CALCULATEDRISK

By Bill McBride

In Part 1: Current State of the Housing Market; Overview for mid-February 2026 I reviewed home inventory and sales. I noted that the key stories this year for existing homes are that months-of-supply was at pre-pandemic levels, while sales in 2025 were at the lowest level since 1995 (tying 2024). That means prices are under pressure, especially in areas with high levels of inventory, although we will NOT see cascading price declines like during the housing bust, since there will not be a huge wave of distressed sales. Most homeowners have substantial equity and low mortgage rates.

In Part 2, I will look at house prices, mortgage rates, rents and more.

In general, house prices were mostly unchanged year-over-year at the end of 2025. Lower mortgage rates have led to a pickup in purchase mortgage applications recently, but this hasn’t led to significantly more sales, at least not yet.

House Prices

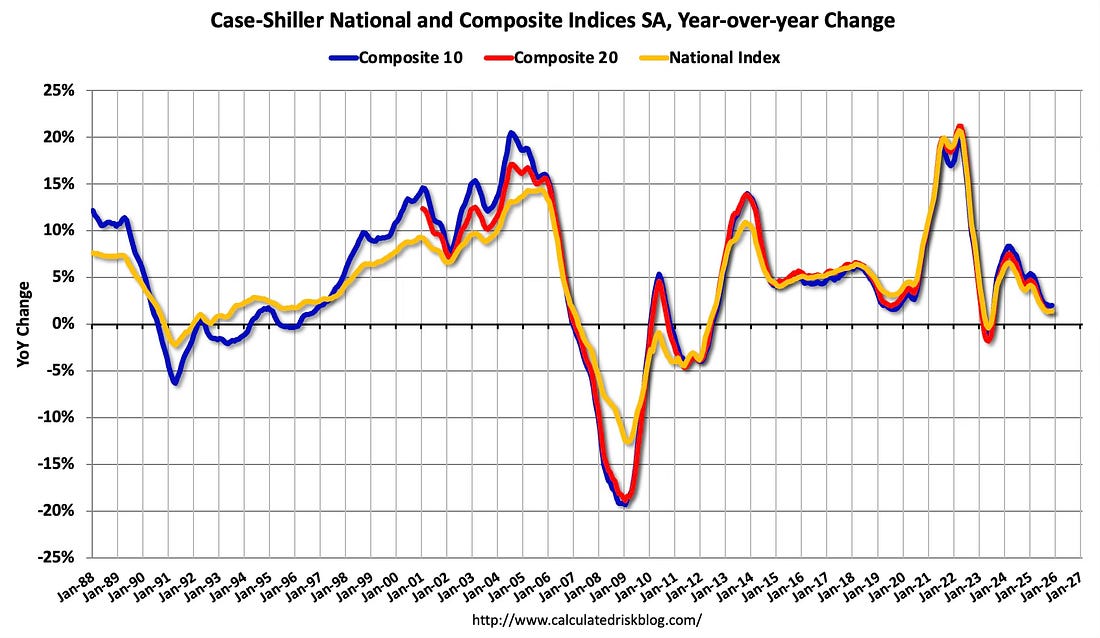

The Case-Shiller National Index increased 1.4% year-over-year (YoY) in November and will likely be about the same or slightly lower year-over-year in the December report compared to November (based on other data).

The Composite 10 NSA was up 2.0% year-over-year. The Composite 20 NSA was up 1.4% year-over-year. The National index NSA was up 1.4% year-over-year.

The National index increased 0.40% month-over-month (MoM). This is the 4th consecutive month with a MoM increase seasonally adjusted that followed 5 consecutive months with a MoM decline.

The November Case-Shiller index was a 3-month average of closing prices in September, October and November. September closing prices include some contracts signed in July. So, not only is the year-over-year change trending down, but there is a significant lag to this data.

