CALCULATEDRISK

By Bill McBride

in Part 1: Current State of the Housing Market; Overview for mid-September 2024 I reviewed home inventory, housing starts and sales.

In Part 2, I will look at house prices, mortgage rates, rents and more.

House Prices

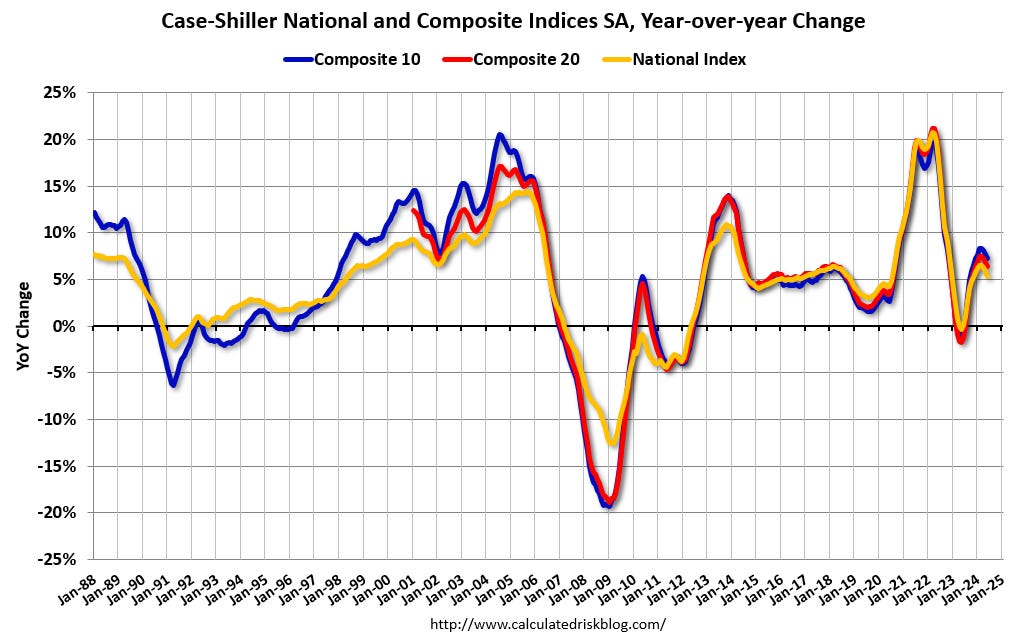

The Case-Shiller National Index increased 5.4% year-over-year in June and will likely slow further in the July report (based on other data).

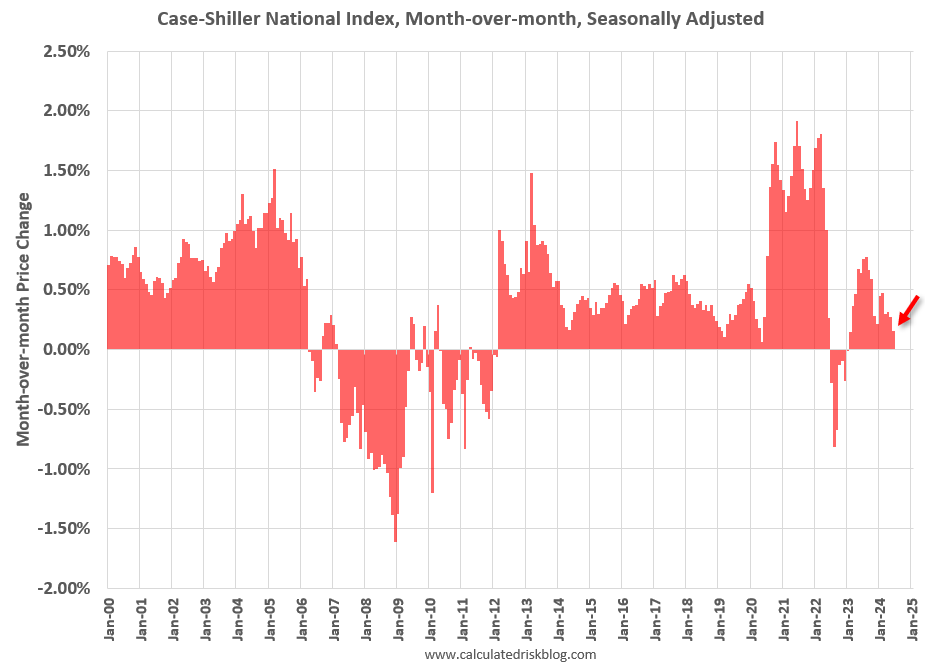

The MoM increase in the seasonally adjusted (SA) Case-Shiller National Index was at 0.16%. This was the seventeenth consecutive MoM increase, but this was the smallest MoM increase in the last 16 months.

