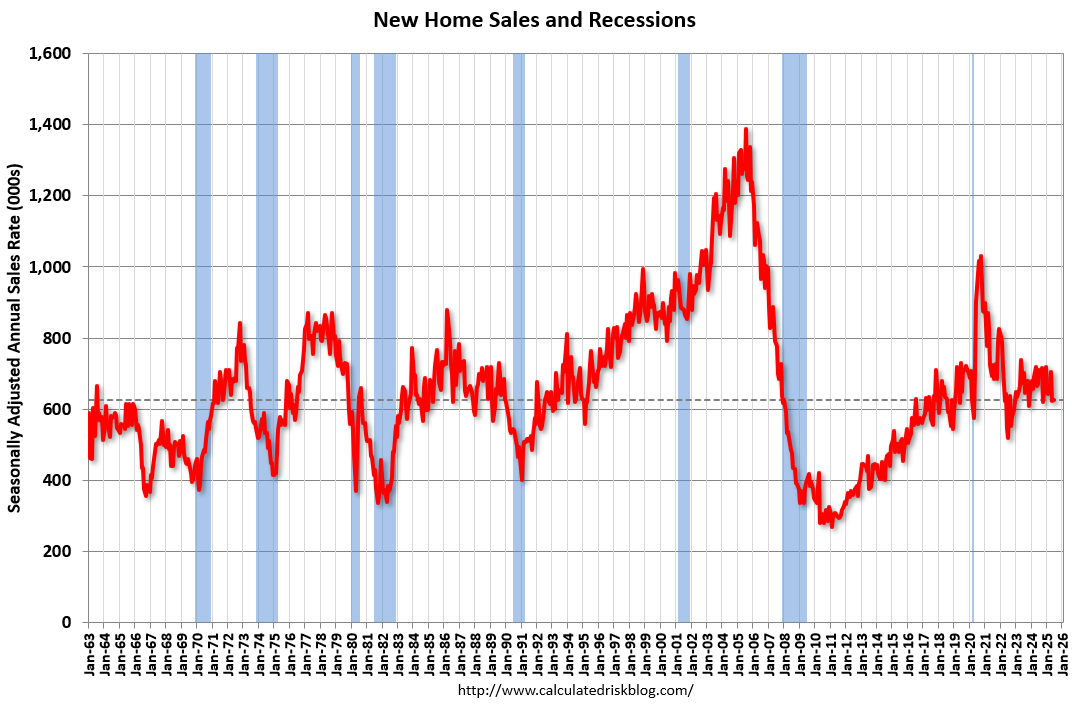

The first graph shows New Home Sales vs. recessions since 1963. The dashed line is the current sales rate.