Let’s review some more timely house price data …

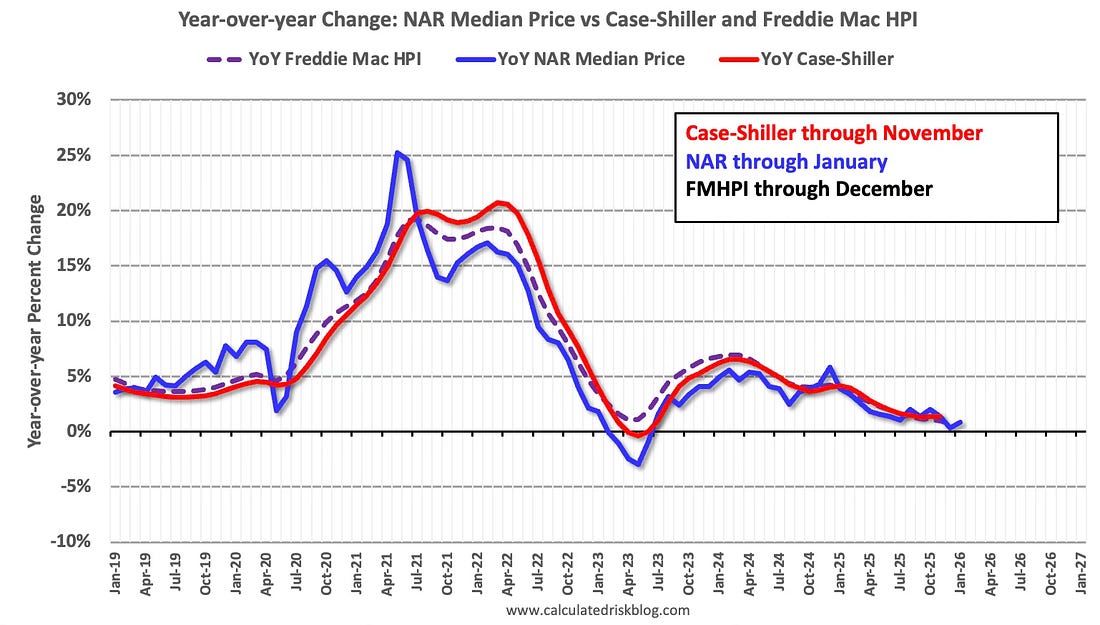

Other measures of house prices suggest prices will be about the same or slightly lower year-over-year in the December Case-Shiller index as in the November report. The NAR reported median prices were up 0.9% YoY in January, up from 0.4% YoY in December. (Note that median prices are impacted by the mix).

ICE reported prices were up 0.5% YoY in January. Freddie Mac reported house prices were up 0.7% YoY in December, down from up 1.0% YoY in November.

Here is a comparison of year-over-year change in the FMHPI, median house prices from the NAR, and the Case-Shiller National index.

This suggests the Case-Shiller index will likely be up about the same or slightly lower year-over-year in the December report compared to November.