In Question #9 for 2024: What will happen with house prices in 2024? I discussed my outlook for house prices in 2024. A review …

In question #9 I wrote:

“I don’t expect inventory to reach 2019 levels but based on the recent increase in inventory maybe more than half the gap between 2019 and 2023 levels will close in 2024. If existing home sales remain sluggish, we could see months-of-supply back to 2017 – 2019 levels.

That would likely put price increases in the 3% to 4% range in 2024. I don’t expect either a crash in prices or a surge in prices. And as usual, we will have to watch inventory and adjust the outlook.”

As I noted in Part 1, inventory is increasing year-over-year, but is still well below 2019 levels, but months-of-supply is almost back to 2017 – 2019 levels. This outlook for prices still seems reasonable – I expect the YoY increase to continue to slow, although that depends on changes in inventory. I don’t expect either a crash in prices or a surge in prices.

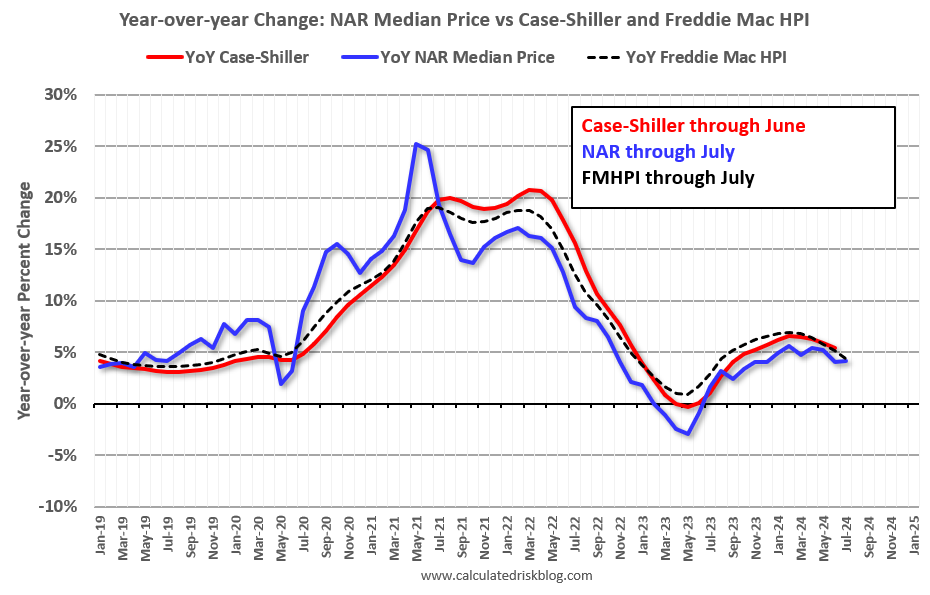

Other measures of house prices suggest prices will be up less YoY in the July Case-Shiller index than in the June report. The NAR reported median prices were up 4.2% YoY in July, up from 4.1% YoY in June.

ICE reported prices were up 3.6% YoY in July, down from 4.1% YoY in June, and Freddie Mac reported house prices were up 4.4% YoY in July, down from 5.2% YoY in June.

Here is a comparison of year-over-year change in the FMHPI, median house prices from the NAR, and the Case-Shiller National index.

The FMHPI and the NAR median prices appear to be leading indicators for Case-Shiller. Based on recent monthly data, and the FMHPI, the YoY change in the Case-Shiller index will likely be lower YoY in July compared to June.

In real terms, the Case-Shiller National index is down 1.6% from the peak, seasonally adjusted. Historically it takes a number of years for real prices to return to the previous peak.

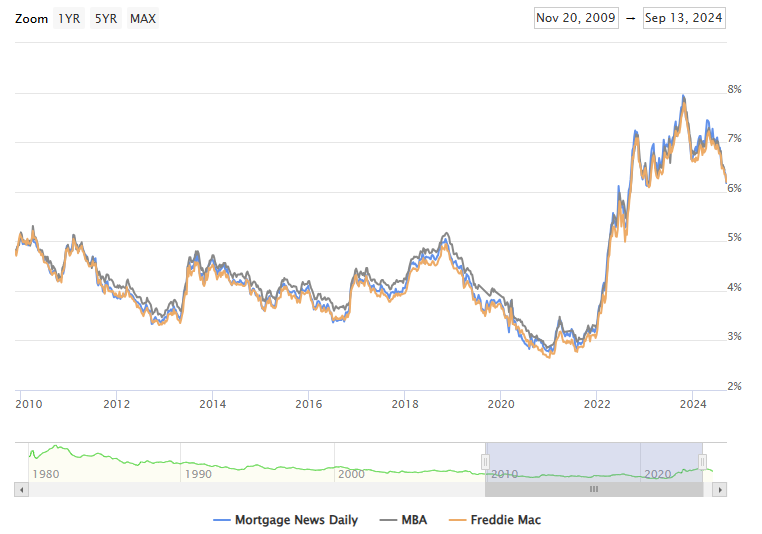

30-Year Mortgage Rates Have Declined to Just Over 6%

The following graph from MortgageNewsDaily.com shows mortgage rates since January 1, 2010. 30-year mortgage rates were at 6.14% on September 13th, down sharply over the last few months due to the better-than-expected inflation reports, a slightly weaker job market, and the expectation of Fed rate cuts (the first cut will be this week!).