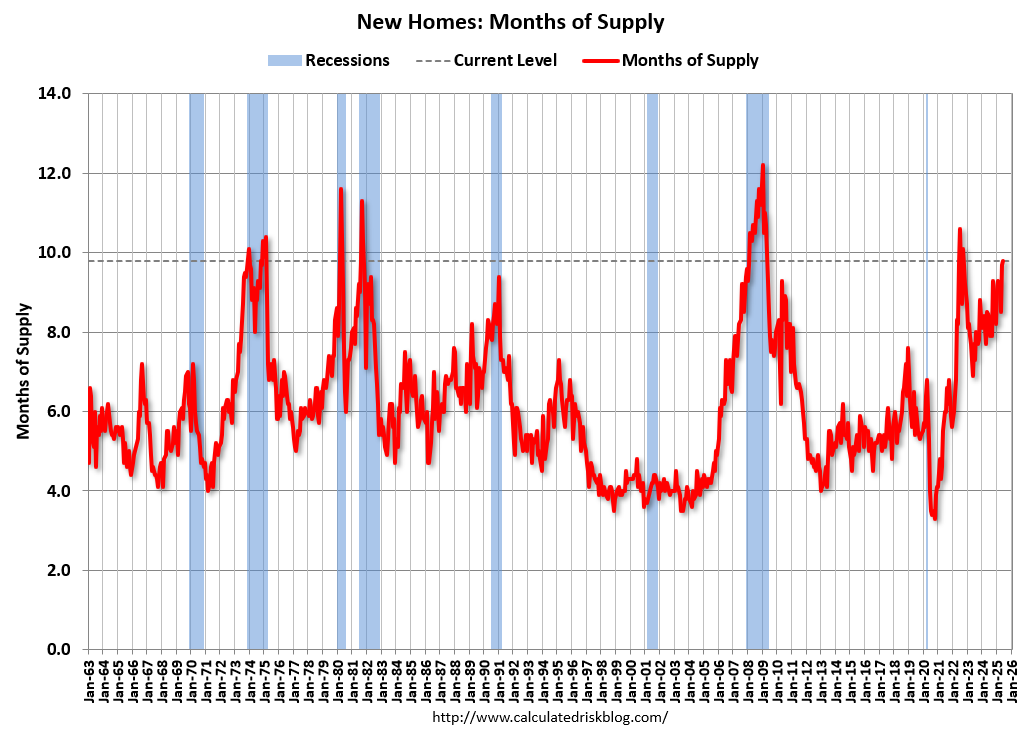

New home sales were below pre-pandemic levels. The second graph shows New Home Months of Supply.

The months of supply increased in June to 9.8 months from 9.7 months in May. The all-time record high was 12.2 months of supply in January 2009. The all-time record low was 3.3 months in August 2020. This is well above the top of the normal range (about 4 to 6 months of supply is normal).

The seasonally-adjusted estimate of new houses for sale at the end of June 2025 was 511,000. This is 1.2 percent above the May 2025 estimate of 505,000, and is 8.5 percent (±5.4 percent) above the June 2024 estimate of 471,000.

This represents a supply of 9.8 months at the current sales rate. The months’ supply is 1.0 percent above the May 2025 estimate of 9.7 months, and is 16.7 percent above the June 2024 estimate of 8.4 months.

On inventory, according to the Census Bureau:

“A house is considered for sale when a permit to build has been issued in permit-issuing places or work has begun on the footings or foundation in nonpermit areas and a sales contract has not been signed nor a deposit accepted.”

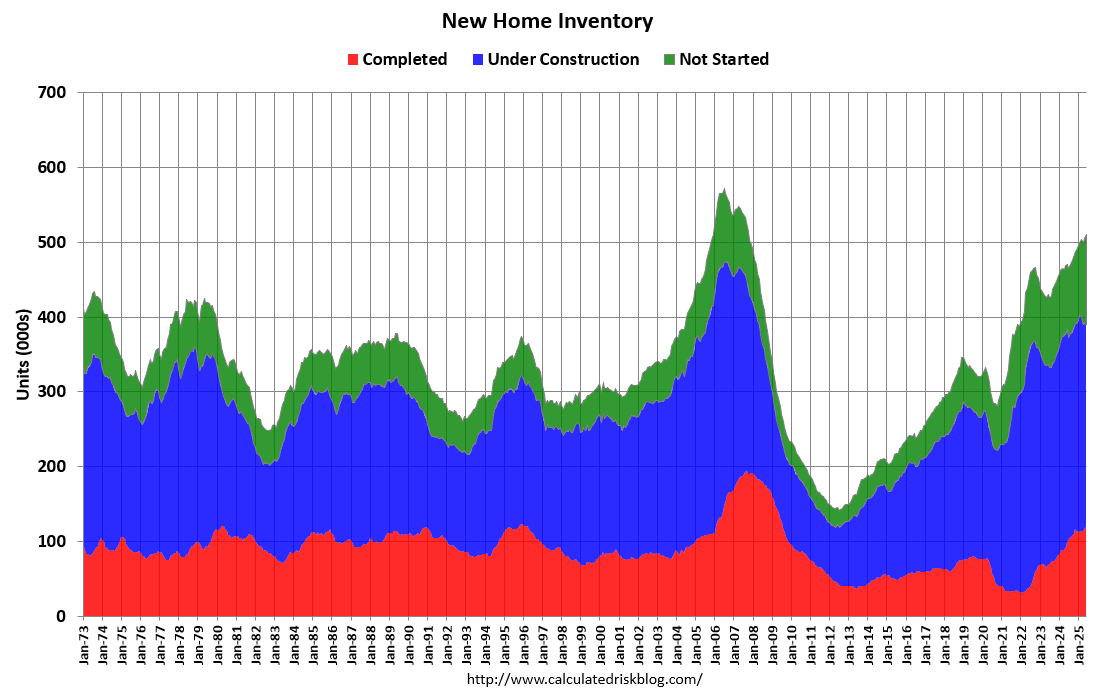

Starting in 1973 the Census Bureau broke this down into three categories: Not Started, Under Construction, and Completed. The third graph shows the three categories of inventory starting in 1973.

The inventory of completed homes for sale (red) – at 119 thousand – is almost quadruple the record low of 31 thousand in February 2022. This is the most since July 2009, and somewhat above the normal level of completed homes for sale.