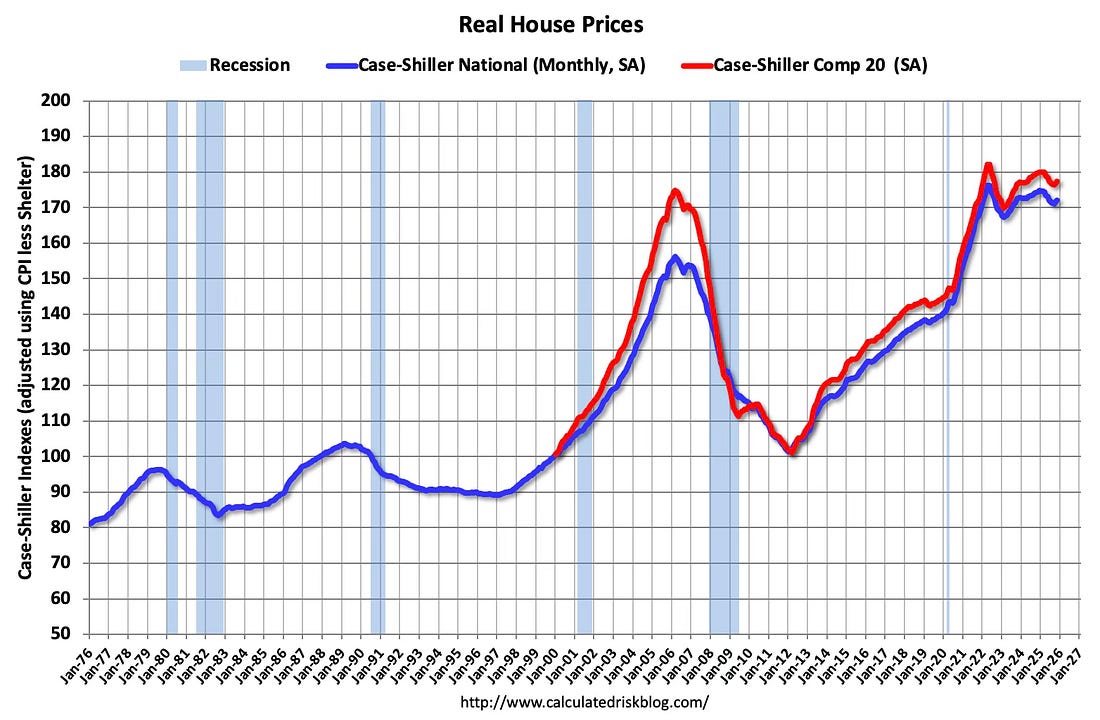

In real terms, the Case-Shiller National index is down 2.4% from the peak in 2022, seasonally adjusted. It has now been 3 1/2 years since the real peak in house prices. Typically, after a sharp increase in prices, it takes a number of years for real prices to reach new highs.

Both the real National index and the Comp-20 index increased in November.

30-Year Mortgage Rates Near 3-Year Lows

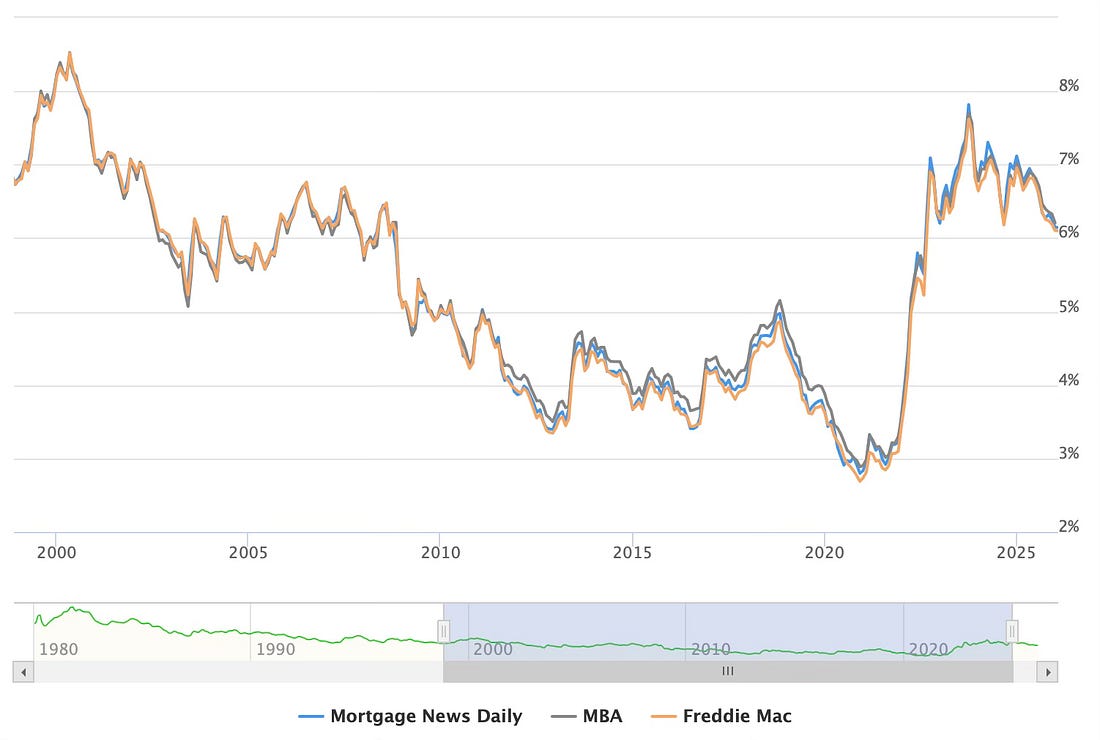

The following graph from MortgageNewsDaily.com shows mortgage rates since 1999. 30-year mortgage rates were at 6.04% on February 13th.