A year ago, 30-year mortgage rates were at 7.29%, two years ago rates were at 6.35%, and three years ago rates were at 2.93%.

A year ago, the payment on a $500,000 house, with a 20% down payment and 7.29% 30-year mortgage rates, would be around $2,740 for principal and interest. The monthly payment for the same house, with house prices up 5.4% YoY and mortgage rates at 6.14%, would be $2,565 – a decrease of 6.4%.

However, if we compare to three years ago, there is huge difference in monthly payments. In 2021, the payment on a $500,000 house, with a 20% down payment and 2.93% 30-year mortgage rates, would be around $1,671 for principal and interest. The monthly payment for the same house, with house prices up 24% over three years and mortgage rates at 6.14%, would be $3,024 – an increase of 81%!

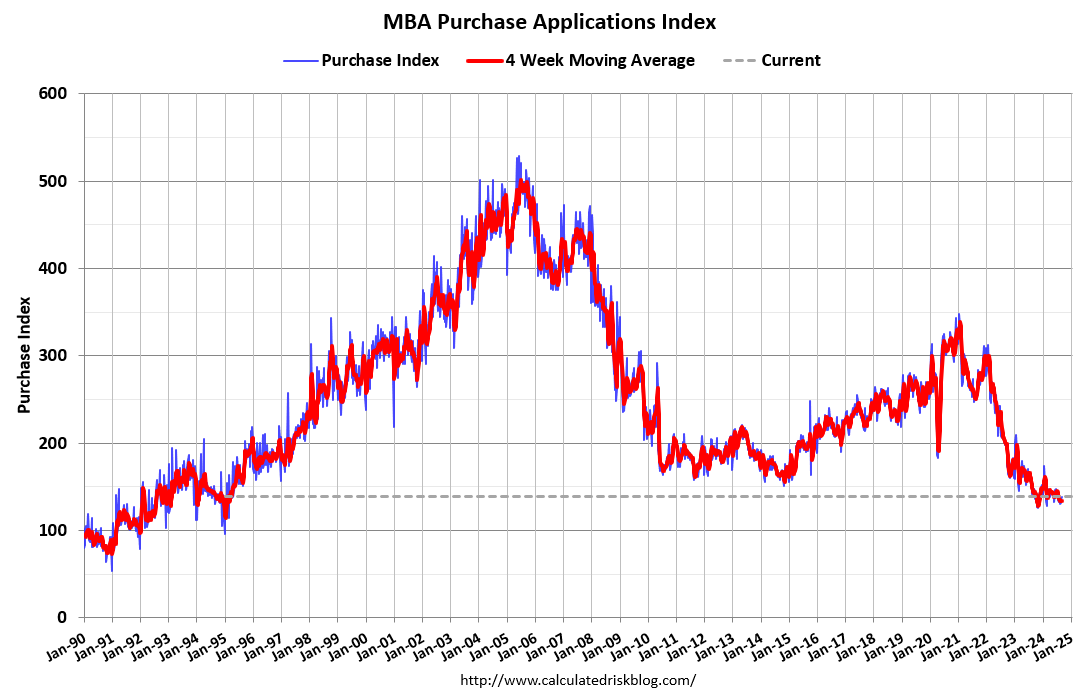

Mortgage Applications Remain Low

Here is a graph showing the MBA mortgage purchase index released last Wednesday. Purchase application activity is up from the lows in late October and early November, and still below the lowest levels during the housing bust.

And the next graph shows the refinance index since 1990. Refinance activity has increased recently as mortgage rates have declined, and anyone with a mortgage rate in the high 6% range or above is probably considering refinancing their mortgage. However, historically, refinance activity is still very low.

Asking Rents Mostly Unchanged Year-over-year

Here is a graph of the year-over-year (YoY) change for these measures since January 2015. Most of these measures are through August 2024, except CoreLogic is through June and Zillow through July.

Asking rents are mostly unchanged YoY for multi-family (single family rents are up), and with new supply coming on the market, we will likely see further softness in asking rents.

However, the official measures are still catching up to the private data.

Low Levels of Real Estate Owned

Earlier today, I wrote another article Q2 Update: Delinquencies, Foreclosures and REO.

In that article I noted that with substantial equity, and low mortgage rates (mostly at a fixed rates), few homeowners will have financial difficulties during this cycle. This is important for prices, since house prices tend to be sticky downwards in the absence of significant distressed sales. We are seeing some price declines in areas with sharp increases in inventory (like part of Florida), but I don’t expect large price declines like during the housing bust.

I’ll have much more on all of these topics.