The inventory of homes under construction (blue) at 271 thousand is very high but is about 15% below the cycle peak in July 2022. The inventory of homes not started is at 119 thousand – this is the all-time high.

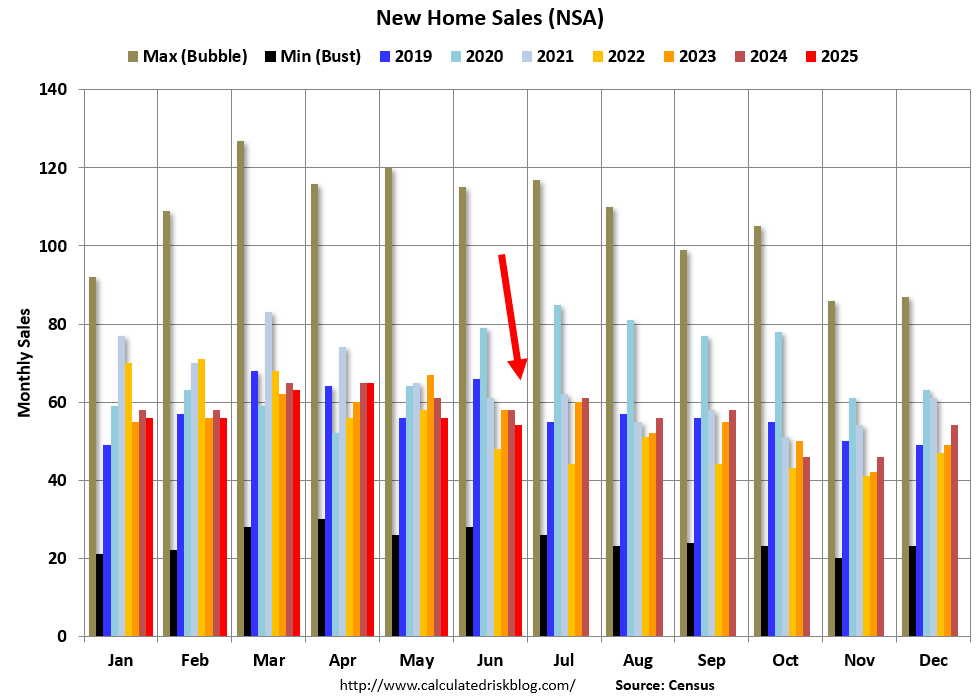

The fourth graph shows new home sales for each month, Not Seasonally Adjusted (NSA), for a few selected periods. Black is the maximum sales per month during the bubble (2005) and light gray is the minimum sales during the bust (2008 – 2011). The most recent six years are shown (2019 through 2025).

In June 2025 (red column), 54 thousand new homes were sold (NSA). Last year, 58 thousand homes were sold in June. The all-time high for June was 115 thousand in 2005, and the all-time low for June was 28 thousand in 2010 and 2011.

Year-to-date, sales are down 4.3% NSA.

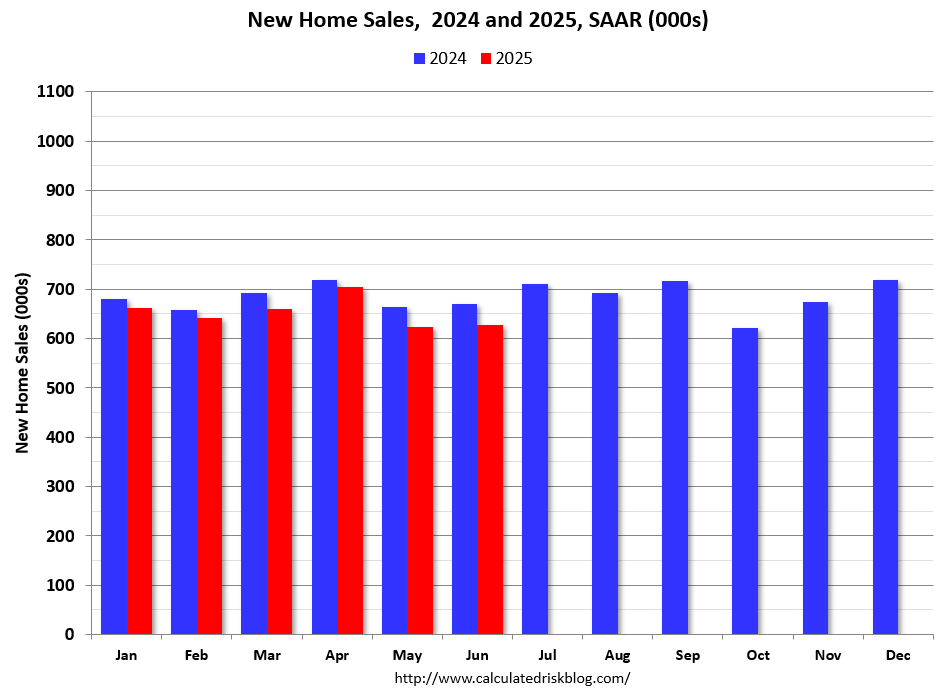

The next graph shows new home sales for 2024 and 2025 by month (Seasonally Adjusted Annual Rate). Sales in June 2025 were down 6.6% from June 2024.