Mortgage rates were low following the financial crisis through the early years of the pandemic. Now rates have returned to a new normal in 30-year mortgage rates in the 6% to 7% range. It is possible that 30-year fixed mortgage rates will move into the high 5% range, but it is unlikely – barring a recession or a crisis – that rates will fall much further.

A year ago, 30-year mortgage rates were at 7.04%, two years ago rates were at 7.13%, three years ago rates at 6.54%, four years ago at 4.10%, and five years ago at 2.86%.

It is financially very difficult for homeowners that bought or refinanced in 2020 and 2021 to move and give up their 3% mortgage rates. This is a key reason the “move-up market” has been moribund. However time and life changes are slowly leading to more listings and will likely lead to more sales activity.

Mortgage Purchase Applications Have Increased Year-over-year

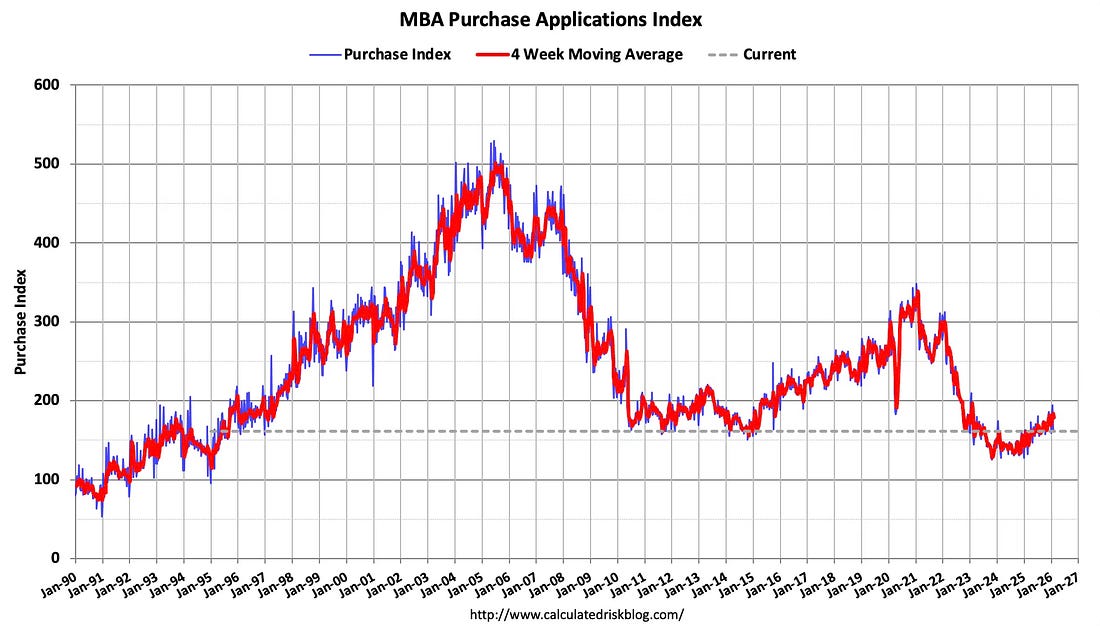

From the MBA last week:

The seasonally adjusted Purchase Index decreased 2 percent from one week earlier. The unadjusted Purchase Index increased 4 percent compared with the previous week and was 4 percent higher than the same week one year ago.

Here is a graph showing the MBA mortgage purchase index released last week. Purchase application activity is up from the lows in late October 2023 but near the lowest levels during the housing bust.

This is still low, but has been increasing, and suggests some pickup in sales (although this is a slow time for home sales).

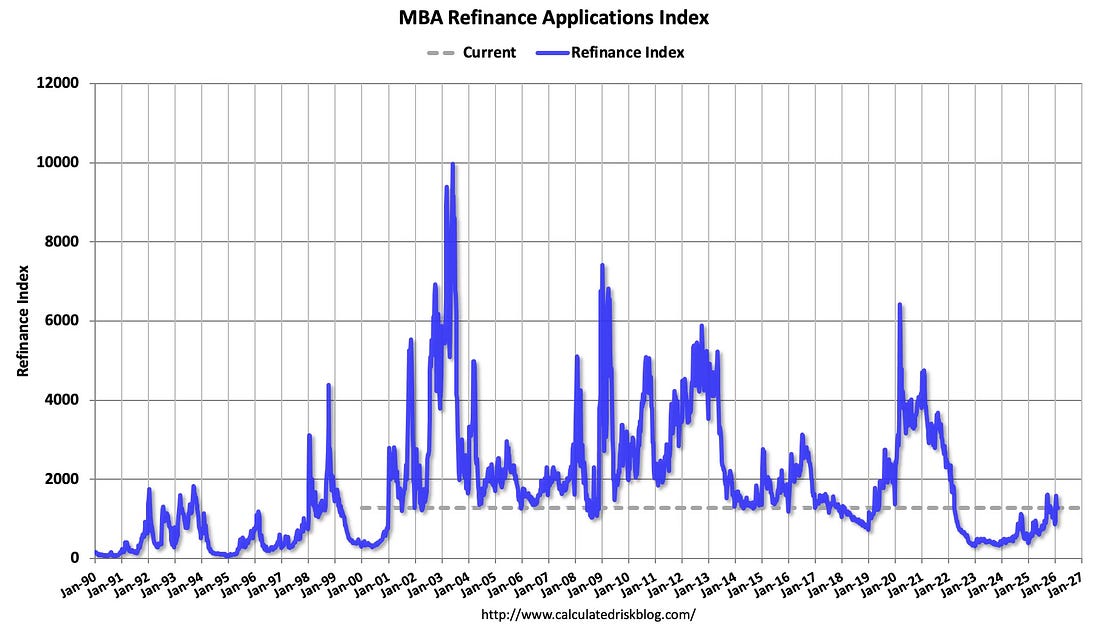

And the next graph shows the refinance index since 1990. Refinance activity is still very low but picking up a little with lower mortgage rates.

Many of the homebuyers in the last few years have been able to refinance recently.

Asking Rents Declined Year-over-year for Multi-family

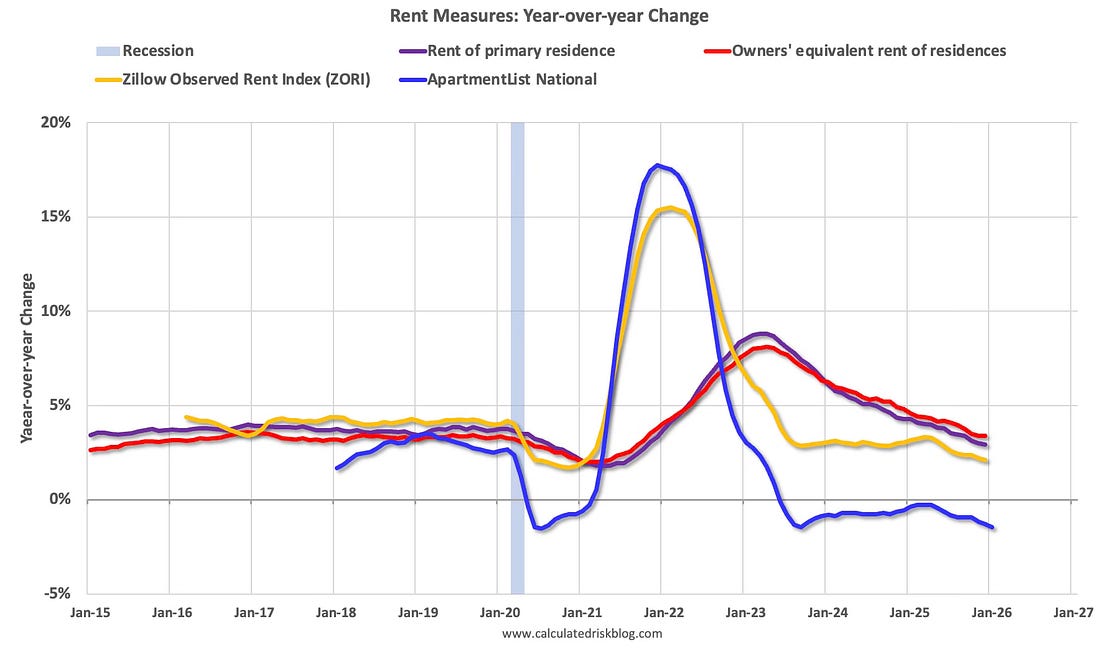

Here is a graph of the year-over-year (YoY) change for these measures since January 2015.