New home sales, seasonally adjusted, have been down year-over-year for 6 consecutive months.

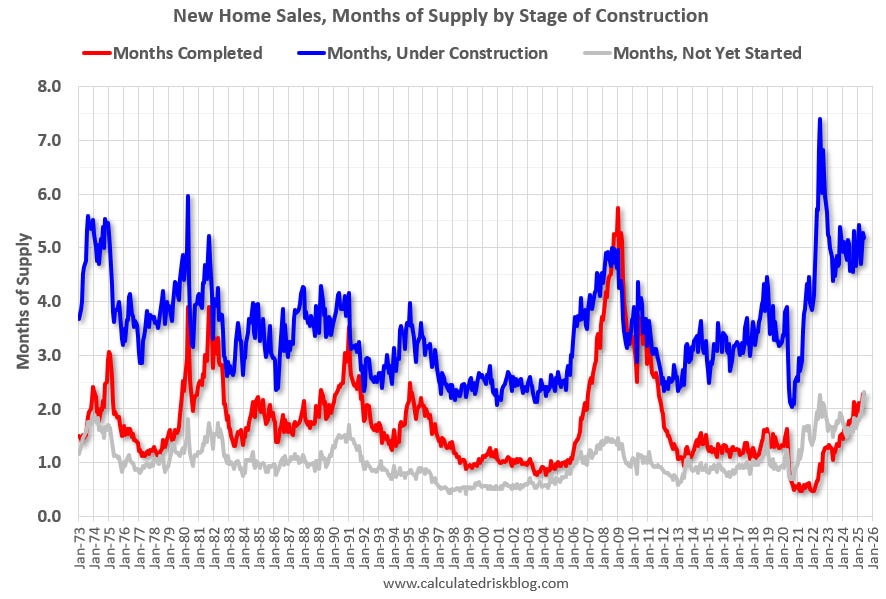

Over 5 Months of Unsold Inventory Under Construction

The next graph shows the months of supply by stage of construction. “Months of supply” is inventory at each stage, divided by the sales rate.

There are 2.3 months of completed supply (red line). This is above the normal level.

The inventory of new homes under construction is at 5.2 months (blue line). This has declined from 7.4 months in July 2022 but is still a much larger than normal number of homes under construction.

And 2.3 months of potential inventory that have not been started (grey line) – above the normal level. Homebuilders are probably waiting to start some homes until they clear more inventory, and have a firmer grasp on prices, mortgage rates and demand.

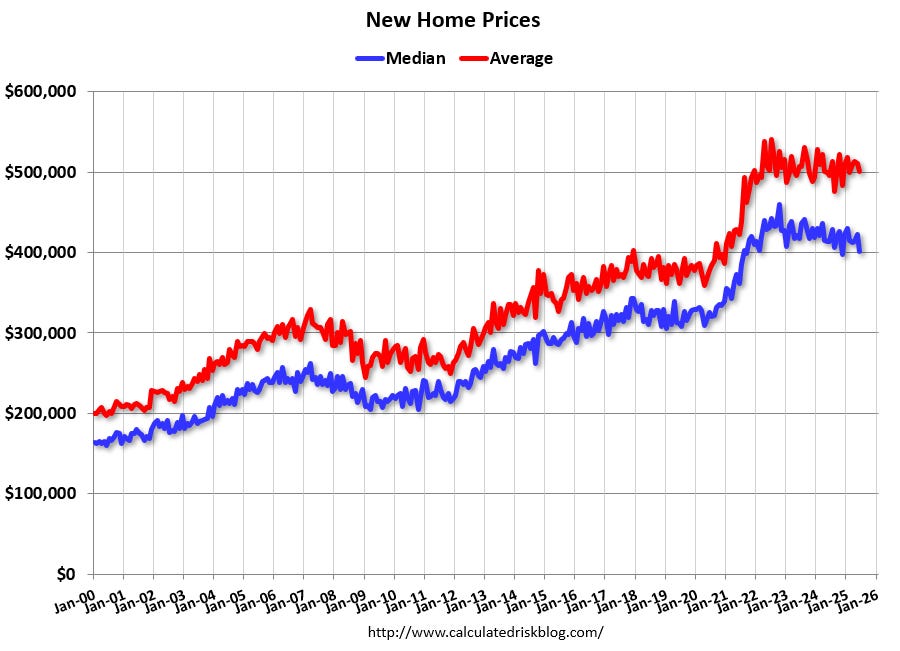

Average Prices Down 3.5% from the Peak

And on prices, from the Census Bureau:

The median sales price of new houses sold in June 2025 was $401,800. This is 4.9 percent below the May 2025 price of $422,700, and is 2.9 percent below the June 2024 price of $414,000. The average sales price of new houses sold in June 2025 was $501,000. This is 2.0 percent below the May 2025 price of $511,500, and is 1.1 percent above the June 2024 price of $495,500.

The following graph shows the median and average new home prices. The average price in June 2025 was $501,000 up 1.1% year-over-year. The median price was $401,800, down 2.9% year-over-year. Both the median and the average are impacted by the mix of homes sold and have drifted down slightly over the last few years.

The median price was down 12.7% from the peak in 2022, and the average prices is down 7.4% from the peak. This just means builders are selling more lower priced units, not that prices have declined that much!

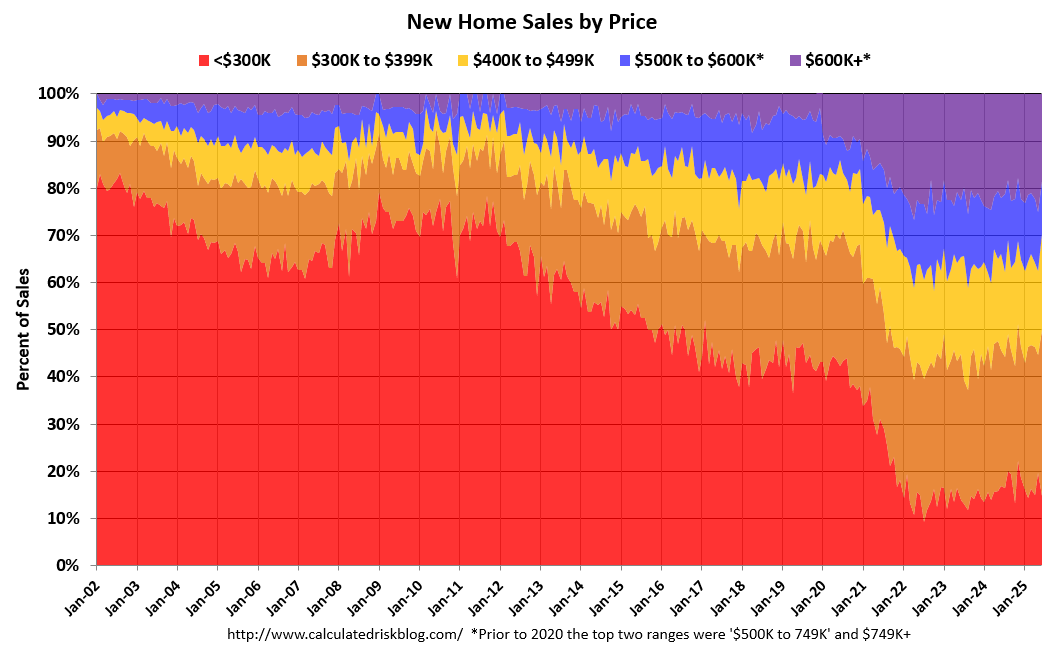

The last graph shows the percent of new homes sold by price. NOTE: In early 2024, the Census Bureau changed “the sales price range groups in … New Privately‐Owned Houses Sold, by Sales Price … to better reflect the current distribution of new home prices”. Prior to 2020 the top two categories were different (as indicated), and this probably increased the purple portion of the graph (reduced from $749K+ to $600K+).

About 15% of new homes sold were under $300K in June 2025. This is up from a low of 9.3% in July 2022, but down from around 80% in 2002. In general, the under $300K bracket is going away (inflation has pushed prices higher).

Last month, 70% of sales were under $500K and 30% over $500K. The percent over $500K is down from 42% at the peak in 2022. Homebuilders have been building less expensive homes to keep up volumes.

Sales were below expectations of 650 thousand SAAR and sales for the three previous months were revised down, combined.