NOTE: The values for October are missing due the government shutdown, and I used the average of September and November values for the month of October.

The Zillow measure (single and multi-family) is up 2.1% YoY in December, down from 2.2% YoY in November, and down from a peak of 15.8 YoY in February 2022.

The ApartmentList measure is -1.4% YoY as of January, down from -1.3% in December, and down from a peak of 17.8% YoY December 2021.

Asking rents declined YoY for multi-family and with new supply coming on the market (although at a lower level than last year), we will likely see continued pressure on asking rents. It is possible that policy (less immigration, more deportations) could also put downward pressure on rents.

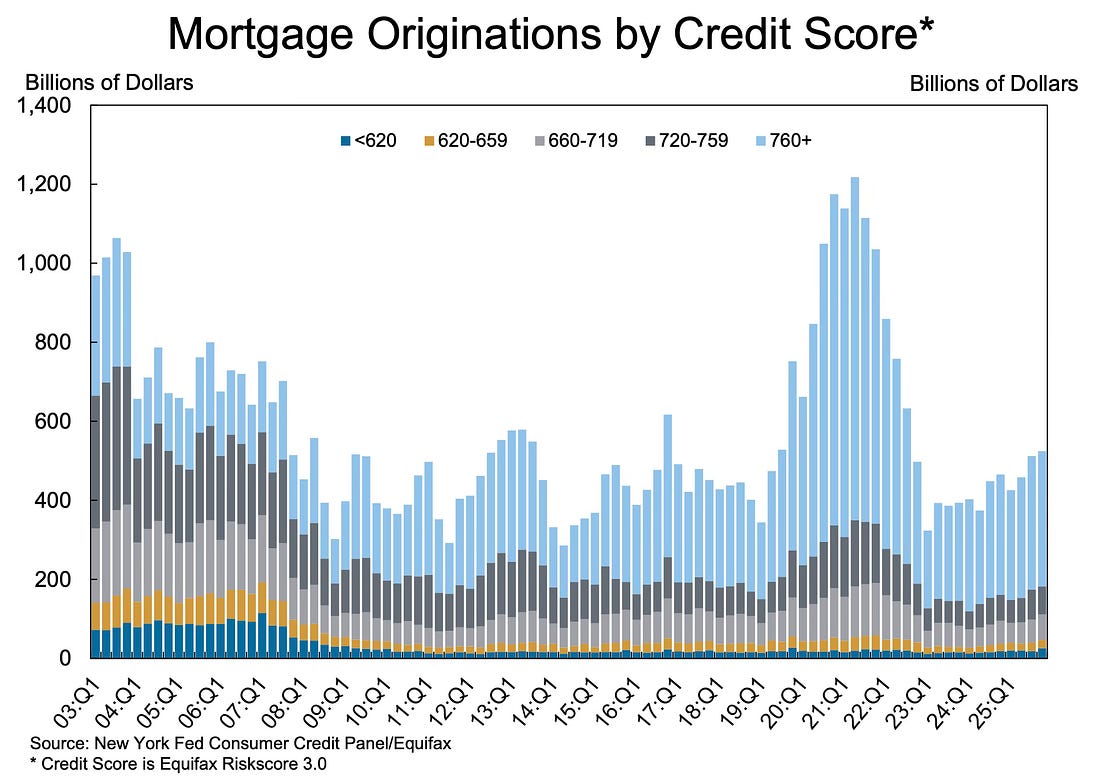

Credit Scores for Mortgages Still Solid

Here is a graph from the NY Fed Q4 Quarterly Report on Household Debt and Credit. The first graph shows mortgage originations by credit score (this includes both purchase and refinance). Look at the difference in credit scores in the recent period compared to the during the bubble years (2003 through 2006). Recently there have been almost no originations for borrowers with credit scores below 620, and few below 660. A significant majority of recent originations have been to borrowers with credit score above 760.

Solid underwriting is a key reason I’ve argued Don’t Compare the Current Housing Boom to the Bubble and Bust, Look instead at the 1978 to 1982 period for lessons